An elderly woman with dementia was secretly scammed out of millions by her home carers, her surviving relatives have claimed.

The accusations were revealed in The Chronicle of San Franciscowhich points to four anonymous women as responsible and 91-year-old Geraldine Clark as its unsuspecting mark.

Clark died in 2023, seven years after the alleged scam.

The group of caregivers found through a placement agency channeled more than $4 million of their finances in that period, surviving relatives said.

The trustee appointed to oversee the San Francisco woman’s finances after her death traced the money to an account managed by Wells Fargo, where he found more than 1,000 canceled checks made out to caregivers.

Geraldine Clark, 91, seen here before her death with her also-deceased partner, William Clement, lost more than $4 million over the course of seven years thanks to four scamming live-in caregivers, her relatives claimed this week.

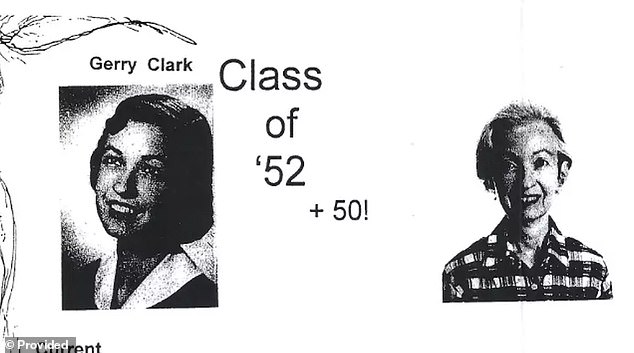

Clark, seen here in a 1952 yearbook photo and in another photo taken 50 years later, died in 2023, seven years after the alleged scam. The group of caregivers found through a placement agency allegedly funneled the money out of their finances in that period.

“There were months when (caretakers) were taking out between $100,000 and $200,000,” David Stewart, Clark’s 60-year-old nephew, told the local newspaper. “It was like a piggy bank.”

“I sat with a bank manager until 8:30 at night, pulling out all the checks and putting everything together to have a case,” added Heather Yarbrough, the administrator appointed shortly after Clark’s death to oversee his finances.

Yarbrough, a licensed private professional fiduciary and nationally certified guardian, proceeded to compare the cashed checks to a checkbook record recovered from Clark’s apartment.

All entries were written in the primary caregiver’s handwriting, she said, citing how Clark had been diagnosed with dementia in 2016.

He added that he made the discovery about the controls four months after the matriarch’s death last year, just a few months after the anonymous caretaker called Clark’s nephew, David Stewart, to tell him that Clark’s savings had been wiped out. exhausted.

The call came after Clark had, for years, lived off the half-million left to him by his partner, William Clement, and an illustrious stock portfolio inherited from his family.

The arrangement allowed the woman to live comfortably in her rent-controlled apartment in the city’s financial district, even as her faculties declined.

However, when Clark was transferred to a nursing home a month after Clement’s death in November 2022, her once $5 million brokerage account was worth a measly $185.

Clark, seen here in her youth, also suffered from dementia, a diagnosis the four women did not reveal to living relatives.

Clark died at the facility months later, after which Yarbrough traced the missing millions to the Wells Fargo account.

There, the fiduciary expert found checks that had been written and cashed for thousands more than the corresponding entries in the checkbook indicated, as well as documents showing how each of the caregivers was supposed to earn $30 an hour.

However, once you factored in the overpayments, the hourly rate skyrocketed to more than $416 an hour, compensation that amounts to more than $4 million that Clark’s relatives now say was stolen when added together. 2016 to 2022.

Yarbrough presented his findings to both San Francisco police and the FBI in a police report filed in May of last year, although both sides declined to take up the case.

As for an explanation as to why, Detective Sgt. Justin Woo told the Chronicle on Saturday that “the case was presented to the district attorney’s office (but) was rejected.”

“Without the testimony of the deceased victim, the Prosecutor’s Office will not be able to prove this case beyond a reasonable doubt.”

However, after contacting the district attorney’s office, the Chronicle found inconsistencies with that narrative when prosecutors refuted Woo’s statement, stating: “No arrest warrant or evidence was presented to our office for review on this affair”.

The administrator appointed to oversee the San Francisco woman’s finances, Heather Yarbrough (pictured), traced the money to an account managed by Wells Fargo, where she found more than 1,000 canceled checks made out to caregivers.

The statement from the San Francisco District Attorney’s Office added: “When the San Francisco Police Department brings a case to us… we will carefully review all of the facts and evidence gathered to see if we can pursue criminal charges.”

Meanwhile, an FBI spokesperson also claimed that the feds had decided not to take on the case, prompting some statements of disbelief from Yarbrough.

“I had no idea that here they would do absolutely nothing about a crime of this magnitude against an elderly person,” he said, citing emails showing the primary caretaker allegedly carrying out the theft amid correspondence with Clark’s financial managers.

Medical records that caregivers had not shared with Clark’s family also failed to convince investigators, showing the extent of his deterioration at the time. dementia and years of monthly prescriptions for 150 5 mg pills of hydrocodone, a powerful opioid that could worsen cognitive decline in older adults.

“Every time a prescription was written it was at the request” of the primary caregiver, Kaira Stewart said, pointing to notes in her aunt-in-law’s medical record.

She and David live in Costa Mesa, more than 400 miles from where all of this happened. Both have said they were never told about the 2016 dementia diagnosis.

David’s sister, Elizabeth Bryant Stewart, lives even further away in France, and the family now says they believe there is little to be gained by suing the carers.

The newspaper did not name the four alleged perpetrators of the plot due to the lack of criminal charges, as the Stewarts struggle to pick up the pieces without a criminal case. In the photo, Clark and his partner, who left half a million to his beloved, who had millions in an inherited stock portfolio.

After doing some digging into Kaira’s social media posts from the primary caregiver, she told the newspaper that her mother-in-law’s money had probably run out a long time ago, and how the posts from the caregiver and her family showed photos of vacations, new vehicles and even a new house.

She also recalled how the head of care repeatedly contacted her and her husband after Clark was moved to a nursing home and then after his death to ask for money, which she said was for missing paychecks.

“I feel really bad about what happened to my number one aunt,” David said, adding that he saw Clark as a second mother. “But I feel like there’s another family this could happen to again.”

John Hartog, a Bay Area attorney who specializes in probate law, blamed the structure of the city’s criminal justice system for the lack of charges, telling the Chronicle: “Criminal law will not punish these types of wrongdoers, nine times out of 10.”

The newspaper did not name the four alleged perpetrators of the plot due to the lack of criminal charges, as the Stewarts struggle to pick up the pieces without a criminal case.

Meanwhile, The Chronicle reported that it reached out to the primary caregiver for comment through emails, text messages and phone calls, but did not receive a response.