Table of Contents

US stock markets are inching closer to record highs as the prospect of further interest rate cuts and the rise of artificial intelligence continue to drive investor flows.

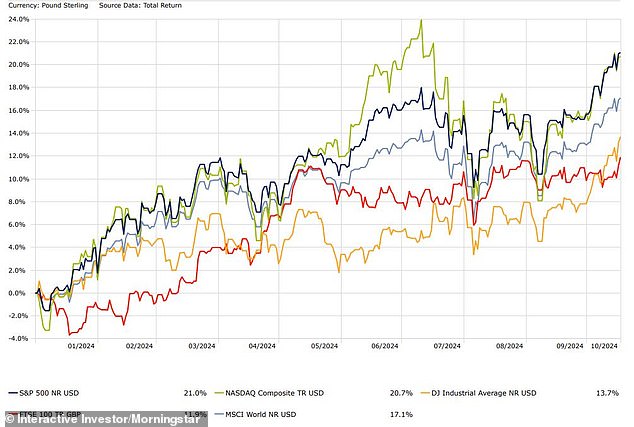

The tech-heavy Nasdaq and S&P 500 are up about 24 percent each since the start of the year, with the latter hitting an all-time high this week, despite a toxic cocktail of global conflict, weakening economic growth in Europe and China, and recent oil price volatility.

The Dow Jones has added just 15 percent this year, having closed at a record level in four of the last five trading sessions.

UBS expects Fed rate cuts of 50 basis points in the remainder of 2024, with 100 basis points expected next year

U.S. stocks have been boosted by a larger-than-expected 50 basis point Federal Reserve interest rate cut in September, as well as rising gains in AI-linked names such as Nvidia and TSMC.

The FTSE 100, which has much less technology exposure, has risen about 8.3 percent since the start of the year, while the MSCI World index has added just 20 percent.

Richard Hunter, head of markets at Interactive Investor, noted that the U.S. consumer has also proven to be in “poor health,” following better-than-expected retail sales and lower-than-expected jobless claims released this week.

He said: “The perfect scenario of an economic soft landing is increasingly possible, which in turn gives the Federal Reserve more options in its interest rate deliberations.”

Fed rate cuts have helped propel US stock markets to record highs in 2024

The Dow, S&P 500 and Nasdaq were at 43,239.05, 5,841.47 and 18,373.61 points, respectively, on Friday morning. This compares to the respective intraday all-time highs of 43,289.76, 5,815.03, and 18,671.07.

In a note on Friday, analysts at UBS, which remains “positive on the broader tech industry, especially the AI-linked segment,” dismissed investor concerns that stronger-than-expected U.S. economic data would lead to the Federal Reserve to postpone further rate cuts.

They said: “We continue to expect another 50 basis points of cuts by the end of this year and another 100 basis points in 2025.”

This would bring the Federal Reserve’s target range to between 4.25 and 4.5 percent by the end of 2024, and already between 3.75 and 4 percent by the end of 2025.

UBS added: ‘Overall, with inflation moderating, spending remaining healthy and the labor market remaining stable, we expect the Federal Reserve to continue cutting interest rates in November and December, and are likely to ease them further in each quarter in 2025. We like US stocks. ‘

Interactive Investor’s Hunt said: “US markets are currently in a sweet spot.

“The central factor has been the growing possibility that the Federal Reserve has been able to engineer the legendary ‘soft landing’ of the economy, avoiding the situation in which higher interest rates and slowing growth can inevitably lead to a recession

‘Inevitably, there are some concerns that the market may be overheating given higher valuations, while corrections inevitably occur as part of the investment story. At the moment, however, the scenario looks ripe for further potential gains.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.