The daughter of the Titanic expert who died when a submersible imploded near the doomed liner says trips to the wreck should continue.

Paul-Henri Nargeolet was one of five killed when the OceanGate submersible, Titan, catastrophically imploded near the wreckage of the Titanic on June 18 last year.

Also killed were OceanGate CEO Stockton Rush, businessmen Hamish Harding and Shahzada Dawood, and Dawood’s teenage son Suleman.

Nargeolet, a former Navy diver, earned the nickname “Mr. Titanic” due to his many expeditions to the wreck.

His daughter Sidonie claims OceanGate never contacted him after the disaster.

Speaking from her home in Ordino, Andorra, the 40-year-old said she had still not heard from anyone at the company eight months after her loss.

She said: “My anger is mainly because no one from OceanGate contacted us to tell us they were sorry for your loss, which makes me angry.”

“At least I think they could have contacted us to tell us we were sorry for their loss.”

The daughter of Titanic expert Paul-Henri Nargeolet, who died when a submersible imploded near the doomed liner, says trips to the wreck should continue. Sidonie claims OceanGate never made contact after disaster

Nargeolet was one of five killed when the OceanGate submersible, Titan, catastrophically imploded near the wreckage of the Titanic on June 18 last year. Above: The wreckage of the submarine is brought ashore in Newfoundland after being discovered shortly after the tragedy.

Nargeolet (left) was on the submarine along with Stockton Rush (right), CEO of OceanGate Expedition, and three others.

Despite her father’s fate, she believes that expeditions to the Titanic wreck should continue.

“I think they have to do it,” he said.

‘We don’t have to confuse between a bad submarine and a good one, you know?

“I think it’s good for people to go on the submarine and it’s good to take artifacts from the Titanic, but not to play with security, with people’s lives.”

Before the disaster, Miss Nargeolet had no idea that her father’s diving could be dangerous.

She said: ‘I’ve always been used to this so I think it was normal for me.

‘So I never questioned whether the submersible was good or not.

“He told me the Titan was a new type of submarine, but he didn’t tell me he was worried about that.”

She continued: ‘I didn’t know anything about this submarine, I didn’t know how it was done.

‘Now, from what I heard, it seems that so many people said it was a bad submarine, so why was it able to go to sea?’

The first sign of the unfolding tragedy came in a text message from Nargeolet’s wife, Anne Sarraz-Bournet.

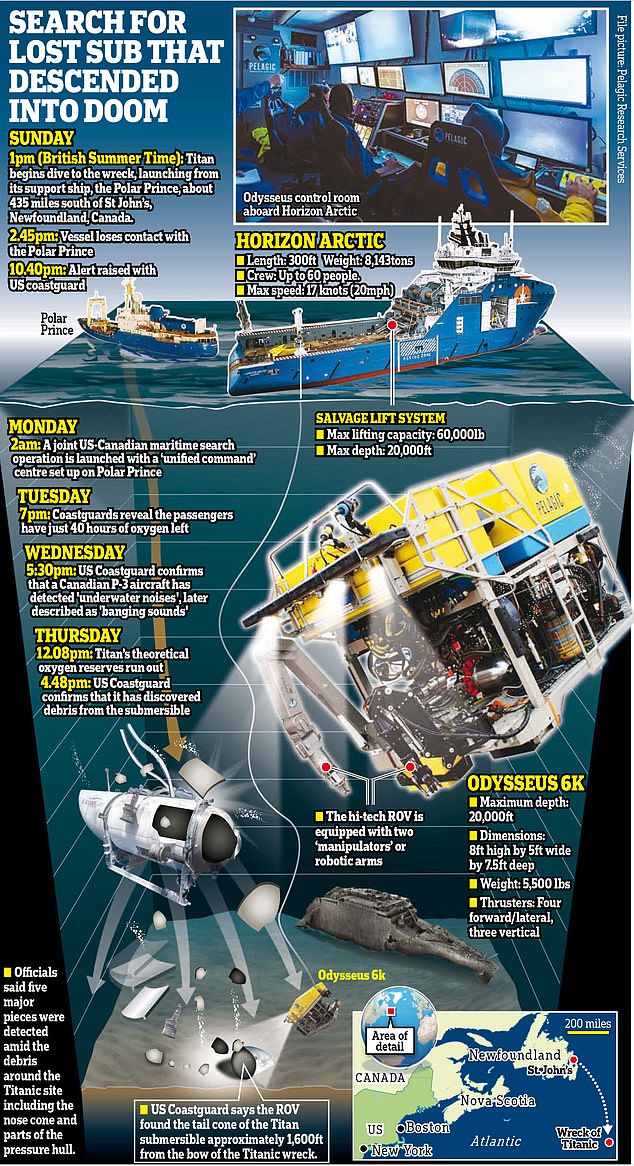

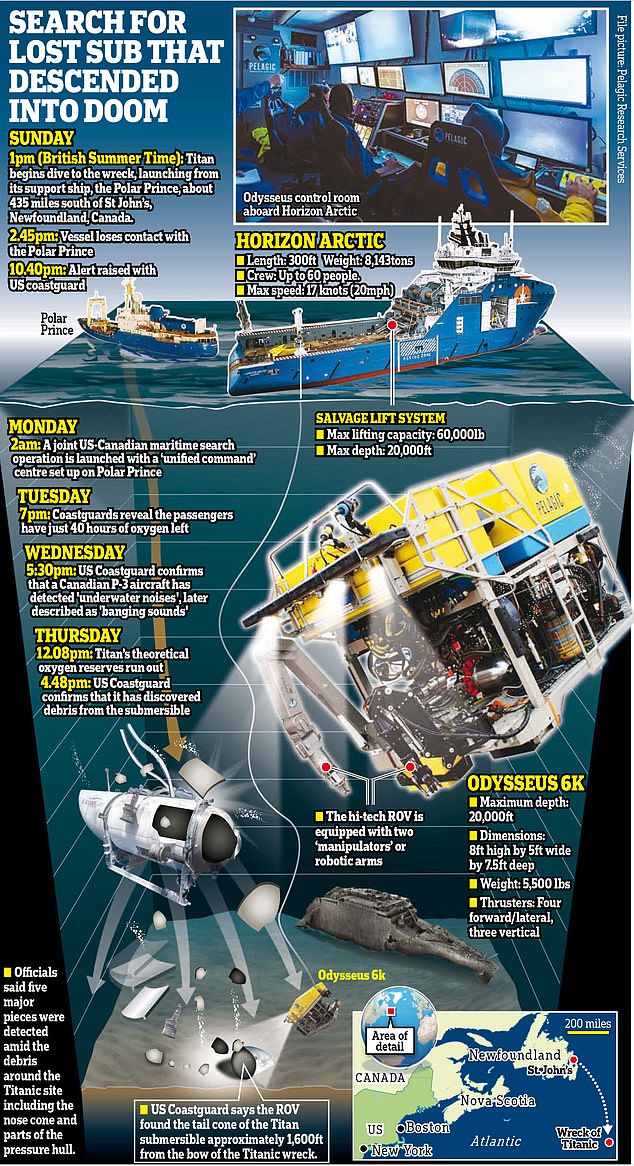

A desperate search was launched for the submarine after it lost contact with its mother ship and disappeared during an expedition to the wreckage of the Titanic on Sunday, June 18, 2023.

The Titan submersible before the disaster. Catastrophically imploded

Also on board were British billionaire adventurer Hamish Harding and Shahzada Dawood and her 19-year-old son Suleman.

A young Mr. Nargeolet in a diving suit. He spent more than 20 years in the French navy.

Mr. Nargeolet in his French navy uniform. He was a veteran of expeditions to the Titanic wreck.

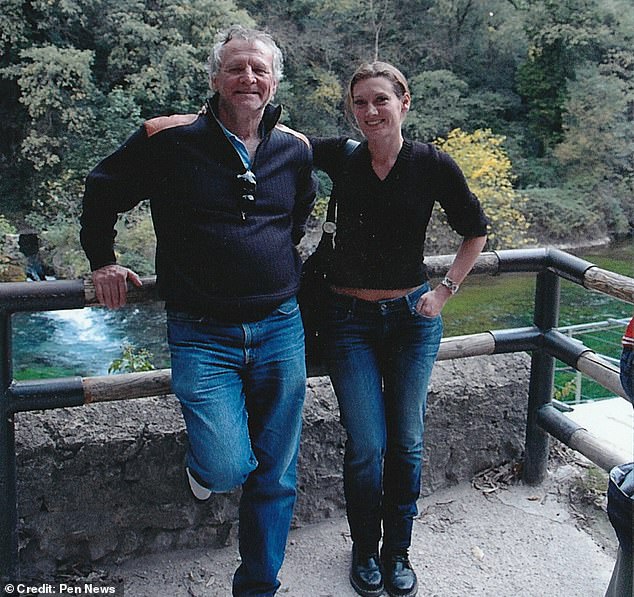

Mrs. Nargeolet as a child with her father. She says expeditions to the wreck should continue.

Speaking from her home in Ordino, Andorra, the 40-year-old said she had still not heard from anyone at OceanGate eight months after her loss.

“He sent me a WhatsApp telling me that my dad had been on the submarine and didn’t return in time,” Sidonie said.

‘The moment I read the message I went into total panic, because I thought ‘it’s a sub, if there’s a problem it’s really bad.’

“But with time and some explanations, I started to hope and think: ‘no, maybe they lost radio contact, everything will be fine.’

“I don’t know if it was because there was really hope or because he’s my dad and I didn’t want to think he was dead.”

In any case, their hopes were shattered when the United States Coast Guard announced to the families that Titan was lost.

She said: ‘We had four days to prepare, but anyway, it’s hard to accept.

“We heard that everything was done, but it’s very difficult to realize because we don’t see any bodies, you know?

“So it’s like he’s gone. It’s okay, but we have nothing to say goodbye to.”

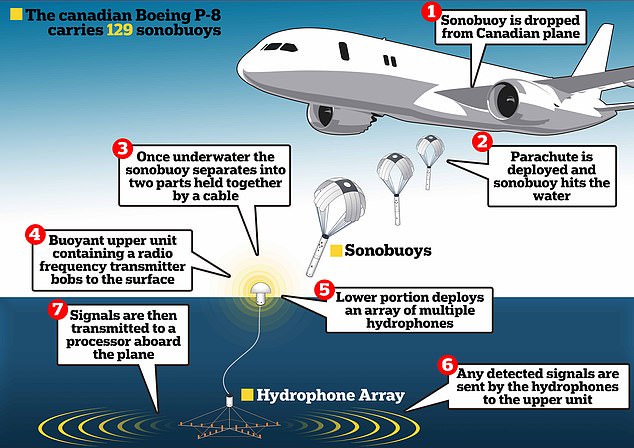

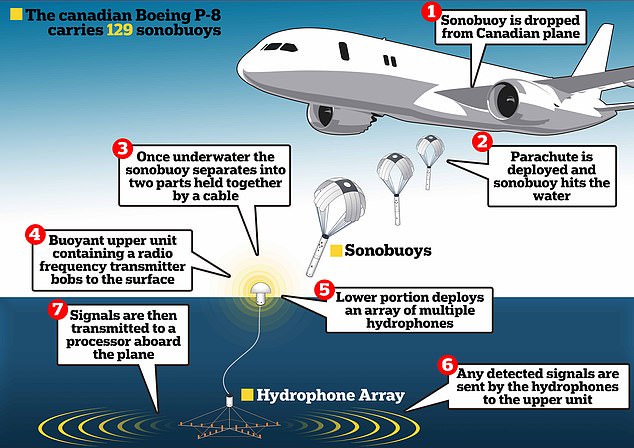

Banging noises were detected at 30-minute intervals using underwater sonar devices called “sonobuoys.” The graph shows how they were used during last year’s search.

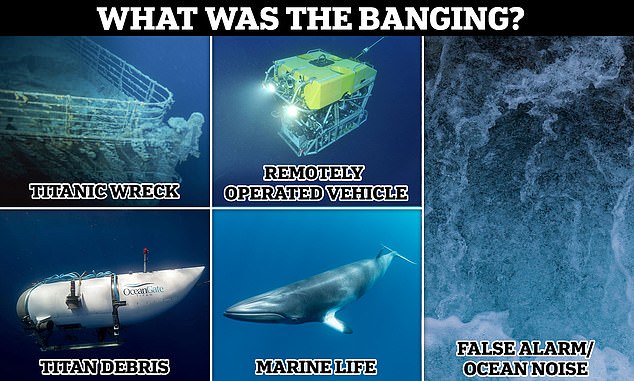

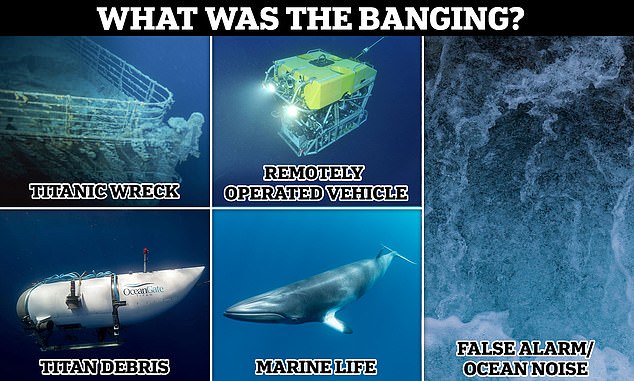

According to experts, the ‘hits’ could be due to search teams in the area, marine species such as whales or even simply sounds from the depths of the Atlantic.

Nargeolet, born in France, detailed his experiences diving the wreck of the Titanic in a book, Dans les profondeurs du Titanic (In the Depths of the Titanic).

Now the book has been translated into English with a new title, The Secrets of the Titanic.

The Secrets of the Titanic, translated by Laura Haydon, is now available for Kindle on Amazon, and a paperback version will be available in June.

Mrs Nargeolet said: ‘I am very happy. Last May, my father told me that his book was beginning to be translated into English.

‘You probably haven’t seen the result, but I’m happy that you told me and now it’s going to come out.

“I have learned many things in the book and it is something that will always be present.”

An OceanGate representative said they contacted the Nargeolet family after the accident.

Nargeolet spent more than two decades in the French Navy before leading several expeditions to the wreck of the Titanic.

His “unparalleled” knowledge of the Titanic and the images he captured during his world-famous dives there helped inspire his friend James Cameron’s hit 1997 film.

Nargeolet’s love of diving and the oceans began at the age of nine, when he discovered his “first wreck” following divers in Morocco.

And that passion led him to join the French Navy, where he served for 22 years in mine clearance before becoming a “leading authority” on the Titanic.

The sailor, born in Chamonix, France, was the first person to unearth an object – a silver plate – from the Titanic in 1987 and in 2022 he told Le Parisien that he had read “between 200 and 300 books” about the remains. of the Titanic.

The initial disappearance of the Titan submarine sparked a frantic, high-profile search, with rescuers initially hoping to find its occupants alive in the ocean.

Initial theories about what might have happened included that it may have lost radio contact or steering and propulsion capabilities.

The world held its breath as militaries, navies and private companies from around the world flocked to Newfoundland to help find the missing submarine before it ran out of oxygen.

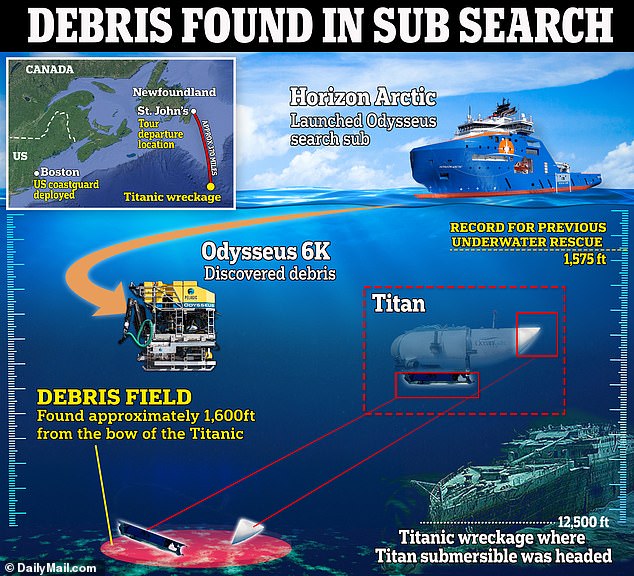

However, after days of searching, a search team found remains of the submarine about 1,600 feet from the Titanic’s bow.

Titan had imploded as a result of the enormous water pressure pressing down on the ship, killing everyone on board in what was likely a matter of milliseconds.

Its occupants had been on an expedition to see the remains of the Titanic, which has been the subject of global interest since it sank after hitting an iceberg in April 1912.