Donald Trump could owe a staggering $100 million in taxes after an alleged “double dip” in deductions, according to an IRS audit.

The investigation, revealed by The New York Times and ProPublica, focuses on the former president’s gleaming skyscraper in Chicago.

The 92-story structure opened over budget and during the recession, causing huge losses that Trump attempted to recoup.

However, the IRS and several tax experts believe he may have effectively written off the same losses twice, resulting in huge tax breaks.

“I think he cheated the tax system,” Walter Schwidetzky, a law professor at the University of Baltimore and an expert on corporate taxation, told the conference. Times.

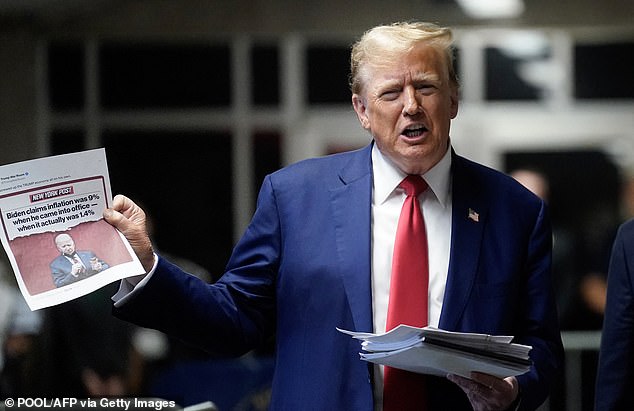

Donald Trump Could Owe a Staggering $100 Million in Taxes After Alleged ‘Double Dip’ in Deductions, IRS Audit Finds

The IRS investigation, revealed by The New York Times and ProPublica, focuses on the former president’s glittering Chicago skyscraper (pictured).

The IRS and several tax experts believe Trump may have effectively written off the same losses on the tower twice, resulting in huge tax breaks.

The first cancellation came in 2008, when Trump claimed the $847 million condo-hotel met the tax threshold of “worthless” as mounting debts meant it would never turn a profit.

Trump secured the former Chicago-Sun Tribune site in 2001 and made it the centerpiece of his TV show The Apprentice, offering the winner the “mind-blowing job” of managing the facility.

Initially scheduled to open in 2007 at a cost of $650 million, several setbacks pushed the deadline and budget further and further away.

The onset of the recession caused already slow condo sales to stagnate even further, and Trump began defaulting on his loans.

This allowed it to report losses of up to $651 million for the year, The Times and ProPublica found.

He would eventually sue his lenders, Deutsche Bank, for the loans, claiming that the recession was a force majeure, in which the bank and its contemporaries participated.

In its 2008 tax return it reported business losses of $697 million, and experts suggest that most of this came from the tower, as this information is not publicly disclosed.

However, just two years later, Trump’s accountants appear to have attempted to extract more tax benefits from the losses by transferring the company that owns the tower to a new company.

Trump allegedly attempted to write off the tower’s losses in 2008 and again in 2010.

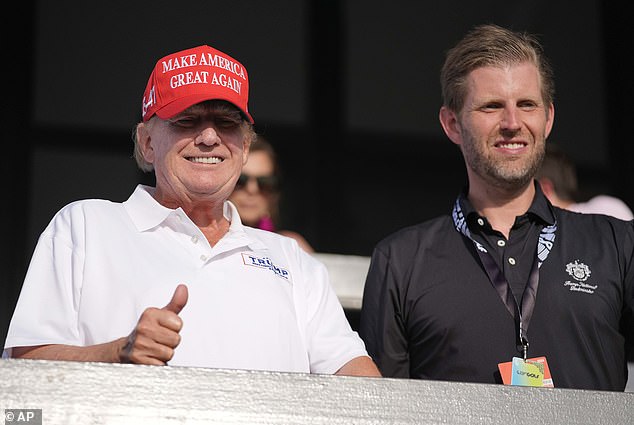

But Eric Trump (R), executive vice president of the Trump Organization, said the matter is resolved and he is confident in the company’s position.

In 2008, Trump declared his Chicago hotel and condominium tower “useless” within the tax definition.

This apparently allowed it to report losses of $168 million more over the next 10 years, according to the Times.

If he had left the organization as it was in 2008, he would not have been able to claim the shortfall as losses again.

The continued losses meant he was allegedly able to evade income tax liability through other sources, such as his entertainment career and the tower’s unpaid debt.

In 2010, its lenders forgave about $270 million of these debts; However, Trump was able to use a stimulus bill introduced by Obama after the recession to spread this over five years.

The 2010 merger maneuver is believed to be what put the IRS on Trump’s trail and was mentioned in a federal agency memo exploring the legality of the strategy.

Trump was not named in the memo, but the Times identified him using details from New York lawyer Letitia James’ 2022 lawsuit against Trump and several Trump Organization executives for alleged financial fraud.

The Technical Advisory Memorandum, which is used to outline the IRS’s position when the law is unclear, states that the agency believes the merger violated the laws to avoid a double dip in tax-reducing losses.

The audit was mentioned in a congressional report in December of that year, however, details about how it progressed would not be publicly available unless Trump decides to challenge the findings in open court.

The 92-story structure opened over budget and during the recession, causing huge losses that Trump attempted to recoup.

The first claim occurred in 2008 and was equivalent to approximately $651 million according to the New York Times. In the photo: Trump (R) with his wife Melania Trump (2L), his son Barron Trump (C) and his father-in-law Viktor Knavs, at the beginning of the funeral of Amalija Knavs, the mother of the former first lady.

Trump was identified as the target of an investigation in a 2019 Technical Advisory Memorandum.

The “useless” classification used by Trump occupies a gray area of tax law that states it can be decided in part by its owner.

However, several tax experts have taken a dim view of the tactics put into play by the Republican candidate.

IRS veteran Monte Jackel said including the debt in the deduction was “simply not right.”

“This issue was resolved years ago, but it came back to life once my father ran for office,” said Trump’s son Eric, executive vice president of the Trump Organization.

“We are confident in our position, which is supported by opinion letters from several tax experts, including the former IRS general counsel.”

Interest in Trump’s tax returns was sparked in 2016 during his White House bid when he became the first candidate to defy tradition by refusing to release them, citing an ongoing audit.

The revelation is the latest threat to the presidential hopeful’s finances and follows several costly legal rulings, including a $454 bill from James’ civil fraud case and $83 million in damages for defaming the attack accuser. sexual E. Jean Carroll.

He is also currently facing a criminal trial in Manhattan for alleged money payments he made to adult actress Stormy Daniels in the run-up to the 2016 election.

A representative for the Trump Organization did not immediately respond to DailyMail.com’s request for comment.