- The man in charge of OJ Simpson’s estate says he is unsure of its value and who will be first in the ‘pecking order’ to receive payments.

- Simpson died last week at the age of 76 after a battle with prostate cancer.

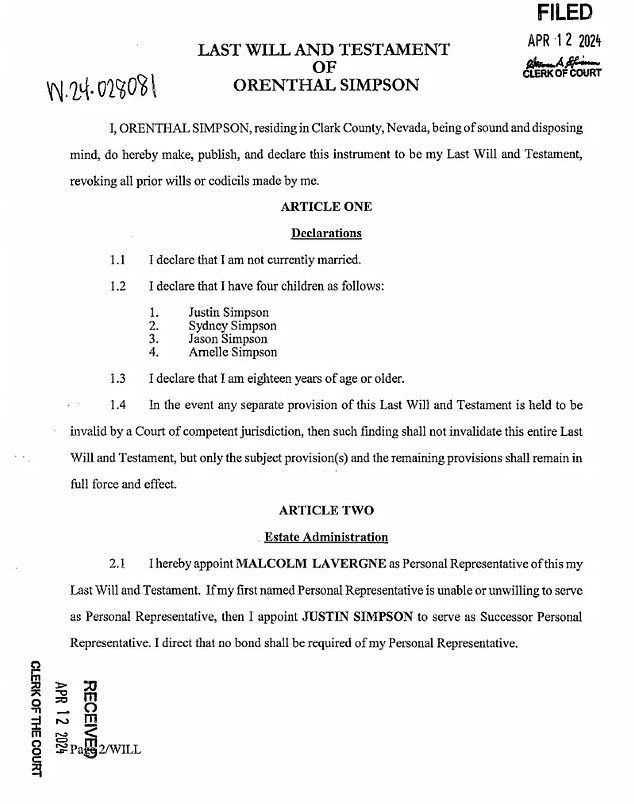

OJ Simpson’s last will and testament was filed in a Nevada court last week, following the death of the 76-year-old former NFL player and accused murderer.

The man who has been named executor says he is not sure what or how much is in the estate and to which creditors the money will go to pay off Simpson’s significant debts.

The seven-page document places Simpson’s entire estate in a trust created in late January of this year, which is now under the control of Simpson’s attorney, Malcom LaVergne, who was named executor of the will.

LaVergne, who represented Simpson in several legal proceedings following his conviction on charges related to a violet robbery in Las Vegas in 2007, has spoken publicly about the estate.

Malcolm LaVerge, OJ Simpson’s longtime attorney, was named executor of his last will and testament.

Simpson (right) photographed alongside LaVerne during a parole hearing in 2017. Simpson died last week after a battle with cancer.

In an interview with KTNV Las VegasLaVergne said Simpson’s estate will now enter the probate process, a complex legal exercise that will require the expert opinion of attorneys trained in probate law.

LaVergne said the late convict’s family is currently in funeral planning mode and have barely scratched the surface of how to deal with the estate.

Simpson died owing a significant amount of money to the families of Ron Goldman and Nicole Brown Simpson, the two murder victims for whom he was accused in 1994.

Simpson was acquitted of the murders, but was later told by a civil court that he must pay the families $33 million.

Some 25 years after the murders, that figure has skyrocketed to $100 million.

However, it is not clear that either family will see a cent of Simpson’s estate.

According to LaVergne, Simpson died owing a considerable amount to the IRS, a creditor he claims will be ahead of “advertising creditors” – a reference to the Goldman family – in the “pecking order.”

According to ABC legal analyst Dan Abrams said Monday morning that once Simpson’s estate has been fully accounted for, it will be an easier process for creditors to claim what they are owed.

Over time, the Goldman family has received about $130,000 of the many millions they are owed.

LaVergne said he hopes the Goldman family gets “nothing.”

“I’m hoping that the Goldmans get zero, nothing. Them specifically. And I will do everything in my capacity as executor or personal representative to try to ensure that they get nothing,” he told the Las Vegas Review Magazine last week.

It’s unclear why LaVergne has such animosity toward the Goldman family.

Abrams explained that despite LaVergne’s role as executor of the will, he may not end up having any specific control over who receives payments and when.