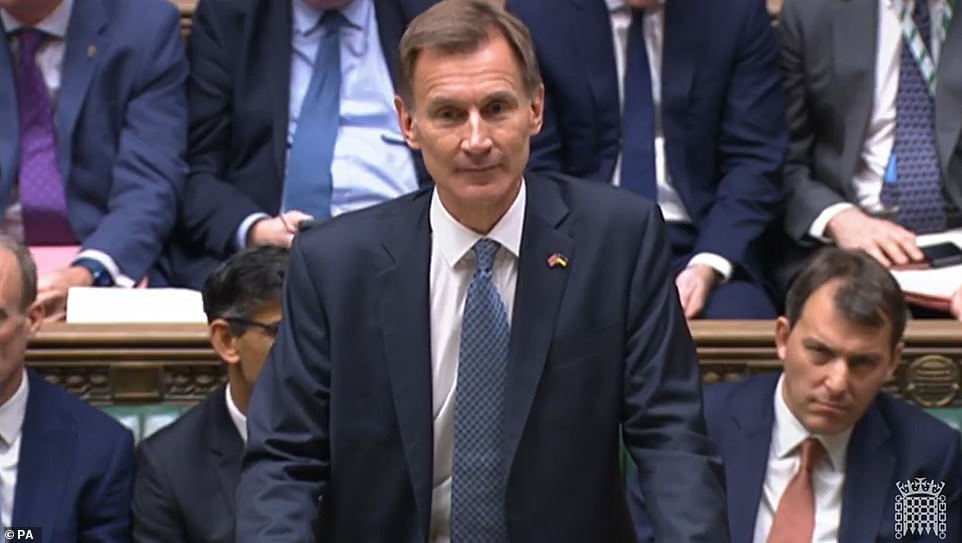

Jeremy Hunt today announced he would increase windfall tax on oil and gas companies and extend it to power generation companies as he seeks to raise money to plug a major hole in the public finances.

The Chancellor said the tax would rise to 35 per cent from its current rate of 25 per cent. It would also apply to electricity generators with a 45 percent tax that will apply from January 1.

This means wind farms in UK waters will pay a higher windfall tax than oil and gas platforms operating nearby.

Hunt hopes the taxes could raise around £14bn for the Treasury next year.

“I have no objection to windfall taxes if they really relate to windfall profits caused by unexpected increases in energy prices,” he told the Commons.

“But any such tax should be temporary, not deter investment, and recognize the cyclical nature of many energy companies.”

He added: “The structure of our energy market also generates extraordinary benefits for low-carbon electricity generation.”

Rising oil and gas prices following Russia’s invasion of Ukraine have pushed household energy bills to record levels, triggering Britain’s worst cost of living crisis for generations.

Today, Hunt also announced an additional £6 billion investment in energy efficiency from 2025 to help meet a new ambition to reduce energy consumption by buildings and industry by 15% by 2030.

Today Jeremy Hunt said windfall profits tax on oil and gas companies would rise to 35 per cent from its current rate of 25 per cent.

Hunt hopes the taxes could raise around £14bn for the Treasury next year.

Many older wind farms and gas-fired power plants have benefited from historically high energy prices.

Gas prices have soared around the world and the price of electricity in Britain is largely decided by how expensive gas is.

Most new wind farms in the UK are built under so-called Contracts for Difference, which gives them a guaranteed price for each unit of electricity they produce.

But these generators are also forced to return anything they earn above that guaranteed price; Therefore, they have not realized any windfall benefits from the recent price increases.

Speculation over a possible windfall tax had prompted warnings from renewable energy companies that investment in the sector could dry up as a result.

“Cheap, reliable, low-carbon energy must be at the heart of any modern economy,” Mr Hunt said.

‘But Putin’s use of international gas prices as a weapon has contributed to increasing the cost of our domestic energy consumption.

“This year we will spend an extra £150bn on energy compared to pre-pandemic levels, which is equivalent to paying for a second entire NHS through our energy bills.”

He added: ‘In the long term, there is only one way to prevent us from being at the mercy of international gas prices: energy independence combined with energy efficiency.

“Energy independence, so that neither Putin nor anyone else can use energy to blackmail us, and energy efficiency to reduce demand and climate impact as much as possible.”

Following Hunt’s announcement, wind farms in UK waters will pay a higher windfall tax than oil and gas platforms operating nearby.

It comes as SSE became the latest energy giant to see its profits soar with high electricity prices, while its gas generation arm became rich.

The company said its renewables division had struggled to capitalize on high electricity prices, but adjusted operating profit at SSE Thermal – the part of the business that burns gas to generate electricity – almost tripled to £100m. in the six months until the end. of September.

Along with an even bigger boost for its gas storage division, it helped boost SSE’s overall operating profit to £716 million, almost double that of last year.

In a call with reporters, SSE boss Alistair Phillips-Davies said a windfall tax could be fair and reasonable but should not discourage investors.

“In terms of levies, caps, windfall taxes, whatever, if they’re fair and reasonable, that’s fine,” he said.

“I think one of the things we have to be careful about in the UK is that we have created an incredible environment for investors to come into.

‘We have one of the best green investment markets in the world, we have created the largest offshore wind market in the world.

“It’s critical that we don’t jeopardize that, especially when all that investment is going to provide energy throughout this decade at much, much lower costs than we’re currently importing.”

Adjusted operating profit actually fell 11 per cent, reaching just £22.5m, as the company had to buy back some of its high-priced hedges.

It came as SSE became the latest energy giant to see its profits soar with high electricity prices, while its gas generation division made lots of money.

SSE’s overall operating profit has reached £716m, almost double that of last year.