New data revealed that the number of babies born in the United States has reached the lowest level on record, as experts say women are postponing having children and concerns about reproductive health care rise.

Just under 3.6 million babies were born in 2023, a 2 percent decrease from the previous year, according to provisional statistics released by the Centers for Disease Control and Prevention.

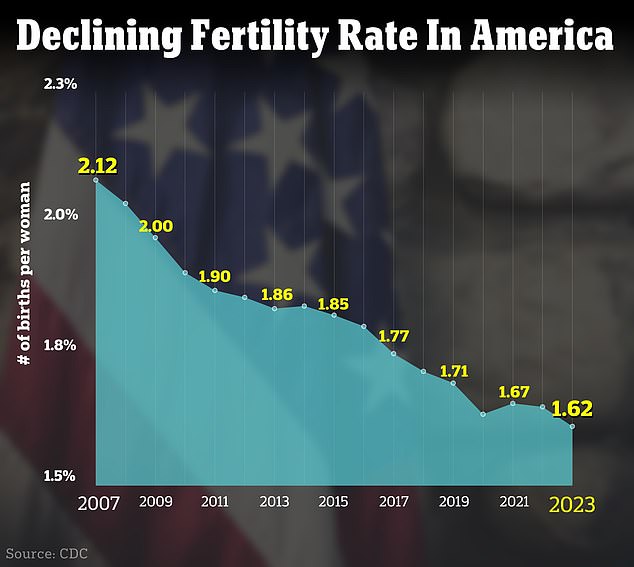

Births in the United States were declining for more than a decade before COVID-19 hit, and then fell 4 percent between 2019 and 2020. After that, they rose for two years in a row, a rise that experts attributed, in part, to the pregnancies that couples had postponed amid the early days of the pandemic.

The figures released Thursday are based on more than 99.9 percent of birth certificates submitted in 2023, but are provisional and the final birth count may change as they are finalized.

There could be an adjustment to the 2023 data, but it won’t be enough to erase the “considerable” decline seen in the provisional numbers, said the CDC’s Brady Hamilton, first author of the new report.

Just under 3.6 million babies were born in 2023, 2 percent less than the previous year, according to provisional statistics.

“The numbers for 2023 seem to indicate that this slump is over and we are returning to the trends we had before,” said Nicholas Mark, a researcher at the University of Wisconsin who studies how social policy and other factors influence health and fertility.

Birth rates have long been falling among teenagers and younger women, but have risen among women in their 30s and 40s, a reflection of women pursuing an education and career before trying to start a family. , the experts said.

Mark called this surprising and said, “There is some evidence that it’s not just a postponement that’s happening.”

CDC data shows that in 2007 the US total fertility rate was 2.12 births per woman, the 2023 rate of 1.62 shows a steady decline.

“People are making pretty reasoned decisions about whether or not to have a child,” said Karen Benjamin Guzzo, director of the Carolina Population Center at the University of North Carolina at Chapel Hill. The Wall Street Journal.

“Most of the time, I think what they decide is, ‘Yes, I would like to have children, but not yet.'”

An analysis published in the prestigious journal Lancet estimated that the average birth rate in the United States is expected to fall to 1.53 in 2050 and to reach 1.45 in 2100.

The concern is that this figure is well below the replacement level of 2.1 children: the number each woman would need to have, on average, to replace both parents and maintain the economic climate.

Some women choose to have children later in life and instead focus on their careers during their younger years.

As fertility is related to age, this can lead to some women never having children or having fewer children than they had originally planned.

Experts have previously warned that some are prioritizing careers over families, which they say has put the country on an irreversible path to economic decline.

Many millennials also say they don’t want to have children.

Increasing pressures on the cost of living, especially the price of childcare, is another factor slowing the efforts of couples who have children or decide to have several.

The first over-the-counter birth control pill in the United States became available in March.

Some women choose to have children later in life and use contraception.

Experts have wondered how births could be affected by the June 2022 U.S. Supreme Court decision that allowed states to ban or restrict abortion. Experts estimate that almost half of pregnancies are unwanted, so limits on access to abortion could affect the number of births.

The new report indicates that the decision did not lead to a national increase in births, but the researchers did not analyze birth trends in individual states or analyze data across all demographic groups.

The new data raises the possibility of an impact on adolescents. The teen birth rate in the United States has been falling for decades, but the decline has been less dramatic in recent years, and the decline appears to have stopped for teens ages 15 to 17.

“That could be Dobbs,” said Dr. John Santelli, a professor of population, family health and pediatrics at Columbia University. Or it could be related to changes in sex education or access to contraception, he added.

Whatever the case, the flattening of birth rates among high school students is concerning and indicates that “whatever we are doing for middle school and high school kids is failing,” Santelli said.