Table of Contents

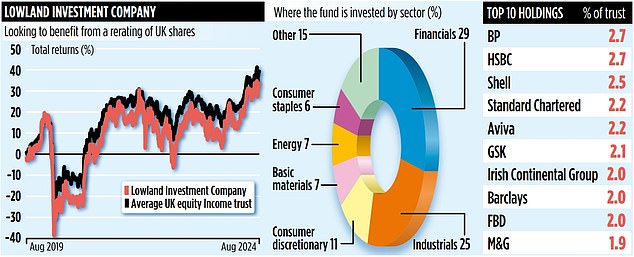

Shareholders in Lowland Investment Trust have seen the value of their holdings rise sharply over the past year thanks to a more dynamic UK stock market.

However, managers believe there is more to come if the recovery in share prices extends to the domestic-focused companies that feature prominently in their portfolio.

Laura Foll, joint manager of the £350m fund with James Henderson, says the trust’s recent performance (a 26 per cent return over the past year) has been driven mainly by some of the holdings it has in FTSE 100-listed companies.

For example, Aviva (up 31 per cent) and Barclays (up 58 per cent). Stocks that are part of the FTSE100 index account for more than 40 per cent of the fund’s portfolio.

However, the smaller companies it owns have yet to be re-evaluated.

“Some of the foundations for such a reclassification have been laid,” says Foll.

‘From a valuation perspective, the UK stock market is at a 20 per cent discount to other overseas markets.

‘That suggests UK stocks remain cheap, especially those of small and medium-sized companies. Plus, we’re seeing signs that the UK economy is performing better than the market thought. OK, it’s not stellar growth and GDP (gross domestic product) is unlikely to rise by more than one per cent this year.

“But this is good news for the small and medium-sized businesses we have that generate most of their income here in the UK. A stronger economy means better incomes for businesses.”

The fund is invested in a diversified manner and has stakes in 118 companies. The number of positions has increased this year, mainly as a result of the acquisition of companies it owned and the managers having used the proceeds to acquire small stakes in a number of new companies.

“We don’t immediately take a two percent stake in a company,” Foll says.

“We take our time to build a position. We are careful.” Recent additions to the portfolio include engineering firm Dowlais, which was spun out of FTSE 100 firm Melrose Industries, and packaging company Macfarlane.

“It’s not a glamorous business,” Foll adds.

“But Macfarlane is well run, focused on the UK market, and its shares have not yet appreciated. They look cheap.”

A key recent change to the portfolio was the exit from Rolls-Royce Holdings after a strong rally in its price that began early last year.

“It was a relative value decision,” Henderson says.

“There are many similar quality companies in the small and medium-sized companies segment whose shares have not yet participated in the market recovery. They are potentially interesting.” These include TT Electronics and Senior plc.

Lowland’s trump card is an attractive dividend that has increased in absolute terms for 14 consecutive years and has never been cut since the trust was launched in 1963.

“It is a priority objective for us and for the board of directors of the trust,” says Foll.

The payments, distributed quarterly, amount to an annual income of 4.8 percent.

It has paid two dividends of 1.6p per share so far this year, compared with the equivalent payments of 1.525p last year.

The managers work for global investment house Janus Henderson and also jointly manage the Law Debenture investment trust.

The trust’s annual fees are competitive at 0.6 percent. Its stock ticker is BNXGHS2 and its ticker symbol is LWI.

Other UK-based capital income-focused trusts include Edinburgh, Merchants and Temple Bar.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.