A young family has revealed how they save a fortune every year by using loyalty programs, as experts demonstrate why using them correctly is a “no brainer” during the cost of living crisis.

Speaking to FEMAIL, Alexandra and Zach Cain, from Melbourne’s western suburbs, revealed they have been feeling the pressure despite earning a combined income of $190,000 a year.

The couple, who have three children under the age of eight at home full time and two teenagers, ages 14 and 17, from Zach’s previous relationship, use loyalty programs to help them manage their budget.

At first glance, the programs save them “between $600 and $700” a year, but once the rewards are calculated “per store,” the family ends up saving thousands of dollars and hours of time.

“We use Flybuys because we shop at Coles and OnePass because it gives us unlimited delivery from as many stores as we want for $4 a month,” they said, adding that most of their shopping can be done from home.

Alexandra and Zach Cain from Melbourne have revealed how they save money using loyalty programs and other budgeting strategies like cooking in bulk.

Adam Posner, Australia’s leading independent customer loyalty specialist, told FEMAIL there has been a trend towards Australians using the programs as the cost of living crisis continues.

He says the trick to maximizing savings is to “stop shopping around.”

Alexandra, 39, and Zach, 38, are the perfect example of how to use programs to save and not spend.

“We really have to plan ahead, buy in bulk and have a plan because sometimes it can be difficult,” Zach said.

She’s learned how to budget under the watchful eye of Alexandra, who “did it long before she had kids.”

Zach is naturally a spender, so trips to the store are usually much more expensive than necessary. When shopping online, he cannot make impulsive decisions.

‘With five children, a quick trip to the shops to buy a few things turns into hours, and much more expensive than necessary because everyone wants something. Then when you’re done, they’re hungry, so you have to buy food,” she said.

Alexandra is much smarter than her husband, she has always been good at saving and said she would rather go on vacation than spend her budget on everyday things.

He explained that they use OnePass, which gives them free delivery on everything from Kmart, Target, Bunnings, Catch and Officeworks (to name a few), and Flybuys, Coles’ loyalty programme.

“We get most of our kids’ clothing from Target, buy everyday items and snacks in bulk at Catch, and often pick up things at Kmart or Office when we need them,” she said.

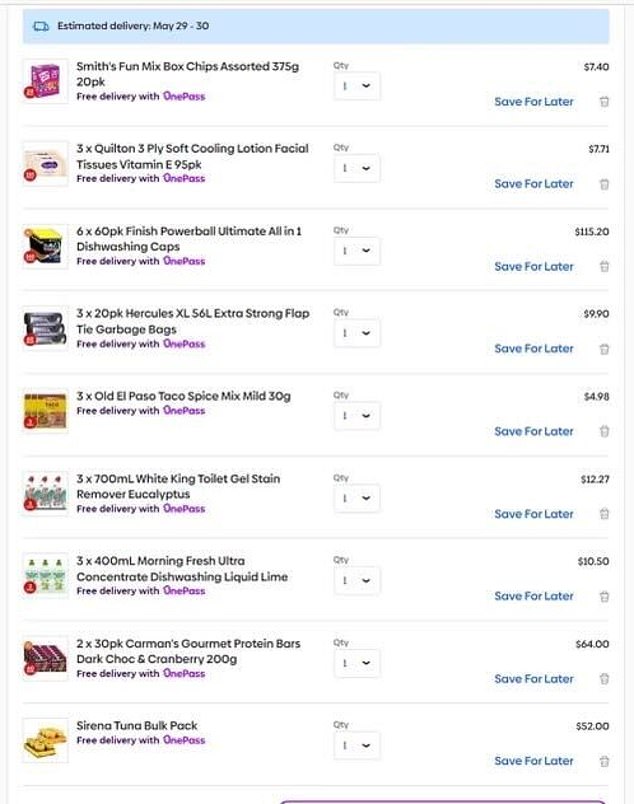

A recent Catch tour cost them $313 and was delivered free as part of their OnePass membership.

Purchasing the same or similar items would have cost them $544 at Woolworths and they would have received 60 fewer dishwashing tablets.

The family uses Flybuys, which is Coles’ free program, and the paid service OnePass, which allows them to get unlimited deliveries from retailers such as Kmart, Target, Priceline and Catch for $4 a month.

“We also shop there for things like Christmas and birthdays,” Zach said.

The family receives one delivery a week during quiet periods, but can receive “many more” before birthdays or during busier school periods.

‘The average shipping would cost between 8 and 10 dollars each, but we pay 4 dollars a month. It’s very useful because we can receive just one thing without having to think about what else we need to save on shipping. And it stops us from spending more money to get free shipping,” Alexandra said.

The couple cooks in bulk and plans as far in advance as possible to make the most of their savings. They admit that their garage is more of a warehouse for their bulk products.

“We went through Maccas recently and it was over $120 and it was disappointing,” Zach said.

This drive to self-service was a success for the budget-savvy couple who normally cooks cheaper meals like spaghetti bolognese in bulk for their family.

The family usually shops at Coles and earns Flybuys every time, then tries to fill up at Shell service stations to maximize their points.

‘We normally save all the prizes for Christmas and then use them for catering. “Usually these are vouchers worth about $300, which is great at that time,” they said.

Posner explained how he, as an expert, uses loyalty programs for maximum benefit.

Zach is the couple’s natural spender, while Alexandra would prefer to save money on “vacation” essentials.

The couple uses Catch, which is part of their $4 unlimited delivery, for things like school snacks and cleaning supplies, which they buy in bulk a couple of times a year, saving hundreds each time.

‘Personally, I choose loyalty programs that are based on our purchasing behavior, where we will get the maximum benefit both financially and from an easy experience. “For me, Amazon Prime offers an easy one-click ordering experience, fast and free delivery, and hours and hours of streaming movies,” he said.

“Based on the volume of orders we place and the shows we watch, the value is a no-brainer.”

In his For Love or Money consumer research study, Posner found that more Australians are turning to loyalty programs as the cost of living crisis continues.

Flybuys came first in Mr Posner’s loyalty program experience study, closely followed by Woolworths: Everyday Rewards and OnePass.

Amazon Prime and American Express Membership Rewards rounded out the top five.

“Consumers should look for the brands they really prefer to shop at to maximize their opportunities to save on that brand through their loyalty program, if they have one,” the expert said.

“For example, OnePass offers its members, for a small monthly subscription, free shipping from some of Australia’s most popular retailers, including Bunnings, Kmart, Officeworks, Target and Priceline.”

The couple uses Catch, which is part of their $4 unlimited delivery, for things like school snacks and cleaning supplies, which they buy in bulk a couple of times a year, saving hundreds each time.

Posner says there’s no “maximum” number of loyalty programs people should have: People should simply create them based on what they already spend.

The Cain family said they invested their savings into making memories with their children.

They have also been known to sign up for fruit and vegetable subscriptions, although they admit they only work if you’re flexible with what you want.

They also did three things with a cow from the butcher: They split the cuts and costs with family members and put it in the freezer.

Alexandra also keeps an eye on expenses and makes sure they are only bulk purchases.

‘Normally they are school snacks, toiletries and cleaning products. Things we always use,” he said.

One in five Australians have looked for a second job to stay afloat during the cost of living crisis.