There is only one week left to enjoy ad-free viewing on Amazon Prime Video.

The ads will finally arrive on Amazon Prime starting next week and users who want to avoid them will have to pay additional costs.

Starting February 5, Amazon Prime Video subscribers in the UK will start receiving ads as part of their streaming service.

Those who don’t want ads interrupting their chosen content will have to pay an additional £2.99 per month.

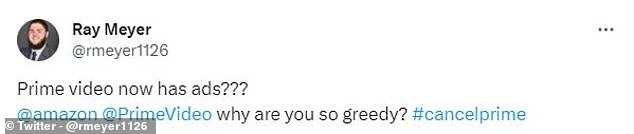

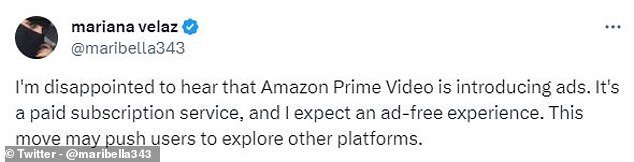

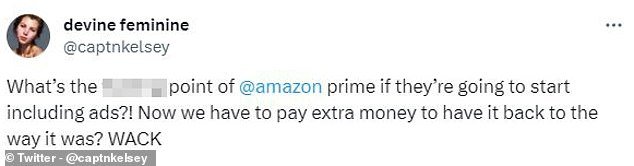

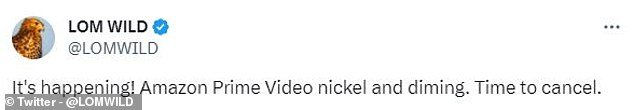

Subscribers have already criticized the move as “greedy” on social media, with many even threatening to cancel their accounts over the change.

Amazon Prime Video users will soon have to endure ads on shows and movies unless they subscribe to an ad-free tier at a higher cost.

Amazon announced the decision in September to bring ads to its streaming platform, but did not publish the dates until December of last year.

Amazon Prime Video is one of the products that customers get when they subscribe to Amazon Prime, the tech giant’s paid subscription service.

Amazon said it won’t make any changes to Prime’s current price, so customers who don’t mind seeing ads when watching Prime Video won’t have to pay more money.

However, customers who do not want to see ads will have to pay an additional fee: £2.99 per month.

Social media users have already reacted with outrage to the change, taking to social media to criticize the decision as “greedy.”

One commenter wrote: ‘Prime video now has ads?? Why are you so greedy?

‘I’m disappointed to hear that Amazon Prime Video is introducing ads. “It’s a paid subscription service and I wait and add a free experience,” wrote another.

While another furious commenter wrote: ‘What’s the fucking point of @amazon prime if they’re going to start including ads?!

‘Now do we have to pay extra money to get it back to the way it was?’

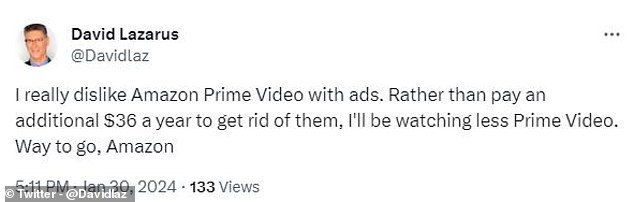

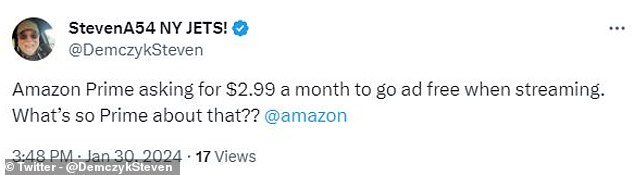

On X, formerly Twitter, Amazon Prime subscribers reacted angrily to the change, calling it “greedy”

With ads ready to roll out to the paid subscription service, some social media users began to wonder why it was worth paying for.

This led one to wonder: ‘What is it about Prime?’

Other subscribers have gone further and taken to social media to say they would cancel their subscriptions rather than face the ads.

‘It’s happening! Amazon Prime Video nickel and dim. It’s time to cancel,” wrote one commenter on X.

Another wrote: ‘Instead of paying an extra $36 a year to get rid of them (ads), I’ll watch less Prime Video. Way to go, Amazon.’

One social media user even said they would “strive to boycott any product that disrupts my viewing.”

Some Amazon Prime Video subscribers were so outraged by the decision that they took to social media to say they would cancel their subscriptions and called on others to do the same.

Amazon announced the changes would come in an email sent to existing Amazon Prime Video subscribers.

But the date on the email was different depending on where the recipient was located: January 29 for US users and February 5 for UK users.

In the email, the company wrote: “Prime Video movies and TV shows will include limited ads.”

‘This will allow us to continue investing in engaging content and continue to grow that investment over a long period of time.

‘Our goal is to have significantly fewer ads than linear TV and other streaming TV providers.

“There is no need for you to do anything and there is no change to the current price of your Prime membership.”

The ads will come to Amazon Prime Video in other countries later in 2024, including France, Italy, Spain, Mexico and Australia.

With Amazon Prime Video set to roll out ads next week, some subscribers have begun to question why the service is worth paying for.

Amazon’s move follows rivals Netflix and Disney+, both of which have launched ads on their cheaper subscription options over the past year.

Amazon is just one of the companies trying to maximize revenue from its video streaming service, as both Netflix and Disney+ have recently introduced ads that generate millions of dollars from advertisers.

Netflix’s ad-supported tier, ‘Basic with Ads’, launched in November 2022 and was originally an alternative option to the existing ‘Basic’ tier for £6.99.

However, earlier this year Netflix got rid of this Basic tier, which did not display ads, in an attempt to force users to opt into the ad option.

Disney+ followed suit by introducing a tier of ads, first for US users in December 2022, and then in the UK and eight other European countries in November.

Disney+ also announced a crackdown on password sharing, following a similar move by Netflix.

Ads on Netflix and Disney+ last an average of four minutes per hour, so the fact that Amazon promises “significantly fewer ads” suggests they will be fewer on Prime Video.