Americans have defaulted on their credit cards at the highest level since the 2008 financial crisis.

After building up cash reserves during the Covid-19 pandemic, high inflation has now virtually depleted the savings of lower-income consumers.

According to BankRegData, credit card issuers wrote off $46 billion in seriously delinquent loans in the first nine months of this year.

That is 50 percent more than in the same period in 2023, and the highest level in fourteen years. The Financial Times reported.

Write-offs occur when a bank decides that it is unlikely that a borrower will be able to pay off his debts. This is a clear sign of increasing financial problems.

“High-income households are doing fine, but the bottom third of U.S. consumers are being tapped out,” said Mark Zandi, head of Moody’s Analytics. “Their savings rate is currently zero.”

Households’ financial resources are increasingly coming under pressure after years of high inflation and higher financing costs.

While the Federal Reserve began cutting borrowing costs from a 21-year high in September, the central bank signaled earlier this month that the pace of cuts next year would be slower than expected.

Americans have defaulted on their credit cards at the highest level since the aftermath of the 2008 financial crisis

Banks have yet to announce their figures for the fourth quarter of this year, but there are early signs that more and more consumers are falling significantly behind on what they owe, according to the Financial Times.

Capital One, the third largest lender in the US, said the annual charge-off rate on credit cards rose to 6.1 percent as of November, up from 5.2 percent last year.

“Consumer purchasing power has declined,” Odysseas Papadimitriou, head of consumer credit research firm WalletHub, told the newspaper.

Following the Covid-19 pandemic, consumers were willing to spend money after being forced to stay at home.

This meant that credit card balances soared and lenders accepted some customers who would not normally be eligible to take on debt because their bank accounts were full of cash.

But higher spending, along with supply chain bottlenecks, led to a rise in inflation.

As a result, the Fed began aggressively raising rates in 2022.

Higher interest rates then made it harder for people to fully pay off their credit card bills – especially for low-income Americans who might not have qualified to take out loans in the past.

In the 12 months through September, Americans therefore paid $170 billion in interest on their credit cards, the newspaper reported.

According to BankRegData, credit card issuers wrote off $46 billion in seriously delinquent loans in the first nine months of this year

The Federal Reserve, led by Jerome Powell, signaled earlier this month that it will slow the pace of cuts next year

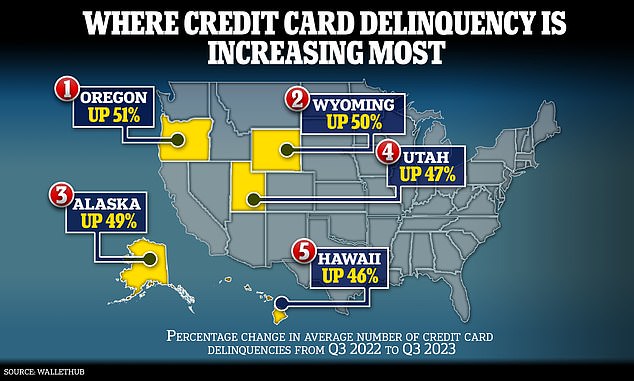

The number of borrowers struggling to keep up with their credit card bills has risen fastest in Oregon, according to an analysis by WalletHub

While many Americans had hoped for some relief from high interest rates next year, the Fed moderated its forecast for rate cuts next year at its latest meeting this month.

Officials now expect to cut just two quarter percentage points instead of four by the end of 2025.

The central bank said inflation “remains somewhat elevated” above its 2 percent target.

Credit card defaults, seen as a precursor to charge-offs, are also high, which experts see as a warning sign.

Delinquency occurs when a borrower fails to make a minimum monthly payment 30 days or more after the due date on their credit card statement.

If a payment is missed by just one or two days, it is considered a late payment.

According to the Financial Times, Americans have $37 billion in credit card debt that is at least a month overdue.

“Delinquencies point to more pain in the future,” Papadimitriou told the newspaper.

A separate January report found that the number of people falling behind on their credit card bills increased in 49 of 50 states last year.

According to the analysis of WalletHubthe number of borrowers struggling to keep up with their credit card bills rose fastest in Oregon. Between September 2022 and September 2023, delinquencies in the state increased by 51 percent.