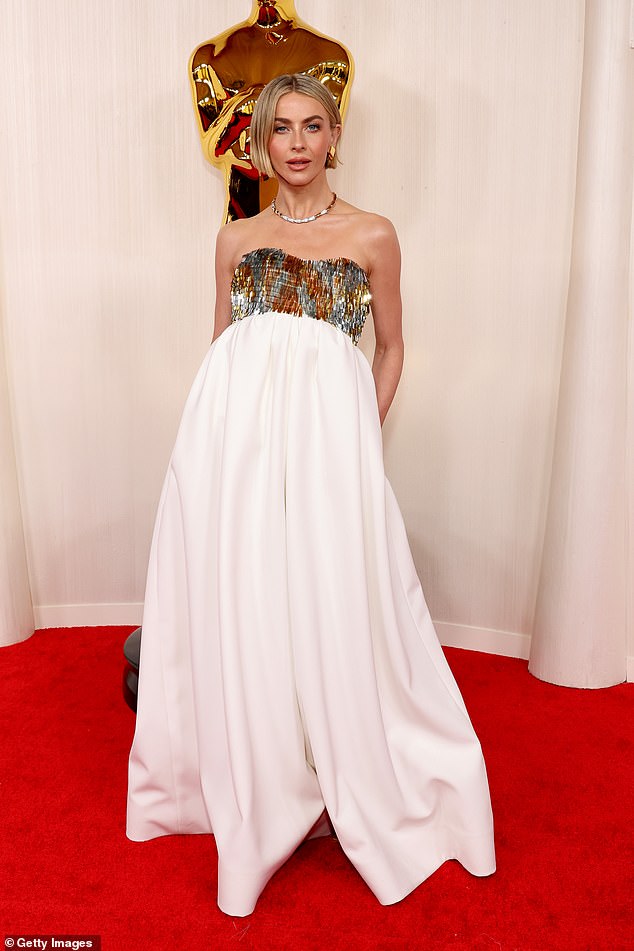

Julianne Hough oozed glamor as she arrived at the 96th Annual Academy Awards in Hollywood, California on Sunday.

As she prepared to host the Oscars red carpet alongside Vanessa Hudgens, who revealed her pregnancy ahead of the ceremony, the 35-year-old dancer ensured all eyes were on her in an eye-catching white jumpsuit with a gold and silver top from Alexandre Vauthier.

She accessorized her chic look, complete with pockets, with a stunning necklace wrapped in diamonds, large pair of gold earrings and nude platform heels.

Her stylish bob, which hovered several inches above her toned shoulders, was smoothed for the occasion.

Julianne Hough oozed glamor as she arrived at the 96th Annual Academy Awards on Sunday

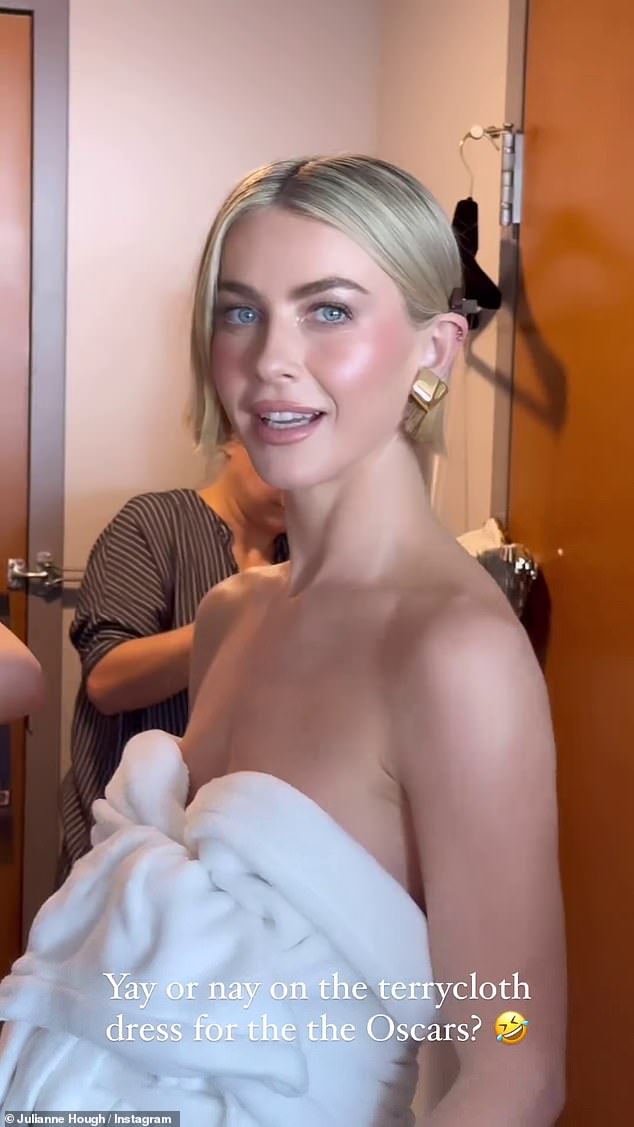

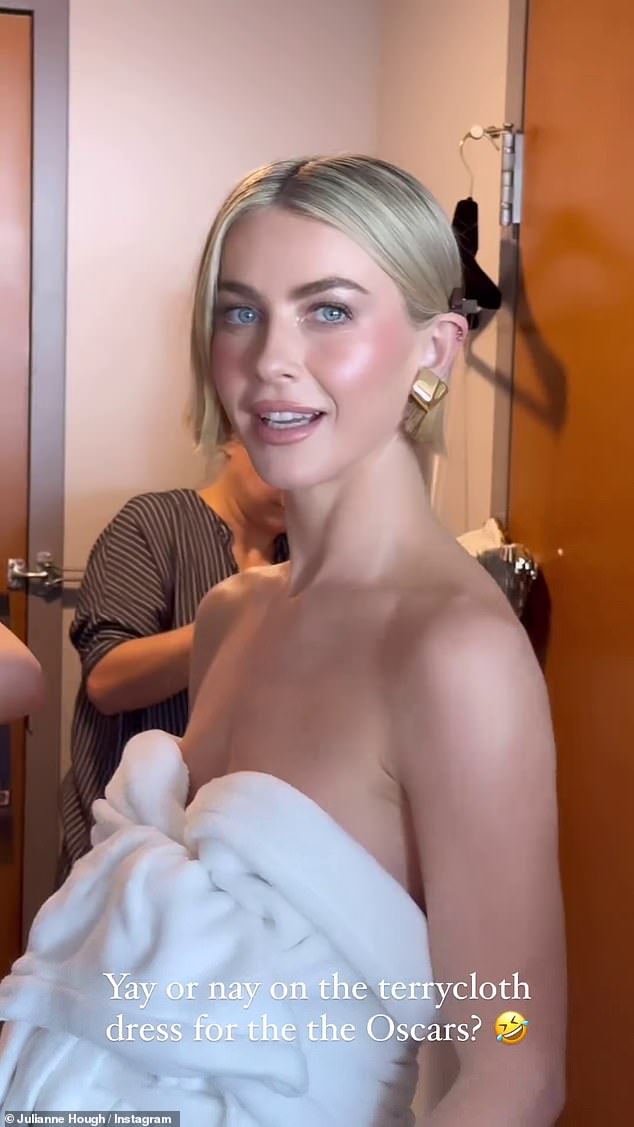

Ahead of the show, Hough joked that she would be wearing a ‘terry dress’ to the event, before revealing that she was only ‘ioddling’.

The Safe Haven actress was in particularly high spirits as she danced around backstage and mingled with other contestants.

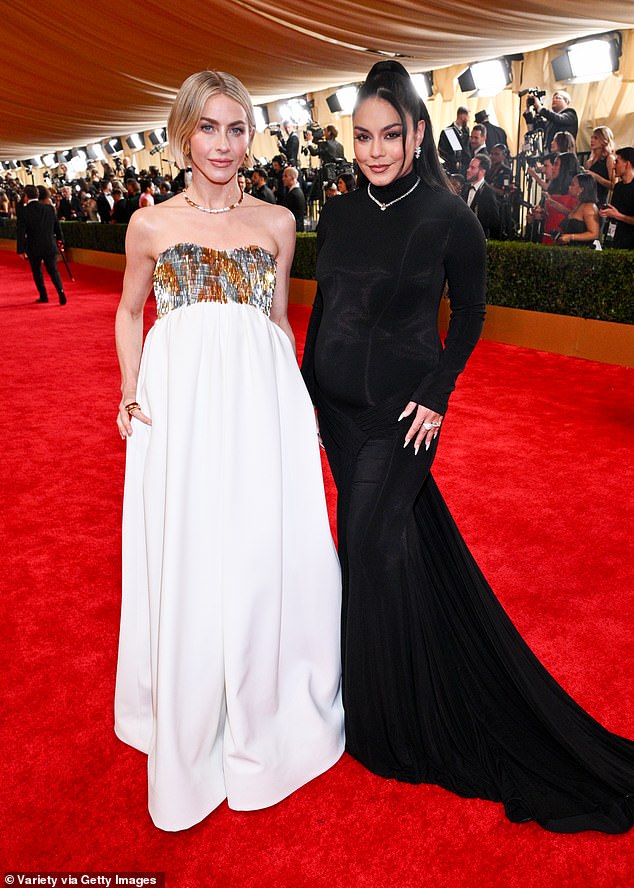

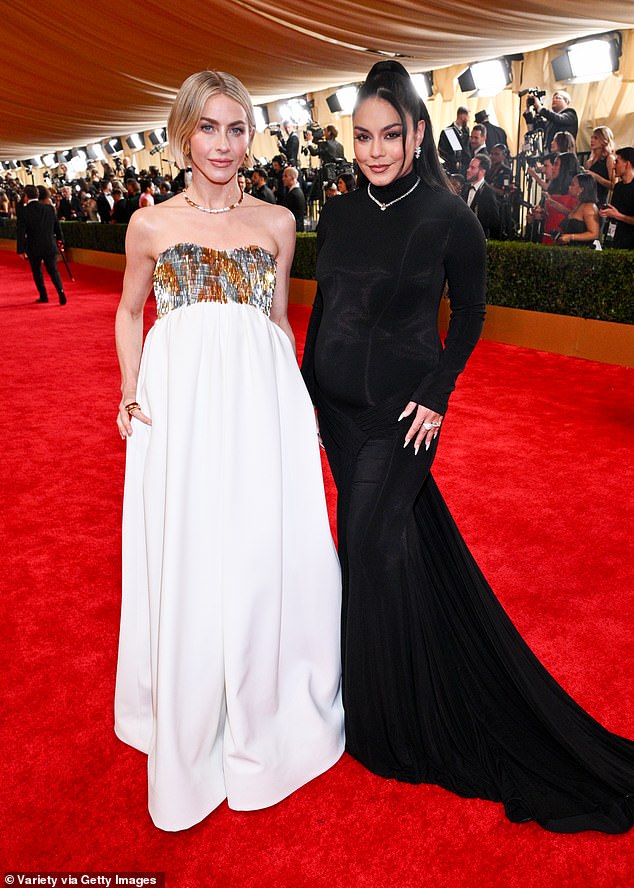

After posing for various solo shoots, Hough was seen mingling with Hudgens, 35, and fawning over her baby bump.

At one point, she was seen sweetly placing her hand on the High School Musical star’s stomach.

The friends hosted the Oscars Red Carpet Show together.

They worked together on the 2016 TV special Grease: Live; Julianne was Sandy and Vanessa was Rizzo.

Hudgens met Cole during a Zoom meditation session during lockdown. Cole is a professional baseball player for the Seattle Mariners.

Hudgens’ pregnancy announcement comes after months of speculation that she and husband Cole Tucker were expecting their first child.

Vanessa and Cole became engaged in February 2023.

The 35-year-old dancer made sure all eyes were on her in an eye-catching white jumpsuit with a gold and silver Alexandre Vauthier top

She arrived early to host the Oscars red carpet alongside Vanessa Hudgens, who revealed her pregnancy ahead of the ceremony

Hough’s stylish bob, which floated inches above her toned shoulders, was slicked back for the star-studded evening

She tied the knot with the MLB player last December after three years of dating.

They married in Tulum, Mexico, ten months after becoming engaged.

The beauty’s confirmation of her pregnancy on Hollywood’s biggest night comes just days after she recalled feeling “fat” following “rude” pregnancy speculation during her bachelorette party in October 2023 in Aspen, Colorado.

‘I went out on my bachelorette and I posted a video of me and there are all these comments that are like, “Oh my god. You’re pregnant.” And I think that’s so rude. I’m sorry, I don’t wear Spanx every day and I’m a real woman and have a real body.’

She added: ‘I’m literally celebrating one of the happiest times of my life and you guys are just going to make me feel fat. It is fantastic. Thanks.’

Hudgens went on to discuss ‘the four agreements’ that women should stick to.

The Safe Haven actress was in particularly high spirits as she danced around backstage and mingled with other contestants

After posing for various solo shoots, Hough was seen mingling with Hudgens, 35, and fawning over her baby bump

“One of them is that you don’t make assumptions … in every aspect of life, but especially over other women’s bodies,” she said.

‘We deal so much with other people trying to control our bodies, let’s not make assumptions about other women’s bodies too.’

In the original video from her Bachelorette, Vanessa wore plenty of baggy clothing, with many of her followers quickly asking if she was pregnant in the comments section.

But Vanessa didn’t take too kindly to the speculation as she replied: ‘(eyeroll emoji) not pregnant so you guys can stop.’

At one point, she was seen sweetly placing her hand on the High School Musical star’s stomach

Fans went wild when Hudgens debuted her baby bump in public for the first time on the Oscars red carpet

There were plenty of commenters jumping to the conclusion that she was expecting with the baseball player, with one writing “omg she’s pregnant” and another saying “she’s actually pregnant.”

Others came to Vanessa’s defence, with one saying: ‘For those who comment about pregnancy it’s rude. We are human! She’s happy so don’t comment about her body if you don’t want anyone to ask you.’

Elsewhere on the podcast, Vanessa shared that she was ‘grateful’ for her split from Dune star Austin Butler, 32, as she ended up meeting her forever person soon after – her husband Cole.

Hudgens split from Butler after nearly 10 years together in 2020. Austin moved on to Kaia Gerber, 22, who he was first spotted with in December 2021.

Ahead of the show, Hough joked that she would be wearing a ‘terry dress’ to the event, before revealing that she was only ‘ioddling’

Later she showed the ‘actual look’

As painful as her breakup from Butler was at the time, she’s now able to reframe the split as a positive as she began a relationship with her now-husband not long after.

“I feel like my last breakup really catapulted me to a very, very special place, of course. You pushed me to the right person!

‘For which I am so grateful! Because he’s just the most supportive, genuine, understanding person I’ve ever met.’

Vanessa’s remark about her ex came after she was asked how certain setbacks led to her current success: ‘I feel like so much of my character was built from my breakups,’ she said.

‘Also, the tenacity I have, I think is just like from starting my career at such an early age and dealing with so much rejection, you really have to build a very strong backbone to keep doing it when everyone says no. It builds a lot of character.’