- A total of 40 percent struggle with rent or mortgage payments.

- Expectations of an interest rate cut have been delayed until later this year.

Two in five people struggle to keep a roof over their heads, new official data suggests.

A total of 40 percent said it was “very difficult” or “somewhat difficult” to keep up with rent or mortgage payments.

The research was carried out by the Office for National Statistics as part of its analysis of public opinions and social trends on the biggest problems facing people living in Britain today.

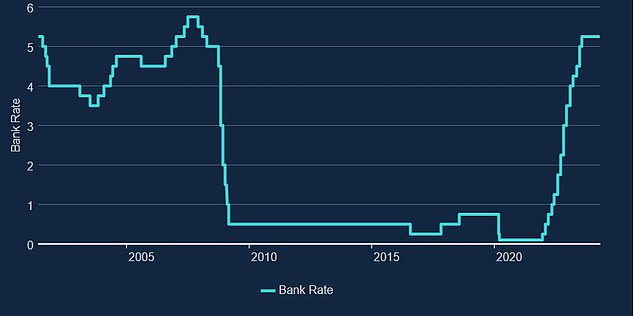

The Monetary Policy Committee kept the base interest rate at a 15-year high at its last meeting, as markets expected.

The latest report covers the period from April 10 to April 21 of this year and compares to March 2022, when the same question was asked.

The current level of financial struggle for landlords and tenants compares with 30 per cent between March 16 and 27 last year.

As some mortgage lenders have recently raised rates, homeowners nearing the end of their fixed-rate agreements may face more difficulties.

Mark Harris, of mortgage broker SPF Private Clients, said: ‘The impact of high inflation continues to be felt, with many people struggling to meet their rent or mortgage payments.

Expectations about the first reduction have been pushed back to the end of summer at the earliest.

‘It’s not just high interest rates that have driven up mortgage costs and skyrocketing rents that have had an impact on people’s pockets, but also higher energy, fuel and vehicle costs. food.

‘While inflation is moving in the right direction and some people have enjoyed pay rises, overall people feel poorer and have less disposable income.

“Fortunately, rate hikes appear to be behind us and the next move in rates is expected to be downwards, although expectations of the first reduction have been pushed back to late summer at the earliest.”

Increases: Landlords face huge bill rises as their fixed deals come to an end

The Bank of England has raised interest rates from 0.1 percent at the end of 2021 to its current level of 5.25 percent.

Mortgage rates followed, and homeowners faced extraordinary increases in their monthly payments as their initial agreements came to an end.

However, financial markets are predicting interest rate cuts later this year, with the first expected to come in the summer.

These were widely believed to have appeared earlier this year, but failed to materialise. As a result, lenders have become more inclined to price mortgages higher.

With mortgages becoming more expensive, many people have stayed in the rental market while still saving for a deposit.

This has helped increase demand for rental housing, with the average rent currently standing at £1,330, according to Hamptons.