Wendy’s plans to charge different prices depending on the time of day, meaning a Dave’s burger will cost more at lunchtime than in the middle of the afternoon.

So-called dynamic pricing aims to attract customers at quiet times of the day, when staff are waiting, and then cool demand at times when there is a rush.

Such a system could mean that at busier times, such as breakfast, lunch and dinner, the prices you advertise on a digital menu will be higher and at quieter times they will drop.

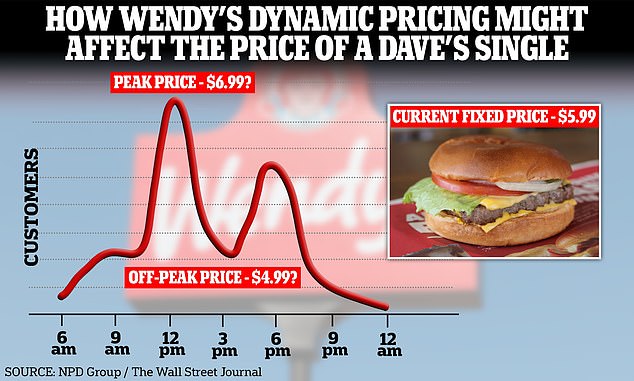

For example, a Dave’s quarter pounder currently costs about $5.99 at Wendy’s in Newark, New Jersey.

Under the new system, that could increase by a dollar at lunchtime and decrease by a similar amount during the post-lunch break.

Wendy’s new system will begin testing in 2025 and will be based on ‘digital menu panels’, in which it will invest $20 million, according to its CEO, Kirk Tanner. That will mean you can update prices in real time and with little or no expense.

A quarter pound of Dave’s Single currently costs about $5.99 at Wendy’s in Newark, New Jersey. Under the new system that may vary throughout the day depending on demand.

Wendy’s CEO Kirk Tanner said the fast-food chain would use “digital menu boards” as a way to alter the listed cost of its menu items.

Although consumers are familiar with the ever-changing prices of airline tickets and concerts, as well as “price surges” when booking an Uber, the bold move would make Wendy’s the first fast-food chain to implement pricing dynamic for meals.

If it pays off, the chain will boost sales and potentially improve margins. On the other hand, you risk distancing yourself from consumers who always expect to pay a set price for a meal, regardless of when they visit.

“They could shoot themselves in the foot by introducing something that customers aren’t prepared for,” said Steven Suranovic, an associate professor of economics at George Washington University.

“If people feel like they’re being ripped off, they’re not going to take kindly to this dynamic pricing strategy,” he said.

In fact, 52 percent of more than 900 consumers surveyed by the software company Capterra last year they said they considered dynamic pricing at restaurants to be price gouging.

“Beginning in 2025, we will begin testing more enhanced features such as dynamic pricing and part-of-the-day deals, along with AI-enabled menu changes and suggestive selling,” Tanner said during an earnings conference call this month.

Wendy’s CEO Kirk Tanner (pictured) said the company will invest $20 million in “digital menu boards” over the next two years.

Retail experts and economists suggest that dynamic pricing could alienate customers who feel they are being ripped off.

Dynamic pricing, also known as flash pricing, means that prices change based on various market factors, particularly demand.

It’s already used by airlines and ride-sharing apps like Uber and Lyft, which adjust prices to ensure they can charge consumers as much as they’re willing to pay at any given time.

It means retailers can gain an advantage over the consumer by ensuring they sell products at the highest possible margins, consuming what is known as “consumer surplus.”

That’s the difference between how much consumers are willing to pay and how much they actually pay. Greater consumer surplus benefits the consumer.

“Dynamic pricing allows them to take that surplus away from consumers and put it in the company’s pocket,” Suranovic said. Ultimately, the biggest losers would be lunchtime customers.

The system would mean that during downtime when burgers are not selling, it could generate additional demand by attracting more potential customers.

“There are times during the day when I’m sure they have crew available to prepare the food, but there’s just no demand,” Suranovic said.

This could be beneficial for both the consumer and the restaurant because the price-conscious consumer pays less than they would otherwise and the restaurant still makes a sale.

In theory, Wendy’s could increase its revenue even if its average margin on each burger was lower simply by increasing sales volume.

Pictured is a quarter pounder of Dave’s Single. In February, a restaurant in Newark, New Jersey, charged a flat price of $5.99 for a burger.

To calculate how much to charge at any given time, retailers can increasingly rely on algorithms and artificial intelligence to set the price at which sales will be optimized – technology that was not easily accessible just ten years ago.

Similarly, smartphone apps would allow restaurants to quickly notify customers of sudden menu price changes.

Retail analyst Neil Saunders of GlobalData similarly suggested that the dynamic pricing business model could backfire as regular customers might not put up with it.

“If regular customers pay $5 for something one day and $6 the next, it’s likely to cause confusion and annoyance,” he said.