The US House of Representatives speaker for China said support for Taiwan was “extremely strong” in a meeting with the country’s newly elected president.

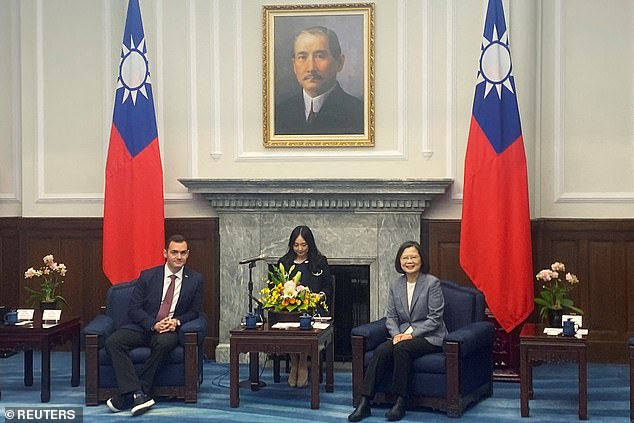

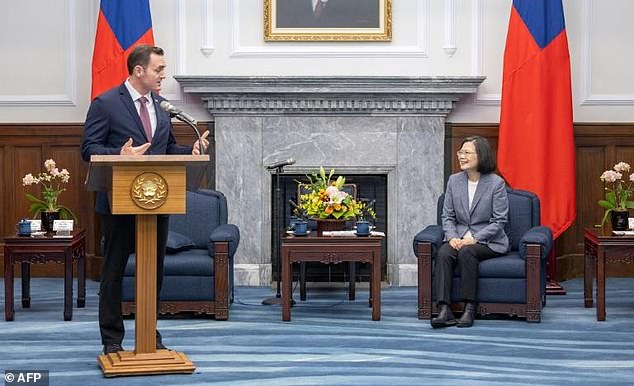

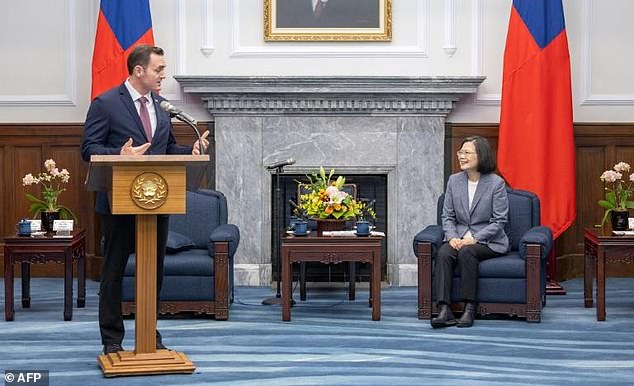

Mike Gallagher heads the five-member delegation that met with Taiwanese President Tsai Ing-wen and Vice President Lai Ching-te yesterday.

The duo won last month’s presidential election and will take office in May.

“In fact, I think the support for Taiwan in the United States Congress… I see growing and extremely strong support for Taiwan,” Gallagher told media.

Gallagher, an outspoken critic of China, added that he believed US support for Taiwan would not be affected by the outcome of the 2024 presidential election in his country.

Mike Gallagher (left), US House China chairman, said US support for Taiwan was “extremely strong”.

Gallagher, an outspoken critic of China, added that he believed US support for Taiwan would not be affected by the outcome of the 2024 presidential election in his country.

“I am very confident that support for Taiwan will continue regardless of who occupies the White House,” he said.

He also said any attempt by Beijing to invade Taiwan would be “incredibly foolish.”

“If Xi Jinping and the Chinese Communist Party ever made the incredibly foolish decision to attempt an invasion of Taiwan… that effort would fail,” he said during the meeting with Lai.

Earlier, President Tsai welcomed U.S. lawmakers and said the visit demonstrated “the United States’ strong support for Taiwan’s democracy through concrete actions.”

‘We will continue to advance our international partnerships and collaborate with the world. In 2024, we hope to see even more exchanges between Taiwan and the United States in a variety of fields,” she said.

The delegation will remain until Saturday as part of a broader visit to the region, the American Institute in Taiwan, Washington’s de facto embassy in Taipei, said in a statement.

Accompanying Gallagher are US representatives Raja Krishnamoorthi, John Moolenaar, Dusty Johnson and Seth Moulton.

The delegation’s visit will focus on U.S.-Taiwan relations, regional security and trade and other topics, according to a statement from Gallagher’s committee.

He also said any attempt by Beijing to invade Taiwan would be “incredibly foolish.”

Earlier, President Tsai welcomed U.S. lawmakers and said the visit demonstrated “the United States’ strong support for Taiwan’s democracy through concrete actions.”

In November 2023, US President Joe Biden hosted his Chinese counterpart Xi Jinping (pictured) for a summit on the sidelines of an Asia-Pacific economic meeting, and the two agreed to restore military communications.

The United States is Taiwan’s most important ally, and the island has been at the center of tensions with China, which claims it as its territory and has not ruled out using force to bring it under Beijing’s control.

While the United States does not formally recognize Taiwan, it is the island’s main ally and supplier of military equipment, a thorn in the side of relations between Washington and Beijing.

The US State Department yesterday authorized the sale of an advanced tactical data link system worth $75 million to Taiwan, according to a Pentagon statement.

Taiwan’s Defense Ministry welcomed the move, saying in a statement that “the United States provides us with the means to enhance our ability to confront current and future threats.”

Before his election victory, Lai, of the ruling Democratic Progressive Party (DPP), vowed to defend the island against “bullying” by China.

Relations between the United States and China have been tense for years, with simmering tensions over a range of issues, including trade, alleged espionage, human rights and foreign policy.

Tensions have eased markedly over the past year after a series of high-level meetings between U.S. and Chinese officials.

In November 2023, US President Joe Biden hosted his Chinese counterpart Xi Jinping at a summit on the sidelines of an Asia-Pacific economic meeting, and the two agreed to restore military communications.

The US State Department yesterday authorized the sale of an advanced tactical data link system worth $75 million to Taiwan, according to a Pentagon statement.

Beijing has called Lai a “troublemaker” and “separatist,” and reacted to his victory by warning against taking steps toward formal independence, which the president-elect has said he opposed.

Beijing has called Lai a “troublemaker” and “separatist,” and reacted to his victory by warning against taking steps toward formal independence, which the president-elect has said he opposed.

“If anyone on the island of Taiwan thinks about seeking independence, they will be… trying to divide China, and will certainly be severely punished by both history and law,” Wang said at the time.

In January, a Chinese Foreign Ministry spokesperson reiterated that Beijing was “firmly opposed” to all official exchanges between the United States and Taiwan after Lai met with a visiting American delegation.

In the latest flare-up, Beijing on Wednesday accused Taipei of “trying to… hide the truth” about an incident in which two Chinese nationals died following a clash between their fishing boat and a Taiwanese coast guard ship in controlled waters. for Taiwan.