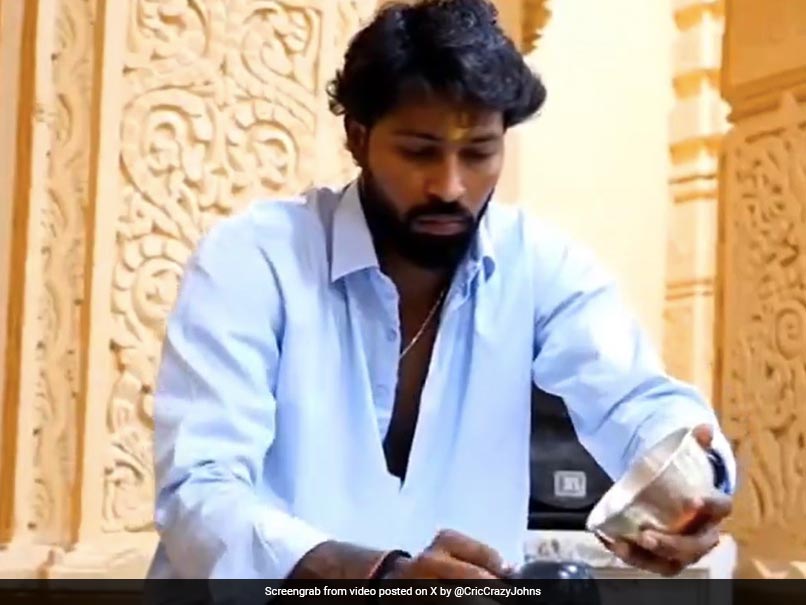

Hardik Pandya is one of the most talked about cricketers in the world right now. Ever since he became captain of Mumbai Indians, replacing Rohit Sharma, nothing seems to be going right for the star all-rounder. MI have lost three matches in the IPL 2024 and were placed last in the 10-team tournament and Pandya was booed wherever his team played, including Mumbai. Amid this, Pandya was seen praying at the Somnath temple in Gujarat on Friday.

Hardik Pandya offers prayers at Somnath temple. pic.twitter.com/hZNIVQ3MH3

– Johannes. (@CricCrazyJohns) April 5, 2024

Former India coach Ravi Shastri believes the fans’ reaction to Hardik Pandya could have been avoided if Mumbai Indians had shown “clarity in communication” while announcing him as captain. Shastri also advised Pandya to remain calm and weather the storm with solid performance. “This is not the Indian cricket team playing. This is franchise cricket. They paid top dollar. They are the bosses. It is their right to decide who they want as captain. Okay, where I think this is better could have been handled was with more clarity in communication,” Shastri told Star Sports’ ‘Cricket Live Show’.

“If you want Hardik Pandya as captain, say we are looking to the future. We want to build. Rohit has done a fantastic job, as everyone knows, and we want him to help Hardik in the next three years as the team moves forward.

“In the end, nothing beats results. If you win matches, things will change. There’s also a lot of nonsense. You know, and some stories are just planted. A lot of it is just planted on other people’s names, including my name” , he added.

“That communication, that clarity should have come out a little more to make this all disappear. So it’s not like you say, ‘No, we don’t want Rohit Sharma’, or ‘He was treated badly’, and all the things that appear on social media,” he added.

Shastri expects the tide to turn once Mumbai Indians start winning. The team is currently on a three-game losing streak.

“So my advice to Hardik would be to be calm and patient, ignore it and just concentrate on your game. Get some performances going. Mumbai Indians are a great side. If they perform well, they will win three or four.” races at the trot, everything will disappear,” he said.

With PTI inputs

Topics mentioned in this article