A business owner was left paralyzed after scammers stole $50,000 from him despite warning the bank to pause cash transfers.

Wade Brown received a panicked phone call late on a Friday night in 2022 after his staff noticed $50,000 was missing from the bank account of his business Pure Glass WA, which is located in Margaret River, south of Perth.

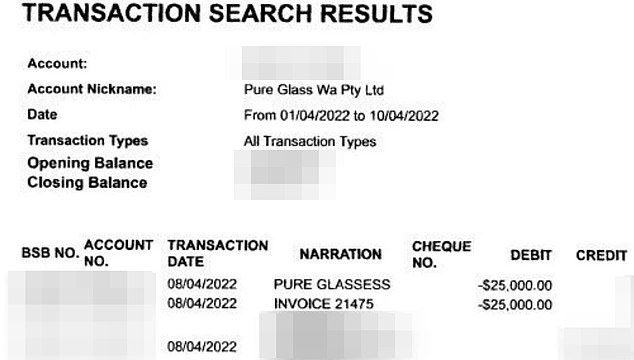

The money was sent to a bank account with AMP titled ‘Pure Glasses’ with the description ‘Invoice 21745’.

Mr Brown quickly called his bank, Bankwest, and froze his account. He said bank staff promised to notify AMP of the fraudulent transfer.

However, Mr. Brown still felt uneasy, so he personally called AMP to ensure that the funds were not credited.

AMP reportedly informed him that the transfer would be pending until Monday.

Despite assurances from both banks, the $50,000 was successfully transferred to the AMP account and into the hands of the scammer.

Mr Brown has spent the last two years desperately trying to recover his money, but without success.

Wade Brown (pictured) lost $50,000 in 2020 after a scammer scammed an employee at his company, Pure Glass WA.

Mr Brown quickly called his bank, Bankwest, and froze his account. He said bank staff promised to alert AMP about the fraudulent transfer.

“It almost paralyzed us. $50,000 is a lot of money in any small business,” he said. news.com.au.

The business owner claims Bankwest told him in 2022 that his company was responsible for the scam, not the bank, and refused to reimburse him.

Mr Brown subsequently lodged a complaint with the Australian Financial Complaints Authority (AFCA).

AFCA concluded that Pure Glass WA was at fault and that Bankwest was not liable to reimburse the company.

Although Mr Brown admits the scam “could have been a lot worse”, he feels he was misled by the banks.

He is still trying to piece together how hackers managed to successfully break into his Bankwest account.

Pure Glass is known to have experienced an internet service outage the day before the scammer called.

The scammer then called, posing as a Telstra employee investigating issues with the company’s modem.

One of Pure Glass’s employees fell for the scam because the criminal was able to provide details of the company’s modem.

Mr Brown said the fraudster should not have been able to access his bank account to make the two transfers (pictured)

Bankwest says the employee was then persuaded to download software that gave him access to Pure Glass’s systems.

Mr Brown disagreed, but said that even if the fraudster had access to Pure Glass’s computer, he would not be able to access its banking services.

A token code must be entered into the system before any transaction is approved.

That code is generated by a device kept in a locked room and is changed every few minutes.

“I tried to make two transactions without a security code – it’s impossible,” Brown said.

Bankwest said the scammer was able to obtain the token code by sending it to a registered mobile phone number.

A Bankwest spokesperson declined to comment directly on Brown’s case to the outlet, but said keeping customer funds safe “is a priority.”

It added that it is “accelerating investment” in its scam detection technology and said it is “doing everything possible to prevent or recover funds lost to scams.”

An AMP spokeswoman said “this appears to be a case that would benefit from further investigation” and urged Mr Brown to contact them again.

“AMP recognises our important role in working with regulators and other banks to help protect the community from fraudulent activity and, like other organisations, we have enhanced our own systems and practices to protect consumers,” he said.

Daily Mail Australia has contacted both banks for further comment.