Table of Contents

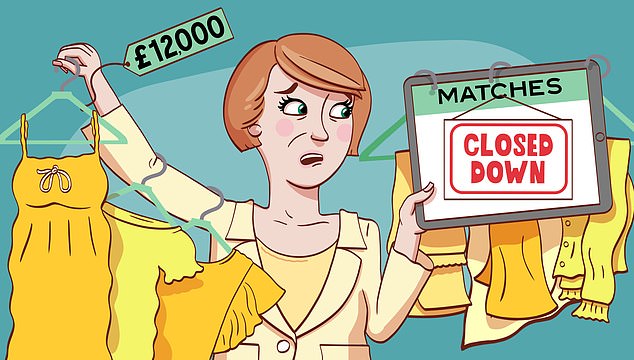

At the beginning of March, I bought six outfits costing around £12,000 from online fashion retailer Matches ahead of a family wedding. I planned to gather everyone in the bridal party in one place to try on clothes and find out what looks worked on who.

I chose to shop at Matches because they had brands that couldn’t otherwise be found in the UK and I was sure that if the clothes weren’t right I could return them under their 14 day no quibble returns policy.

But a few days later I found out that its owner, Frasers Group, had put the company into administration. The items were unsuitable and needed to be returned, but Frasers refused to take them back. SH, Kettering, Northants.

It’s one thing to return an item of clothing if a retailer goes bust, but another if it’s £12,000 worth of wedding suits.

Sally Hamilton responds: You contacted me shortly after it was announced on March 8 that Matches had been placed into administration, meaning that an insolvency specialist has taken over management of the business with a view to a possible recovery or finding a buyer.

It came as a surprise as a few months earlier the company had been acquired by retail giant Frasers for £52m.

Customers can still shop on the website and those who have made purchases since March 8 can take advantage of their returns policy as before. But those who purchased items before that date, like you, have been told they cannot be helped.

When you attempted to arrange a return, Matches informed you, as they informed me when I processed your refund request, that you were not eligible to get your money back.

An automated response said: ‘Unfortunately, any orders purchased before the administration period… are not eligible for a refund. Please do not attempt to return these orders as we will not be able to accept a refund or return these items to you.’

I found this unfair as the law says that any purchase made online can be returned if the company has been informed that the buyer wishes to cancel the purchase within 14 days of receiving the merchandise.

Buyers have another 14 days to return items and must receive a refund within 14 days of the company receiving the products. This is an essential protection for online shoppers, as they have not had the opportunity to inspect or try on items, as they would in a store.

Her order included sets in different shades of yellow from Matches’ own brand, Raey. Yellow was the theme color for a family member’s wedding party. Also in the order was a Paul Smith jacket for the groom, along with some citrus-colored T-shirts.

Since you purchased the items with credit and debit cards, you expected it to be protected. Credit cards offer protection under Section 75, which is part of the Consumer Credit Act of 1974.

It comes to the rescue if customers are left out of pocket when something goes wrong with a credit card purchase worth between £100 and £30,000.

The credit card provider is “jointly and severally” liable for a retailer’s breach of contract, even if it goes out of business.

Chargeback is similar, but is offered voluntarily by card providers. They will consider a refund when a purchase costing any amount has gone wrong, whether with a credit or debit card. Typically, customers must inform the retailer before initiating a chargeback and do so within 120 days of making the purchase.

You were aware of these options, but worried you wouldn’t be covered because you still had £12,000 worth of clothing in your possession, items you didn’t want but couldn’t return.

I asked your Nationwide card provider for guidance. He said that if he could prove that he had attempted to return the items, this could increase his chances of being successful with the claim.

You had evidence, including requests for a courier to pick up the items, so you initiated a chargeback claim through your Nationwide Visa card. Card providers usually refund customers’ money during this period, but can take it back again if the dispute fails.

Companies typically have 30 days to dispute a claim. If cardholders hear nothing after that time, then your chargeback is considered successful. When I met you last week you confirmed that the application had been successful and your £12,000 was secured.

A Nationwide spokesperson says: ‘We are pleased that our client has been successful with his claim. This is a great example of why we encourage people to pay by credit or debit card where possible, as they offer more consumer protection in case the products do not arrive or do not arrive as described, or because they do not arrive. items can be returned.’

He is considering selling the yellow clothing and donating the profits to the charity Citizens Advice to help others understand their rights as consumers.

Our insurer rejected a £1,118 pet insurance claim

We have a pet insurance policy with LV=. In January our fit labradoodle, Dave, fell ill and was diagnosed with kidney failure, with vet bills of £1,118.

We filed a claim but it was denied because the insurer said he had shown previous symptoms of kidney disease. We disagre. Please help. PL, Diss, Norfolk.

Sally Hamilton responds: Given that you pay £380 a year for this cover, you were hoping for better treatment when making a claim for your furry friend.

Dave was a generally healthy puppy, you say, except for one day about a year ago when he was cranky and panting in an unusual way. Routine blood and urine tests by a veterinarian showed nothing was wrong.

The tests were repeated a month later as a precaution, but the results were normal for a dog Dave’s age (nine years old at the time). But in January of this year, when Dave seemed to have lost his appetite, you became concerned: being a half-Labrador, he usually eats voraciously.

The vet thought he had a virus but did an additional blood test to check. It turned out he had a kidney problem, resulting in a treatment bill of £1,118.

I asked LV= to review her decision, as her vet supported her version of events. He agreed to pay his claim in full.

A spokesperson for LV= says: “We have reviewed this case and the information provided by the vet, and have re-evaluated the claim.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.