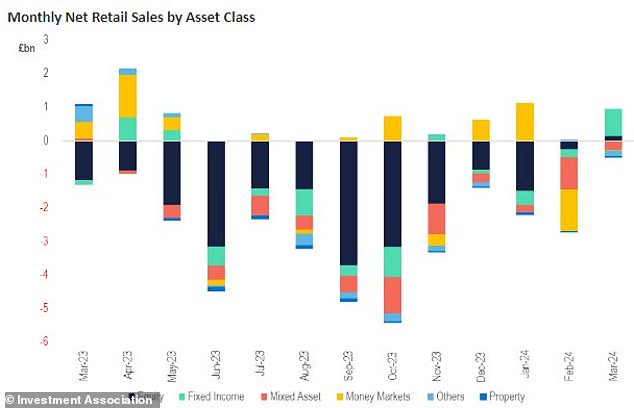

- UK funds saw net retail outflows of £1.3bn last month, AI said

- Capital inflows into US equities in the first quarter rose to £1.5bn

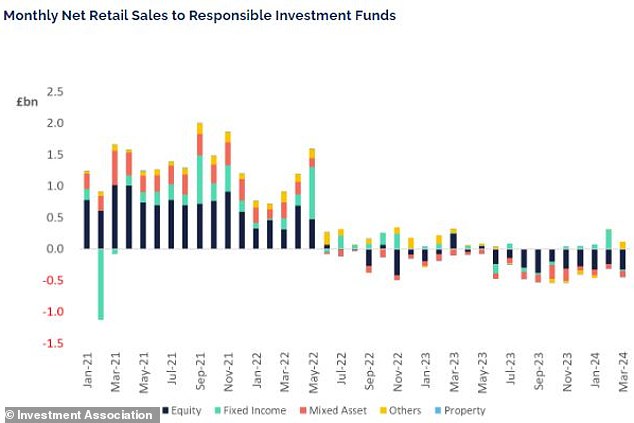

British investors continued to withdraw large sums of money tied up in UK share funds and “responsible investments” last month, new data reveals.

The “worst selling” sector in March was all UK companies, which saw outflows of £887m, according to the Investment Association (IA).

UK funds recorded net retail outflows of £1.3bn last month, results published on Thursday added.

Meanwhile, capital inflows into US shares in the first quarter rose to £1.5bn, more than double the level seen at the same time a year ago, the figures show.

The AI said: “This has been driven by the dominance of the Magnificent Seven and by advisors and wealth managers choosing US stocks if they reallocate them to equities.”

Across the pond: Capital inflows through British investors into US stocks in the first quarter rose to £1.5bn

The popularity of responsible investment funds appeared to decline, with net retail outflows of £329m in March.

Amid significant capital outflows, responsible investment funds under management stood at £106bn at the end of March, meaning their total share of industrial funds under management was 7.2 per cent, the AI said.

Share funds saw modest inflows in March, with US share funds proving popular with British retail investors.

The return of British investors to fund markets in March generated inflows worth £446m.

AI Director Miranda Seath said: “Inflationary pressures eased towards the end of 2023 and, together with expectations of interest rate cuts, this resulted in a more optimistic outlook among investors.

‘Although inflation continues to fall, expectations of rate cuts have been sharply reduced in April, following recent data suggesting it will take longer for inflation to return to target levels.

“It remains to be seen how investors will react to this, which coincides with continued geopolitical tensions.”

Investing Matters: An AI chart showing monthly net retail sales by asset class

Data suggests global funds were the biggest selling sector in March, with inflows totaling £842m.

Bond funds also saw significant inflows during the month, with £809m invested.

But the AI added: “However, the data also showed that allocations to fixed income are beginning to stabilize as investors anticipate a rate cut in 2024 and other asset classes begin to regain popularity and strength.”

Tracker funds maintained steady inflows of £2.9bn, an increase of £800m on February, when the sum stood at £2.1bn.

Seath added: ‘Markets have yet to falter from rising geopolitical tensions and there are growing signs of investor confidence driven by rising sales as investors look to complete their Isa allocations before the end of the financial year.

In decline: AI graph shows monthly net retail sales to responsible investment funds

‘As equity performance improves, particularly in the US, we have seen funds under management increase – up 3 per cent in the first quarter and 11 per cent from the recent low in late October .

‘North American equity funds had a particularly strong performance in the first quarter of the year, with high inflows of £1.5 billion born from stronger growth rates in the US.

“The dominance of Magnificent Seven stocks, as well as the Federal Reserve’s monetary policy decisions, help control inflation, which has fallen faster in the United States than in the United Kingdom and Europe.”

Laith Khalaf, head of investment analysis at AJ Bell, said: ‘March is one of the two big months of the Isa season, and was relatively benign for retail fund flows, but it wasn’t a big deal by any means.

‘Retail investors put a net £446m into funds, but that follows withdrawals of £3.8bn in January and February.

‘Fund managers will hope this is the start of some green shoots of recovery for the industry, but it could simply be a blip caused by increased activity at the end of the financial year and renewed dynamism in the global stock market.

“Indeed, it is notable that US equity funds did much of the heavy lifting in the first quarter, as investors put aside concerns about concentration risk and the relatively high valuations of the Magnificent Seven.”