<!–

<!–

<!– <!–

<!–

<!–

<!–

A mega merger between Vodafone and Three is in danger of falling apart after the competition watchdog launched an in-depth investigation into the deal.

The Competition and Markets Authority (CMA) will investigate the £15 billion commitment over concerns it will drive up prices for customers.

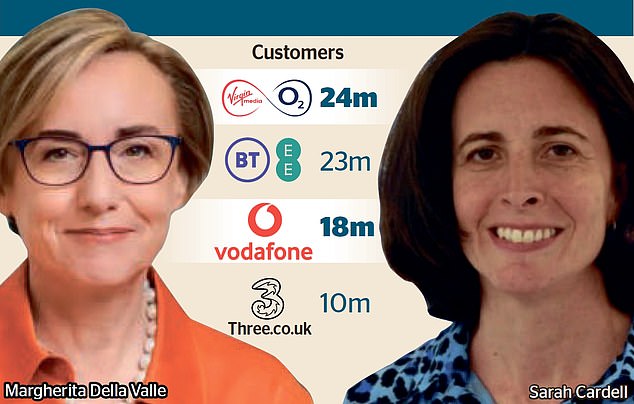

This decision pits Vodafone boss Margherita Della Valle against CMA director Sarah Cardell.

Last week, the regulator said the merger would reduce rivalry in the sector. The companies were given five days to respond to the findings of the first phase of the investigation. But they offered no solutions, which prompted the second phase of the investigation.

The CMA has the power to block mergers that would harm customers.

Probe: Regulator’s decision on £15bn deal pits Vodafone boss Margherita Della Valle, left, against CMA director Sarah Cardell, right

Three and Vodafone said yesterday that the phase two trial was “an expected next step in the process”. But Karen Egan, head of telecoms at Enders Analysis, said there was “a significant risk” the deal would be blocked.

Della Valle became Vodafone’s first female CEO at the beginning of last year. She took over after Nick Read, who presided over a major fall in the FTSE 100 company’s share price, was ousted in 2022.

The Italian businesswoman, who has worked for Vodafone for almost thirty years, was tasked with turning around the telecom giant’s fortunes.

Under the plan, the proposed partnership would bring together 28 million customers under a single provider, creating the UK’s largest mobile phone network.

But the CMA warned last week that the merger could reduce rivalry between networks to win customers, removing price competition and the incentive to improve service.

In a joint statement, Vodafone UK and Three UK said: ‘This was an expected next step in the process and is in line with the timeframe for completion.’

Last week, Julie Bon, the CMA’s deputy chief economic adviser, said: ‘While Vodafone and Three have made a number of claims about how their deal is good for competition and investment, the CMA has so far seen insufficient evidence to support these claims .

“Our initial review of this deal has identified concerns that could lead to higher prices for customers.

‘These warrant an in-depth investigation unless Vodafone and Three can come up with solutions.’

The companies have insisted a deal will benefit customers as it will allow them to invest £11 billion in technology. They said they cannot compete with market leaders EE and O2.

Sophie Lund-Yates, chief equity analyst at Hargreaves Lansdown, said: ‘The outcome of this won’t be known until mid-September, and there will be little to move Vodafone’s share price between now and then as this is the key sentiment driver. .’

Vodafone shares fell 1.5 percent.