Warner Bros. Discovery has reportedly halted merger talks with Paramount Global after the proposed deal raised concerns on Wall Street and sent shares of both companies tumbling.

Sources familiar with the matter said CNBC on Tuesday that acquisition talks had ground to a halt, several months after news of the potential media megamerger first emerged in December.

Skydance Media, the film and television studio run by David Ellison, is still conducting due diligence on a potential transaction with Paramount Global, two of the people said.

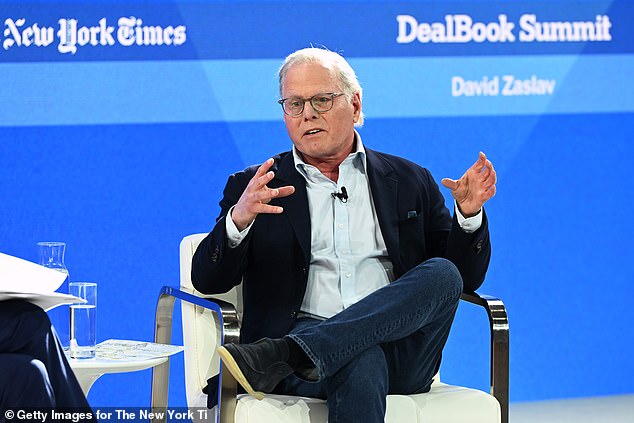

Shortly before Christmas, it was reported that WBD CEO David Zaslav had spoken with Paramount global CEO Bob Bakish and Shari Redstone, owner of Paramount’s parent company, about a potential acquisition.

Shares of both companies fell sharply on the news, and analysts warned that a merger would leave both companies “worse off” and saddled with billions more in debt.

WBD CEO David Zaslav speaks on stage during the New York Times Dealbook Summit 2023 at Jazz at Lincoln Center on November 29, 2023 in New York City

WBD shares (above) fell following reports of a proposed Paramount merger

‘It seems like a play to survive at all costs. “Both companies are heavily indebted and additional debt will likely need to be issued to make this deal possible,” Ben Barringer, technology analyst at Quilter Cheviot, said at the time.

The proposed deal came after months of industry speculation about consolidation between companies that lack the scale to compete with streaming pioneer Netflix, while steadily losing customers in the traditional television business due to cord cutting.

Among other holdings, WBD owns the Warner Bros. movie studios, HBO, CNN and the Max streaming service, while Paramount runs Paramount Pictures, CBS Entertainment Group and the Paramount+ streaming service.

A merger would have created Hollywood’s largest movie studio and a streaming business with the third-largest number of subscribers in the United States, analysts said.

The companies together would have accounted for up to 40 percent of the total time watched on traditional television.

But the current decline in the television business – its main profit driver – is also expected to make it more difficult for the companies to deal with the additional debt that would have accompanied the merger.

Warner Bros. Discovery has tried to shore up its cash flow and aggressively cut costs in recent months, but it still has about $45 billion in debt. Paramount has about $15 billion.

Meanwhile, new data on Tuesday showed that U.S. streaming subscriber growth has halved in 2023, a sign that the boom may be over for the industry in its key market.

Growth in the premium subscription video-on-demand category slowed to 10.1 percent last year from 21.6 percent in 2022, according to data from research firm Antenna.

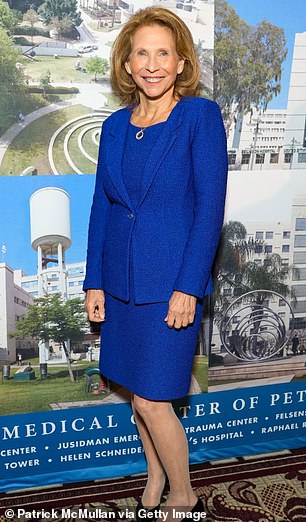

Shortly before Christmas, Zaslav was reported to have spoken with Paramount Global CEO Bob Bakish (left) and Shari Redstone (right), owner of Paramount’s parent company.

But its overall growth has more than doubled in four years, indicating a continuing resubscription trend.

Streaming giant Netflix, Comcast-owned Peacock and Paramount Global’s Paramount+ drove the biggest growth, with total subscriptions of 242.9 million by the end of 2023.

At the beginning of the streaming boom, companies focused on investing money in creating content to attract and retain subscribers.

Customers also signed up for services during the pandemic while they were confined to their homes and movie theaters were inaccessible.

But since then and with last year’s twin Hollywood strikes, companies have been looking to keep spending on content low while boosting their advertising offerings to generate revenue.

Earlier this month, Paramount Global said it would lay off about 800 employees, or about 3 percent of its workforce, in a bid to cut costs.

After merger talks emerged, several analysts questioned the timing of the deal talks, as the upcoming US presidential election would increase the regulatory uncertainty facing large mergers.

“It’s risky to push a deal of this magnitude during an election year when antitrust is making a comeback,” said Ross Benes, senior analyst at eMarketer.

Among other holdings, WBD owns the Warner Bros. movie studios (above), HBO, CNN and the Max streaming service.

Paramount runs Paramount Pictures, CBS Entertainment Group and the Paramount+ streaming service

Some analysts believed the talks could encourage Comcast, owner of NBCUniversal, to make its own move with Warner Bros. Discovery.

Comcast’s nearly $180 billion market value is much larger than Warner Bros. Discovery’s $30 billion and Paramount’s roughly $10 billion.

CEO Brian Roberts has also long been rumored to be interested in expanding the company’s media business.

“At the end of the day, Comcast may be the only strategic buyer with the capital structure and assets necessary to benefit WBD or PARA in a viable long-term manner,” MoffettNathanson analysts said.