Table of Contents

Far from boosting growth, the Government’s economic plans are likely to cause serious damage and make the country’s finances much worse by the end of this decade. This is the conclusion of a study by the Center for Economic and Business Research (CEBR).

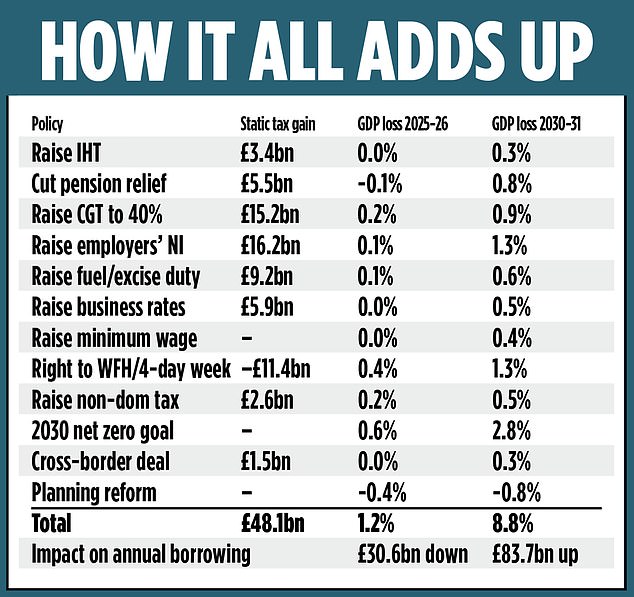

The think tank estimates the overall effect will be a cut in national output – or gross domestic product – by almost 9 per cent by the end of the decade, assuming Labor remains in power and the policies are not reversed. It would also result in a black hole in government finances of more than £80 billion a year.

This is partly because higher taxes cause people and businesses to change their habits, but also because stricter tax policies lead to slower growth. The policies may result in increased income initially.

But so-called “static tax gains,” which assume people don’t change their behavior, may soon evaporate as individuals and businesses take steps to avoid paying more. This can lead to lower tax collection over time.

The Mail on Sunday asked the CEBR to examine what is known about the Chancellor’s plans to fill the controversial £22bn-a-year “black hole” she says Britain faces.

Reform: Angela Rayner, centre, and Louise Haigh have pushed for workers’ rights alongside union magnates such as RMT boss Mick Lynch.

This work has been carried out as part of a wider project, the Growth Commission’s Autumn 2024 Growth Budget, which will be published on Tuesday. Douglas McWilliams, vice-president of the CEBR, says: “The three most economically damaging potential policies are aligning the capital gains tax with the income tax, the workers’ rights package and the premature adoption of net zero.”

The Government says growth is at the heart of its ambitions. However, this independent analysis suggests that his policies will have the opposite effect: in the long term, they will reduce tax revenues. If it is true in general terms, it will be terrible for all of us. Here is the impact of the main measures that the Government could take:

Capital gains tax

An increase in the capital gains tax will reduce economic activity. The Government has denied that the tax will be aligned with income tax as initially suggested, which the CEBR predicted would lead to a 0.9 per cent fall in GDP by 2030. But even a smaller increase would lead to a fall in GDP. savings, investment and business activity.

NI contributions

If the rate of employers’ national insurance contributions increased by two percentage points, £16.2 billion a year would be raised. But we know from business reaction that companies are likely to hire fewer staff, cut jobs and limit wage increases.

The CEBR concluded that, as a result, not only would tax collection be much lower, but the measure would reduce GDP by more than 1 percent by 2030.

Workplace reform

The plan is to make it harder for employers to lay off staff and give employees greater rights.

Labor is keen to placate the unions, which has put them in conflict with some foreign investors they have been courting. This tension was highlighted recently when Deputy Prime Minister Angela Rayner and Transport Secretary Louise Haigh announced legislation to protect seafarers and attacked P&O Ferries, prompting parent company DP World to threaten to withdraw a £1 billion investment. The CEBR model assumes that workers’ rights will result in a drop in productivity in unionized sectors of the economy, especially in the public sector, and this will lead to a 1.3 percent drop in GDP by the end of the decade already an immediate worsening of the situation. The financial situation of the government.

Tax-free pensions

Most pensioners can withdraw 25 percent of their pension fund tax-free. In theory, if Reeves stopped this, he would raise £5.5bn in taxes. But in addition to impoverishing pensioners, it would also reduce savings and investment, reducing GDP by almost 1 percent by 2030. The resulting cut in government revenue would far exceed any short-term increase in tax revenue.

Inheritance tax

One proposal is to eliminate the business property exemption from the inheritance tax. Currently, the support covers business assets transferred to survivors, including shares in companies listed on the AIM market and agricultural land. The Institute for Fiscal Studies estimated this would raise £3.4bn a year. The CEBR assumes this figure does not take into account the effect on growth and says a 0.3 per cent fall in GDP by 2030 would lead to a fall in other tax revenue of £10.7 billion a year.

Commercial rates

The CEBR estimated that if business rates were to rise by 20 per cent it would add £5.9 billion to the expected tax take of £29.5 billion in this financial year. But that does not take into account the impact on growth, particularly for retailers, pubs and restaurants. The impact on GDP, according to the CEBR, would be at least 0.5 percent by 2030, eliminating any gains.

Energy policy

The CEBR looked at the effect of producing carbon-free electricity and banning the sale of new fossil fuel vehicles by 2030 (although this date has been pushed back to 2035) and ensuring rental properties meet new energy standards. It estimates that current plans will reduce growth by 0.6 percent in the next financial year, and that its energy policies will be the biggest drag on economic growth for the rest of this decade, cutting growth by 2.8 percent. hundred. So far, the UK has managed to become greener because old, energy-intensive heavy industries have been supplanted by service industries. But in the future Artificial Intelligence will cause a huge increase in electricity consumption.

non-dominant state

Reeves has reportedly backtracked on plans to end the ‘non-dom’ regime, under which non-domiciled foreigners resident in Britain can, for a limited time, pay tax on their UK earnings. only and not on its assets worldwide.

Going ahead, the CEBR said, would have cost 0.5 per cent of GDP by 2030 and lost £5 billion a year in tax revenue, as high earners, including between 50 and 80 top footballers, They left the country.

Planning reform

A plus of the Government’s policies is the flexibility of planning. This could lift growth to 0.4 percent in the next financial year, which is good, but not enough to offset the damage. It is estimated that with other measures, while the Government would get a £31bn improvement next year, by the end of the decade it would need to borrow an extra £83bn a year to cover the cost.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.