Donald Trump’s net worth has plunged by nearly $2 billion as a result of his publicly traded media company’s decline on the stock market over the past two days.

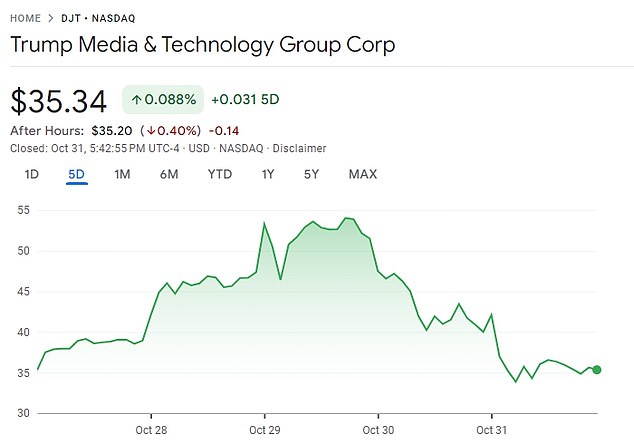

Trump Media & Technology Group, which owns Truth Social and trades under the symbol DJT, fell 11.7 percent to $35.34 on Thursday.

And that’s on top of the 22 percent drop DJT shares suffered on Wednesday.

The stock, which had previously risen more than 24 percent in the days following Trump’s raucous rally Sunday at Madison Square Garden, essentially traded back all of its gains and more.

As The New York Times As reported, declines in these often volatile stocks hurt its 600,000 shareholders, many of whom are average people who support Trump’s candidacy and use Truth Social.

But it’s Trump himself who routinely sees the biggest changes in his net worth, owning a staggering 115 million shares of Trump Media.

Former President Donald Trump watches a rally he held Thursday at the Albuquerque International Sunport in New Mexico.

The stock, which rose more than 24 percent in the days after Trump’s raucous rally Sunday at Madison Square Garden, essentially traded back all of its gains and more

At DJT’s intraday high of $54.68 on Tuesday, the former president’s stake was worth nearly $6.3 billion.

After the frenetic two-day liquidation, that figure was reduced to just over $4 billion.

It’s not entirely clear what caused this, but DJT has attracted many short sellers; In other words, those who believe the stock will go down.

Part of what fueled the stock’s 200 percent rise through most of October is the fact that short sellers had to buy more shares to cover their losing bets, according to research group S3 Partners.

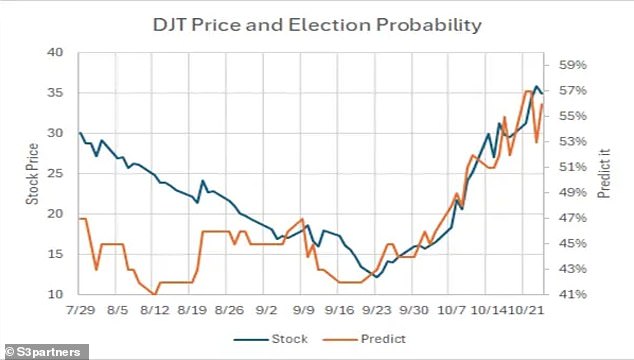

S3 Partners also noted that DJT’s share price somewhat reflects the trajectory of the odds of Trump winning the presidency in betting markets.

Since Trump owns nearly 60 percent of the company, if he decided to sell even a small portion of his stake, it would ruin the stock price and, more importantly, the wallets of his most ardent supporters.

So when a provision prohibiting him from selling his shares expired on September 19, he tried to reassure his followers by promising that he would not do so.

“A lot of people think the reason (DJT is) down is because a lot of people think I’m going to sell, and if I sell, it won’t be the same,” Trump said days before his lockup period ended. ready to finish. “But I have no intention of selling.”

This chart from S3 Partners shows how DJT’s stock price compares to betting odds on Trump’s chances of winning the election.

Trump Media was formed weeks after he left the White House in January 2021, but waited more than three years before going public on the NASDAQ stock exchange.

The stock often closely tracks the positive and negative results of Trump’s political and business efforts.

For example, it fell 9 percent immediately after he was convicted in his hush money trial.

Shares plunged 21 percent in a single trading day in April after financial documents revealed the company lost $58 million in 2023.

Trump invested only a few million dollars in the startup of the company, which means that, either way, it has done extraordinarily well.

A Trump supporter named Greg Bowden, 66, who owns shares in Trump Media, told the New York Times that Trump has “no reason to sell.”

Trump’s recent financial setback comes as millions of Americans head to the polls ahead of Election Day, either to return him to the Oval Office or elect his opponent, Vice President Kamala Harris, to the top office.

Bowden expressed this view in early September, when DJT shares were trading much lower than they are now.

On September 23, four days after Trump was technically allowed to sell DJT, the price reached $12.15.

At the time, Trump’s stake would have been worth nearly $1.4 billion.

Trump’s recent financial setback comes as millions of Americans head to the polls ahead of Election Day, either to return him to the Oval Office or elect his opponent, Vice President Kamala Harris, to the top office.

The final DailyMail.com/JL Partners national poll before Election Day showed Trump leading Harris by three percentage points.

The survey of 1,000 likely voters, which has a margin of error of plus or minus 3.1 percent, shows Trump trending upward, with support at 49 percent to Harris’ 46 percent.