Table of Contents

- Mining companies paid £2.6bn less in dividends during the third quarter

- Glencore, Antofagasta and Anglo American reduced dividend payments

UK corporate dividends plunged in the third quarter of 2024 as the traditionally generous mining sector cut payouts.

Headline dividends fell 8.1 percent year-on-year to £25.3 billion in the three months ending September, according to the latest Dividend Monitor published by financial services provider Computershare.

It marked the weakest third quarter in dividends since 2020, when Covid-related restrictions led companies to cut payments to shareholders to preserve cash.

Declining payouts: UK-listed companies paid fewer dividends in Q3 2024, following lower payouts from the mining sector

Mining companies paid £2.6bn less during the period, partly because falling commodity prices hit profits at groups such as Antofagasta and Anglo American.

However, Computershare said the decline was mainly because Glencore was cutting funds to finance its £5.6bn acquisition of Teck Resources’ steelmaking coal business.

It further attributed the overall drop in dividends to “poor” one-off special dividends, large share buyback plans and the “rapid strengthening” of the pound.

The value of sterling has appreciated significantly against the US dollar and euro over the past year as the Bank of England has kept interest rates at high levels for longer periods.

Mark Cleland, Computershare’s managing director of issuer services for the UK, South Africa and Ireland, noted that around two-fifths of UK dividends are declared in US dollars.

Cleland added that his company’s dividend figures were “far more encouraging than they suggest if you look beyond the typically volatile mining sector and take into account factors such as exchange rates and one-off special dividends.”

Of the 21 sectors measured in the study, 17 increased payouts, while about 75 percent of companies increased dividends or kept them stable.

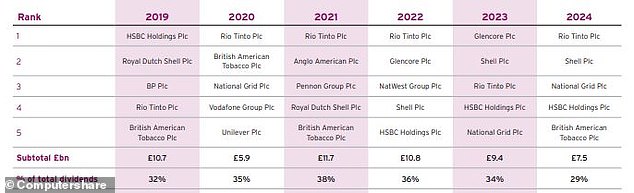

The UK’s top five dividend payers in recent years have been dominated by miners.

At the same time, four industries reported paying 9 percent more in total dividends: industrials, consumer discretionary, information technology, and healthcare and pharmaceuticals.

Rio Tinto was the largest dividend payer during the third quarter, followed by oil major Shell, National Grid, HSBC Holdings and British American Tobacco.

Together, these five companies distributed £7.5bn to shareholders, equivalent to 29 per cent of all dividends paid.

Computershare expects UK-listed companies to pay £92.3 billion in core dividends in 2024, an increase of 2 per cent on the previous year.

It had previously forecast a 3.8 percent rise but reduced it due in part to the impact of exchange rates and share buybacks.

Cleland added: ‘Share buybacks mean companies can return excess cash to shareholders, but fewer shares in circulation mean the overall cost of providing dividends is lower.

“This is not necessarily bad news, because buybacks mean shareholders will receive additional cash, albeit in a different form.”

Total 2024 dividends still expected to exceed last year’s result

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.