- W.Hite Ribbon Australia CEO torched Trent Robinson

- Stunned by his defense of Michael Jennings

- Jennings ordered to pay $500,000 to ex-wife

<!–

<!–

<!–

<!–

<!–

<!–

White Ribbon Australia boss Melissa Perry has branded Roosters coach Trent Robinson “scandalous and appalling” after he backed controversial NRL star Michael Jennings.

It comes as the center prepares to score his 300th first grade game, which will not be celebrated by the NRL due to his “past conduct”.

Jennings recently returned to the code following a three-year ban for steroid use after testing positive for a performance-enhancing drug in 2020 while on Parramatta’s books.

While suspended, Jennings was ordered to pay nearly $500,000 in damages to his ex-wife Kirra Wilden following allegations of sexual and verbal abuse in a civil lawsuit.

Jennings denies the claims.

White Ribbon Australia boss Melissa Perry (pictured) branded Roosters coach Trent Robinson “scandalous and appalling” after he backed controversial star Michael Jennings.

The veteran center is preparing to score his 300th game in first grade, but the NRL will not celebrate him due to his “past conduct”.

Roosters coach Trent Robinson agrees with the club celebrating Jennings’ milestone and says her return to the NRL is “not disrespectful to women”.

It comes as Roosters coach Robinson claimed ahead of his team’s game against Newcastle on Thursday that Jennings’ return was “not disrespectful to women”.

‘It’s difficult, right? “We don’t know what happened…there have been no criminal charges,” she said.

‘What judgment can we make when it has not been a crime? [charges] and follows the traditional line?

“Therefore, it is not a lack of respect for women, because there has not been any trial in the criminal sense.”

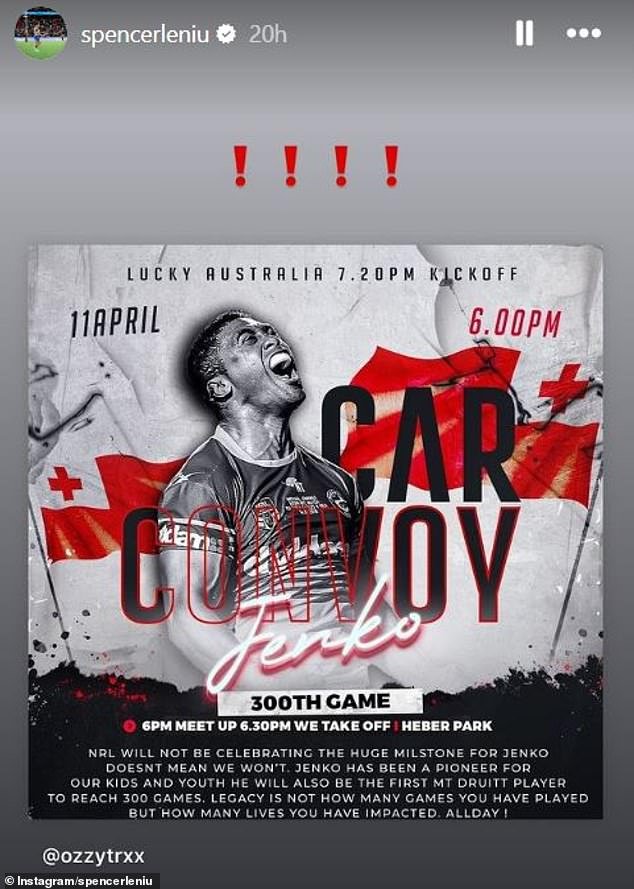

Jennings’ Roosters teammate Spencer Leniu took to Instagram to share details of a fan-driven celebration for the under-fire veteran (pictured)

Perry, furious, felt that Robinson had shown no leadership.

“These comments from the Sydney Roosters coach are frankly outrageous and appalling,” he said. News Corporation.

‘While it is important that we continue to support men who behave in unacceptable ways to change their behaviour, we must also ensure that their actions have consequences.

‘Trent Robinson missed the opportunity to show genuine leadership within his club and the wider sporting community on how important it is for men and boys to play an active role in keeping women safe and reporting violence and abuse Men’s.

“The complete lack of responsibility shown is astonishing.”