The US general in charge of the Middle East headed to Israel on Thursday to coordinate with Israeli defense officials after Iran threatened retaliation against the country for an attack in Syria.

General Michael ‘Erik’ Kurilla’s long-awaited meeting with Israeli Defense Minister Yoav Gallant and other senior Israel Defense Forces officials was first reported by axios. Kurilla is the commander of the United States Central Command.

It comes after an Israeli attack on an embassy compound in Damascus killed Brigadier General Mohammad Reza Zahedi and several others last week.

Zahedi was the highest-ranking Islamic Revolutionary Guard Corps officer killed since the assassination of Qasem Soleimani in 2020.

Iran’s Supreme Leader Ayatollah Ali Khamenei said Wednesday that Israel made a mistake and “must be punished.”

Gen. Michael Erik Kurilla headed to Israel to coordinate with Israeli defense officials as Iran threatens to attack. He is in charge of the Middle East (file photo)

Israeli Prime Minister Benjamin Netanyahu appeared to reiterate a warning to Iran on Thursday that if Iran attacks, Israel will retaliate.

“We established a simple principle: anyone who attacks us, we hit them,” Netanyahu said during a visit to an F-15 base, according to Israel Times. “We are ready to fulfill our responsibilities for Israel’s security, in defense and attack.”

“We are in difficult times,” Netanyahu told the pilots during his visit. ‘We are in the middle of a war in Gaza that continues in full force. Furthermore, we continue relentless efforts to return our hostages, but we are also preparing for challenges from other fronts.’

Israel’s Prime Minister Benjamin Netanyahu visits an F-15 base on April 11, 2024. Netanyahu appeared to reiterate during the visit that if Iran attacks, Israel will respond “anyone who hits us, we will hit.”

An attack by Iran or its proxies against military and government targets in Israel is imminent. Bloomberg News reported citing intelligence sources, with one source saying it’s more a question of when, not if, it will happen.

Israeli officials said they are preparing for a possible unprecedented attack by Iran using ballistic missiles, drones and cruise missiles, Axios reported.

“Our commitment to Israel’s security against these threats from Iran and its proxies is ironclad,” President Biden said.

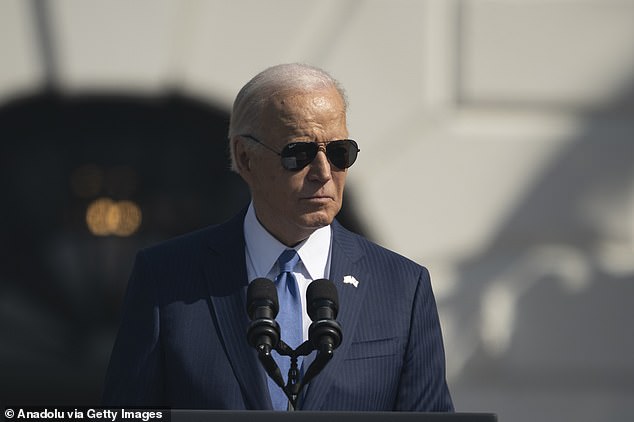

It comes after President Joe Biden pledged Wednesday that U.S. support for Israel is “strong” amid concerns that the country could be the target of major missile or drone attacks by Iran.

‘As I told Prime Minister Netanyahu, our commitment to Israel’s security against these threats from Iran and its proxies is ironclad. Let me say it again: tough, Biden said at a news conference with Japanese Prime Minister Fumio Kishida.

“We are going to do everything we can to protect Israel’s security,” Biden said.

Muslims arrive at the Shah Abdol-Azim shrine to perform the Eid al-Fitr prayer marking the end of the fasting month of Ramadan, one of the holiest months in the Islamic calendar, in Tehran

Tehran warned it would retaliate for an Israeli attack in Syria on April 1.

Iran’s Supreme Leader Ayatollah Ali Khamenei said in a speech on Wednesday to mark Eid al-Fitr that attacking an embassy “means that they have attacked our soil.”

“The evil regime made a mistake and must be punished and will be punished,” he added, according to IRNA, the state news agency.

Iran’s main proxy group is Hezbollah, which is based in southern Lebanon and has been exchanging fire with Israeli forces almost daily since war broke out in Gaza in October.

Israel has not explicitly acknowledged that it was behind that attack on an Iranian embassy but has put its military on alert.

Iran’s Supreme Leader Ayatollah Ali Khamenei said in a speech on Wednesday to mark Eid al-Fitr that attacking an embassy “means that they have attacked our soil.”

Israel has not explicitly acknowledged that it was behind that attack while putting its military on alert.

And Israeli Foreign Minister Israel Katz wrote in X: “If Iran attacks from its territory, Israel will react and attack in Iran.”

There are fears that an open war between Israel and Iran could turn into a much broader conflict.