Fighting inflation: US Federal Reserve head Jerome Powell (pictured)

Federal Reserve chief Jerome Powell was last night forced to play down fears of rising interest rates and the specter of US “stagflation” after the battle against inflation stalled.

Powell said a hike was “unlikely” but made clear that if inflation continues to move “sideways,” rates will not fall.

It came as the Federal Reserve left rates unchanged at a range of 5.25 percent to 5.5 percent and said “there has been a lack of further progress toward the 2 percent inflation target.”

The US central bank’s decision came after an abrupt change in the cuts schedule in recent weeks, following higher-than-expected inflation readings.

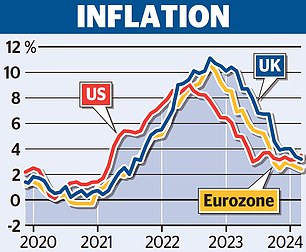

The latest figures showed inflation rose to 3.5 per cent, surpassing the UK where it is 3.2 per cent.

In March, the Federal Reserve had projected there would be three cuts this year. Now, however, the financial markets are betting on only one, in November.

This has intensified speculation that rates could even rise again. Powell last night reiterated recent comments that the Federal Reserve will take “longer than expected” to be ready to cut rates.

But he added: “I think the next policy rate move is unlikely to be an increase.”

To do so, there would have to be “convincing evidence” that the rates were not helping to reduce inflation to 2 percent.

“That’s not what we think we’re seeing,” he said. He downplayed the likelihood of cuts at a time when inflation remains persistent, suggesting that the Federal Reserve would have to be persuaded that inflation is coming down, or it would see an unexpected weakening of the labor market.

Powell rejected suggestions that persistent inflation and weaker growth meant the United States was entering a period of 1970s-style stagflation.

“I was talking about stagflation and there was 10 percent unemployment, high single-digit inflation and very slow growth,” he said. And he added: “I don’t see the deer or the inflation.”

The latest decision from the US central bank comes a week before the next meeting of the Bank of England. The Bank is also expected to keep rates unchanged.