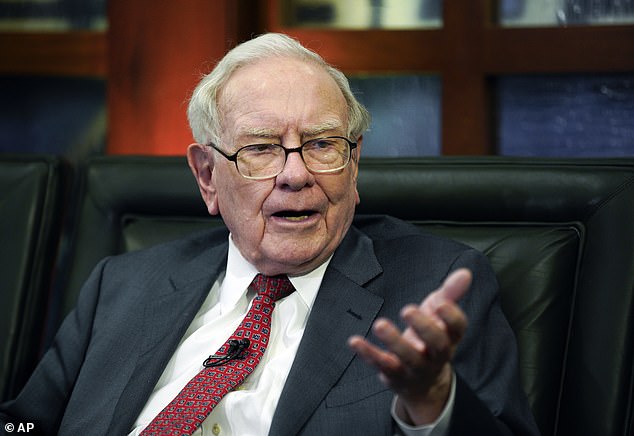

Warren Buffett’s Berkshire Hathaway has sold another big stake in Bank of America, bringing total sales since mid-July to nearly $5.4 billion.

Berkshire’s stake in BofA fell by about 150 million shares, in what some analysts see as clear warning signals to Wall Street that tougher times may lie ahead.

Buffett has traditionally been a fan of investing in financial companies, with BofA being his favorite stock for the past seven years and the bank’s largest individual shareholder.

The sale of such a large amount of shares in such a short period of time could suggest that economic turmoil or further market turbulence is on the way.

Warren Buffett’s Berkshire Hathaway has sold another big stake in Bank of America, bringing total sales since mid-July to nearly $5.4 billion.

Buffett’s massive purchase of Bank of America stock could be a sign of uncertainty on Wall Street

Brian Moynihan, the bank’s chief executive, has also managed to attract investors by rewarding them with dividends and share buybacks.

But the fact that Buffett appears to have sold nearly 15 percent of his company’s stake in BofA in just six weeks suggests that the Oracle of Omaha, as Buffett is known, has some concerns about the state of the economy and the stock market.

Berkshire remains BofA’s largest shareholder with a stake of around 11.1%, according to LSEG data.

Under regulatory requirements, Berkshire Hathaway must continue to report sales periodically until its stake falls below 10%.

Buffett, one of the world’s most respected investors, began investing in the bank in 2011 when Berkshire bought $5 billion of preferred stock.

Berkshire’s stake in BofA fell by about 150 million shares, in what some analysts see as clear warning signals to Wall Street that tougher times may lie ahead.

That purchase signaled confidence in Moynihan’s ability to restore the lender to health following the 2008 financial crisis.

In April 2023, Buffett, 94, told CNBC that he liked Moynihan “enormously” and did not want to sell the bank’s shares at that time.

Some analysts have suggested that Buffett is simply taking profits from the stock, which is up nearly 10 percent over the past six months and 38 percent over the past year.

“The Berkshire BofA sale is simply profit-taking after being opportunistic when the stock was much cheaper,” said Christopher Marinac, director of research at Janney Montgomery Scott.

“Buffett and Berkshire Hathaway have likely trimmed their stake in Bank of America to bring it in line with Apple’s after recently halving that stake,” added Michael Ashley Schulman, chief investment officer at Running Point Capital Advisors.

The billionaire investor is not known for his profits through sales, but he does occasionally manage to turn a profit, Schulman added.

Buffett has also been selling other key holdings, including half of his stake in Apple.

The company’s cash reserves had grown to a staggering $277 billion by the end of June.

“Building the cash position… when I look at the alternatives of what’s available in the equity markets and I look at the composition of what’s going on in the world, we find it quite attractive,” Buffett said at the company’s annual meeting in May.

Bank of America Chairman and CEO Brian Moynihan has also managed to attract investors by rewarding them with dividends and share buybacks.

Most of that cash is being invested in short-term treasuries, valued at $234.6 billion at the end of the second quarter — more than the Federal Reserve itself holds.

Last month, Buffett’s Berkshire Hathaway became the first non-tech company to reach a $1 trillion valuation.

Buffett’s conglomerate joins a small elite group of companies that have surpassed the trillion-dollar mark, including Google parent Alphabet, Meta, Nvidia, Apple, Microsoft and Amazon.

Shares of the Nebraska-based company have risen about 25 percent this year, outperforming the S&P 500, which is up 15 percent.

The coveted $1 trillion milestone was surpassed just days before the “Oracle of Omaha” turned 94.

The milestone “is a testament to the company’s financial strength and the value of the franchise,” said a Berkshire analyst at CFRA Research. CNBC.

“This is significant at a time when Berkshire represents one of the few conglomerates still in existence today.”

Berkshire Hathaway is a sprawling business empire with a $285 billion stock portfolio that Buffett has built over six decades, making him one of the richest people in the world.

The conglomerate has continued to focus on traditional investments as the owner of BNSF Railway, insurance companies and Dairy Queen.

‘It’s a tribute to Mr. Buffet and his management team, because the “old economy” companies… are the ones that built Berkshire.