An apocalyptic prepper has revealed the essential items that everyone should stock up on to ensure their survival in the event of an apocalyptic disaster.

Carrie, who is not revealing her full name, began her preparations after moving from California to Bozeman, Montana, with her husband Colton.

Since making the decision, the trainer has been busy preparing for all types of emergencies, whether caused by a natural disaster, foreign conflict or another pandemic.

The content creator, who posts as Housewife Trainer online, he has now amassed over 218,000 loyal followers on his TikTok, where he advises his fans how they too can be prepared for any kind of social collapse.

Carrie (pictured alongside retired politician Dr. Ben Carson) began her preparations after moving from California to Bozeman, Montana.

You have been preparing for all emergencies, whether caused by a natural disaster, foreign conflict, or another pandemic.

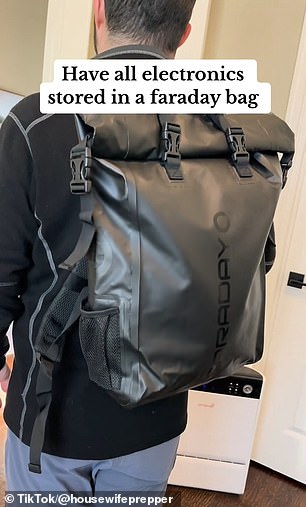

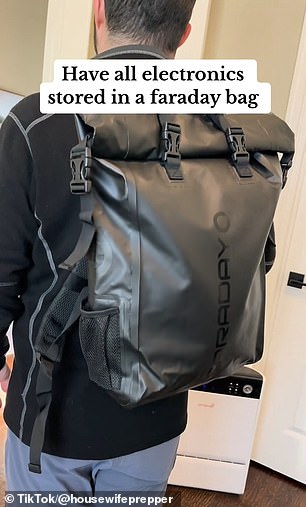

The content creator, who posts as Housewife Prepper, is now advising fans how they too can prepare, suggesting storing all electronics in a Faraday bag and creating a long-term emergency food supply.

Carrie uploaded her first preparation video after a Chinese ‘spy’ balloon passed through US airspace.

He was first seen above the skies over his new hometown, Montana, before being shot down by a fighter jet over the Atlantic in February 2023.

She said Fox News: ‘I thought, oh my God, this is an uncontrolled situation. We need to start preparing for anything.

‘We’re allowing this other country into our airspace, what’s next?’

Her initial clip turned out to be so popular that Carrie decided to continue giving advice.

In one of his most popular videos, which has been viewed more than 2.2 million times, he explained: “When Russia and China attack the United States, you will need them.”

He then recommended having a ‘TRAP device installed to ensure your generator will still run if an EMP hits’ and storing all electronics in a Faraday bag.

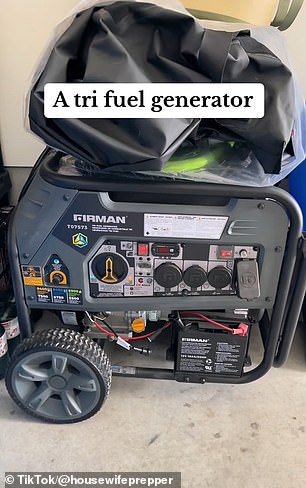

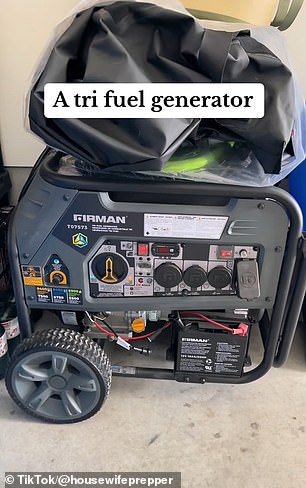

Carrie also urged her followers to get a solar-powered radio, portable emergency water filters, a solar generator, a battery backup, a tri-fuel generator and a long-term emergency food supply.

Carrie also urged her 218,000 followers on TikTok to invest in several portable emergency water filters.

He also listed a solar crank radio, a solar generator, a battery stack and a tri-fuel generator as essential items.

The content creator added in the caption: “It’s not a matter of if it’s going to happen… (it’s when).”

“We should all be aware of what is happening and take care of our families ourselves and not depend on the government to take care of us in a disaster situation,” he told the outlet.

Husband Carlton also stated that change had already begun and that more people than ever believed that “preparation is more of a way of life and something to do, not something to look at negatively.”

And it seems like the prepper market is becoming increasingly popular.

Recent investigation suggests that the global survival tools market will be worth $2.46 billion by 2030, growing at a compound annual growth rate of more than seven percent between 2023 and 2030.

Carrie further explained, “Everyone should be getting ready. Women are gatherers by nature, we are the ones who go to the store and do all the shopping.

“So, I think I grew up with those traditional values and I’m using them in my marriage.”

He explained that his habits probably come from his father, who always made sure the family was prepared to prepare for earthquakes.

He would stock his car with dry food and other survival supplies in case of a quick evacuation.

Carlton concluded that it was important to have a “backup plan to the backup plan.”