As Robert F. Kennedy Jr. strengthens his independent bid for president, Republican and Democratic operatives are more motivated than ever to keep his supporters away from his campaign.

For Democrats, Kennedy is a dangerous conspiracy theorist; For Republicans, Kennedy is a radical left “crazy.”

Democrats are desperate to convince their voters to ignore Kennedy, despite the family name’s legacy in the party.

“The name Kennedy has great importance in that sense,” Democratic National Committee campaign agent Lis Smith acknowledged in a statement. interview on the Pod Save America podcast, hosted by former aides to former President Barack Obama.

Smith is part of a new team of DNC shock troops aimed at discrediting Kennedy with Democrats.

He described Kennedy supporters as “low-information voters” who are tormented by the family legacy, revealing his goal of puncturing that balloon.

“The Kennedy name has a great influence in that sense,” acknowledged Lis Smith, a campaign agent for the Democratic National Committee, in an interview on the Pod Save America podcast, hosted by former advisers to former President Barack Obama.

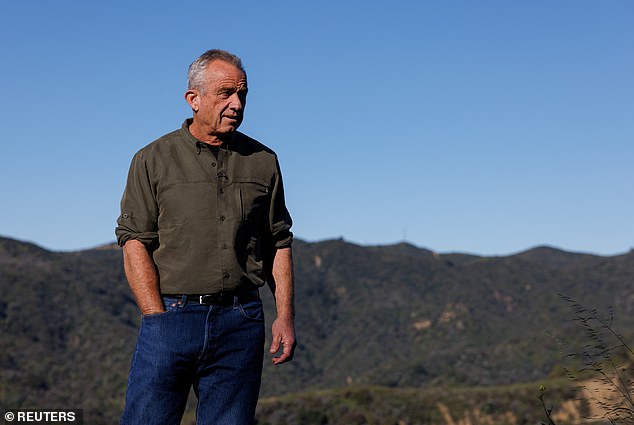

Independent United States presidential candidate Robert F. Kennedy, Jr.

The most important thing in his argument against Kennedy is that RFK Jr. is the black sheep of the family.

“The people who know him best, the members of the Kennedy family, do not support him,” he explained.

Smith and his fellow Democratic politicians are establishing a narrative that Kennedy has a long history of dangerous views on medical vaccines and conspiracy theories.

“This guy has never met a conspiracy theory he doesn’t like, he thinks Wi-Fi causes cancer, that chemicals in water and fish turn children gay and transgender,” he said.

Kennedy’s skeptical views on vaccines, he argued, were “dangerous” to voters, especially in black communities.

“Your words and your actions have consequences, there are real-life consequences,” he said, warning of her “long history of spreading medical misinformation” that attracted the “new age left.”

Smith accused Kennedy of choosing Nicole Shanahan as his running mate as a cynical ploy to use his campaign money. As the ex-wife of Google co-founder Sergey Brin, Shanahan has access to a small fortune while she works with Kennedy.

As the ex-wife of Google co-founder Sergey Brin, Shanahan has access to a small fortune while working with Kennedy.

429.990234375 SEI*197541559 A supporter applauds independent presidential candidate Robert F. Kennedy Jr. as he speaks during a campaign event to announce his choice as running mate

“We know that the Kennedy campaign is broke and that he needs money to hire staff to get on the ballot in states across the country,” he said. “This might be the first case in history where someone was able to buy themselves a vice president position.”

Democrats also note that Kennedy’s Super PAC is partially funded by billionaire Tim Mellon, who has also donated to former President Donald Trump. For Democrats, that’s proof that Trump operatives like Roger Stone and Steve Bannon successfully recruited Kennedy as a spoiler for Democrats in the 2024 election.

Ultimately, they warn potential Kennedy supporters, a vote for RFK Jr. could help usher in another term for former President Donald Trump.

‘What if he plays the role of saboteur? ‘Do you really want another four years of a crooked agent of chaos in Donald Trump?’ Smith warned Democrats.

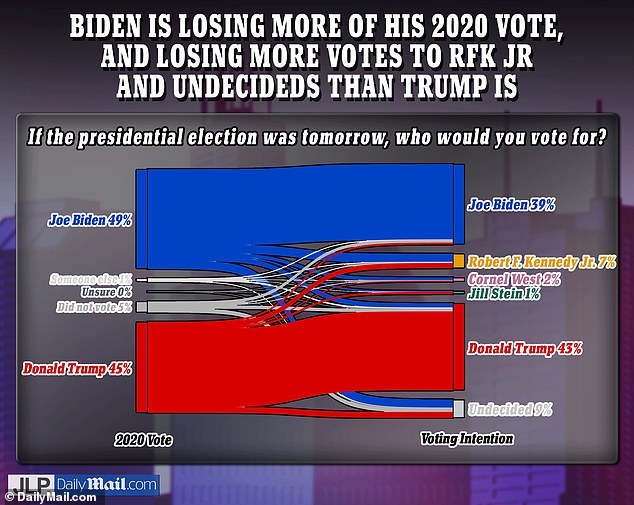

Democrats are right to be concerned. According to a new poll from DailyMail.com/JL Partners, Kennedy is siphoning off nine percent of Biden supporters who voted for him in 2020.

“Right now, RFK Jr is getting more votes from Biden than Trump,” Johnson pollster James Johnson, co-founder of JL Partners, told DailyMail.com. “He does particularly well among female voters, younger voters and black voters, all demographic groups where Biden performs better overall.”

Trump allies appreciate new polls that show Kennedy’s campaign is more of a threat to Democrats than to Trump supporters, but they’re not content to crow.

Team Trump wants to make sure his supporters realize that he is a radical leftist who supports draconian environmental policies like the Green New Deal.

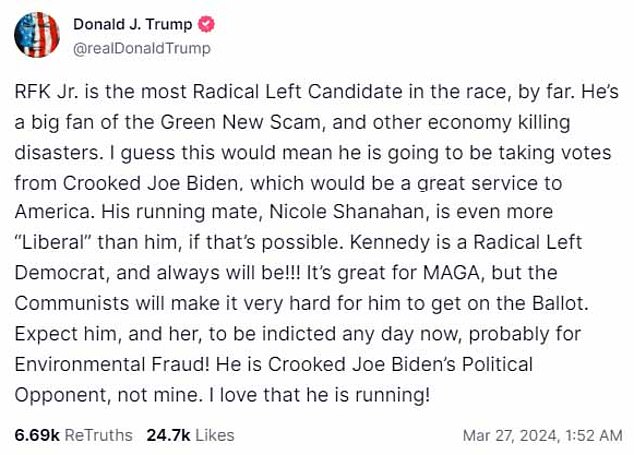

Trump himself warned his followers on his social network that Kennedy was not his candidate.

“RFK Jr. is by far the most radical left-wing candidate in the race,” Trump wrote in Truth Social, describing the environmental lawyer as “a big fan of the New Green Scam.”

“Kennedy is a radical left democrat and always will be!!!” Trump went on to describe him as “great for MAGA” because of his ability to siphon votes away from Biden and “the communists.”

Republican operatives understand, however, that Democrats are not the only ones who could lose votes to Kennedy.

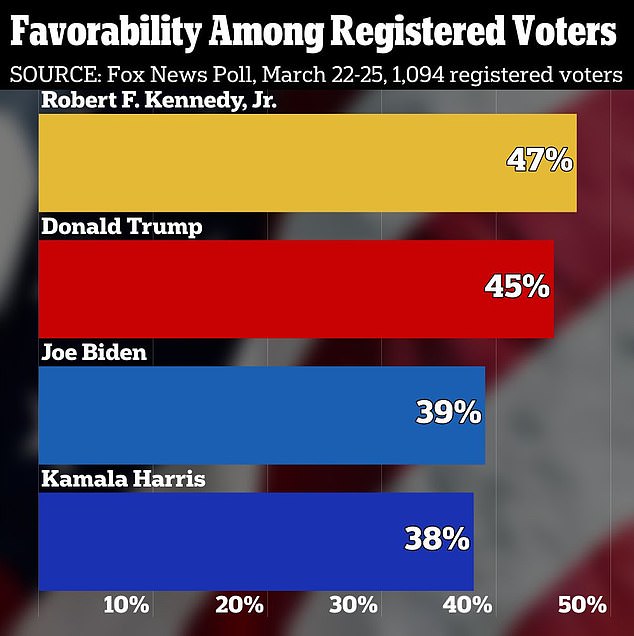

A new Fox News poll shows Kennedy you accept votes from both sides. While ten percent of Democrats now support Kennedy, he also appeals to eight percent of Republicans.

Despite efforts by both parties to highlight his negative points, Kennedy has a 47 percent favorable rating in the Fox News poll, while Trump gets 45 percent and Biden only has a 39 percent favorable rating.

The independent United States presidential candidate, Robert F. Kennedy Jr.

MAGA Inc., the Super PAC that supports Trump, is portraying Kennedy as a dangerous radical who supports sweeping tax increases proposed by Democratic socialists like Rep. Alexandria Ocasio-Cortez and the Green New Deal.

His social media posts describe Kennedy as a “lifelong leftist who voted for Biden in 2020 and a Hillary Clinton “fan.”

“RFK Jr. is a leftist nutcase,” the group posted on X, highlighting a 2018 social media post that called the National Rifle Association a “terrorist group.”

Since announcing his campaign, Kennedy has made some tactical changes on hot-button issues for the right, such as immigration, border security and the Second Amendment, but Trump and his team continue to remind Republicans that he is no friend of conservatives.

Donald Trump Jr. has repeatedly warned his father’s supporters not to support Kennedy, described as a

California attorney Nicole Shanahan speaks after independent U.S. presidential candidate Robert F. Kennedy, Jr. announced her as his vice presidential running mate.

Donald Trump Jr. expressed his concerns about Kennedy on Wednesday on his show Triggered at Rumble.

“Now Joe might not be the most left-wing choice on the November ballot, because RFK Jr. is now making an even more pronounced move to the left, just as I predicted folks,” he said, calling his candidacy a “bait and” change” for conservatives.

Trump Jr. juice old video clips of Kennedy attacking Voter ID on MSNBC and discussing the idea of a ‘smart grid’ that would turn off people’s personal appliances before announcing his presidential campaign.

Kennedy’s choice of Shanahan, Trump Jr. warned, was troubling because she was connected to Google and Big Tech.

“RFK is a far-left radical, I’ve already been telling you that,” he said.

Kennedy’s campaign is trying to capture the vote of “double enemies,” who are fed up with both Biden and Trump.

The campaign did not respond to a request for comment from DailyMail.com.

Kennedy embraced the idea that his campaign was a “spoiler” for both candidates, speaking directly on the issue during his vice presidential candidate’s announcement in California on Tuesday.

“Their main technique is to call me a saboteur and instill fear in Americans that voting for me will elect another scary candidate,” he said. ‘Our campaign is a saboteur. I agree with that. “He is a spoiler for President Biden and for President Trump.”