Table of Contents

- The world’s largest economy added only 12,000 jobs in October

- The lowest level in almost four years and well below the expected 113,000 economists

- Last major set of economic data before presidential election

Worse-than-expected US jobs figures yesterday added to the market turmoil in Britain sparked by this week’s Budget.

Official figures showed the world’s largest economy added just 12,000 jobs in October, the lowest level in almost four years, and well below the 113,000 economists had expected.

That reaffirmed expectations that the U.S. Federal Reserve will cut interest rates by a quarter percentage point next week.

It was also the last major set of economic data before next week’s presidential election.

But the numbers were skewed by the impact of hurricanes and strikes, and experts said they failed to provide a clear picture to voters about whether the overall economy was improving. However, they helped reverse a sell-off in UK bond yields and the pound that took hold after Rachel Reeves’ Budget debut.

Upheaval: Official figures showed the world’s largest economy added just 12,000 jobs in October

Investors have been anxious that the Chancellor’s plans to borrow £162 billion more over the next five years to fund a spending splurge could help fuel inflation. That could slow the pace of the Bank of England’s interest rate cuts, at a time when the Federal Reserve and European Central Bank have been cutting more rapidly.

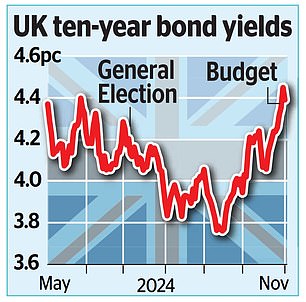

As a result, yields on UK bonds – known as gilts – have risen sharply, effectively increasing the cost of government borrowing.

Ten-year bonds rose above 4.5 percent on Thursday to hit their highest level in a year.

They had been as low as 3.75 per cent in mid-September, before Labor began making clear that it was preparing to change debt rules so it could embark on a new borrowing binge.

Yesterday, bond yields shot up again in early trading before falling back to nearly 4.4 percent.

But despite yesterday’s quieter end to trading, 10-year bonds – whose prices are falling as yields rise – still suffered their worst week so far this year, with yields rising by 0. 2 percentage points.

For two-year bond yields, the damage was even greater, as they endured their worst week since June 2023.

The pound also defended itself yesterday, rising one cent to almost $1.30 against the US dollar during a volatile day. It had sunk about $1.28 in the wake of the budget.

The market reaction led some to draw comparisons with Liz Truss’s disastrous 2022 mini-budget, which caused a bond market crash and ultimately cost the prime minister her job.

Reeves said his budget – unlike Truss’ – had been backed by the International Monetary Fund and the Office for Budget Responsibility.

Data from fund network Calastone showed a record £2.71 billion was withdrawn from funds last month as investors anticipated an increase in capital gains tax in the Budget that would reduce any profits. of sales.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.