Donald Trump has said he is serious about eliminating the federal income tax if he wins the race for the White House.

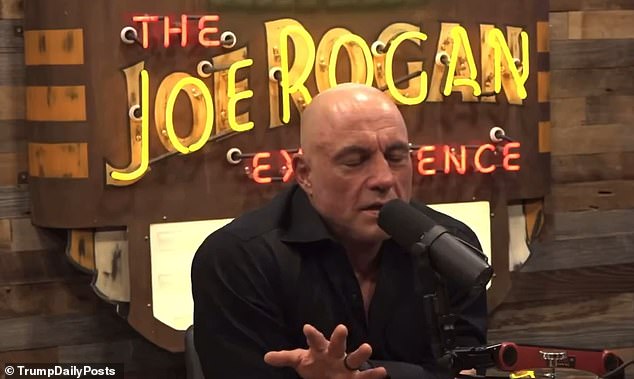

talking to comedian Joe Rogan on his hugely popular podcast On Friday, Trump suggested reimposing tariffs on imports of foreign goods.

He referenced President William McKinley, who raised tariffs on imports to nearly 50 percent when he was in power in 1890.

Rogan, 57, asked the Republican candidate: ‘Did you just raise the idea of eliminating income taxes and replacing them with tariffs? Are we serious about that?’

He replied: ‘Why not, our country was the richest in the 1880s and 1890s, a president who was assassinated named (William) McKinley was the tariff king. He spoke wonderfully about tariffs, his language was really beautiful.’

Trump referenced President William McKinley, who raised tariffs on imports to nearly 50 percent when he was in power in 1890.

Rogan had asked the presidential candidate if he was serious when he mentioned slashing the federal income tax.

‘We will not allow the enemy to come in and take away our jobs, our factories, our workers and our families unless they pay a high price. The big price is the tariffs.”

Trump has repeatedly talked about his plans to impose tariffs of up to 60 percent on imported goods, especially those from China.

In an appearance at a Bronx barbershop on Monday, Trump was asked if the United States could end all federal taxes.

He again raised the idea that he would return to the economic policies installed by President McKinley.

He said: ‘I had all the tariffs. I didn’t have income tax. Now we have income taxes and people dying.

“They are paying taxes and they don’t have the money to pay them.”

Trump has yet to provide more details on how he proposes that idea would work; It is unclear whether it would also eliminate corporate income taxes and payroll taxes.

He had frequently denied that average Americans would bear the brunt of the cost of the tariffs, arguing that companies abroad would pay them.

Despite their claims, the Center for American Progress Action Fund concluded that a 10 percent tariff would be equivalent to an annual tax increase of about $1,500 for the typical American household.

Trump has repeatedly talked about his plans to impose tariffs of up to 60 percent on imported goods, especially those from China.

A report from earlier this year said aggressive tariffs are more likely to hurt American workers than help them.

It would include a $90 tax increase on food, a $90 tax increase on prescription drugs and a $120 tax increase on oil and petroleum products.

The study found that while tax increases would drive up the price of goods, they would fail to significantly boost manufacturing and jobs in the United States.

Americans are estimated to import $3.2 trillion in goods next year, so a 10 percent tariff would effectively raise taxes on goods by about $300 billion.

That would be an average of $1,700 per household in the first year. But when you look at middle-income households that consume about 85 percent more than the average household, according to Consumer Expenditure Surveys, it suggests a tax increase of about $1,500 on the typical household.

For food, the tariffs would be equivalent to a $90 tax increase, according to the analysis. 60 percent of fresh fruit coming to the United States is imported, as are 38 percent of fresh vegetables. Between 70 and 85 percent of seafood is imported. And less than 1 percent of coffee is produced in the United States.

A tariff would also raise prices in the long term, as American farmers face higher costs of obtaining supplies from abroad.

In addition to increases on food, prescriptions and oil, it would include an $80 tax increase on electronics, $220 on cars, motorcycles and recreational boats, a $70 increase on clothing and a $50 increase on furniture, kitchen appliances and other household items.

As part of his appearance on the podcast alongside Rogan, Trump also spoke extensively about UFOs, the unopened archives of the JFK and Martin Luther King assassinations, as well as his recent brush with death.