Tony Hetherington is the Financial Mail on Sunday’s star investigator, battling readers’ corners, revealing the truth behind closed doors and winning victories for those left penniless. Find out how to contact him below.

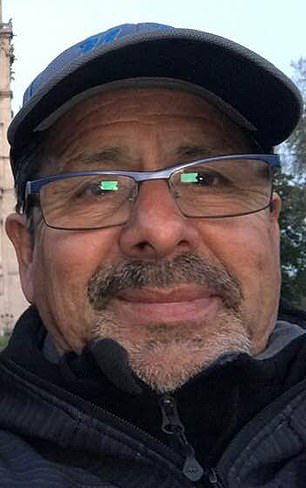

Broken promises: William Abundes, owner of Cauta Capital

Mrs. YG writes: We invest savings in Cauta Capital loan bonds.

We have been in regular contact with the company’s owner, William Abundes, for a couple of years, since interest payments ceased.

He promised dates for the reimbursement of the bonds, but these have already passed without our money being returned.

Tony Hetherington replies: Cauta Capital made many promises. He would only invest his money in real estate projects in which the developers had pledged their own assets as collateral. He would put his money in a real estate plan only if the plan’s assets were much larger than the amount injected by Cauta.

And it would give an independent accountant a legal burden on more than £28 million of his own assets as a safety net. However, each of these promises was broken.

When complaints started coming in from investors, who told me Cauta had failed to pay the interest owed and then failed to repay the loan bonds when they came due, I contacted the company’s boss, William Abundes.

He is a 70-year-old American who lives in Luxembourg and is a major figure in Donald Trump’s campaign among American voters living in Europe.

Last April I reported that he told me that his company had made unsuccessful real estate investments, so he had used the remaining money to buy uncut emeralds, something he never mentioned when he offered his loan bonds with the sales pitch that the funds They would be invested in safe properties. developments.

He described this as “a strategic decision made in response to unexpected losses incurred by the company.” And when I pressed him to explain what allowed him to make such a dramatic change in the way his money is used, he pointed out a vague section of investment terms that allows for “secured joint ventures.”

You and any other investor may have taken this as a reference to real estate transactions secured with land and buildings. However, it is evident that Abundes saw that this allowed him to invest in practically anything he wanted.

Cauta Capital has twice been on the verge of being forcibly canceled for failing to file its accounts with Companies House.

Its 2023 accounts – presented at the end of May this year – were nothing more than an absurd cut-and-paste copy of its 2022 figures.

They valued the company’s assets at £19.4m, but did not include interest owed to investors.

The worst has followed. In July, Cauta Capital fell into administration. Administrators have acted with impressive speed to investigate what went wrong.

They discovered that Cauta first invested in an apartment development on the site of Copenhagen’s historic Tuborg brewery.

The developer went bankrupt in 2019. Abundes then backed a second Danish project, which also failed.

In 2020 Cauta invested his money in uncut emeralds. The accountant in charge of safeguarding the interests of investors told me that he was not even informed of this.

And at the end of last year – again without any announcement – Cauta exchanged his emeralds for an investment in a Luxembourg fund that will not mature until at least next August.

There is great uncertainty about this, but the administrators say the investment had a “face value” of around $3m (around £2.3m).

This is in stark contrast to Cauta’s most recent accounts which show him to be worth £19m. The uncertainty is not helped by the difficulties that directors have faced in obtaining company records.

Apparently Cauta did not even operate his own bank account.

The bottom line is that bondholders are owed more than £11 million plus interest of around £1.5 million.

It is impossible to predict the value of the Luxembourg fund when it matures, but administrators say the likely outcome is that Cauta Capital will have to be placed into liquidation, with a possible return to unsecured creditors of just over 12 pence in the pound.

This whole issue has reinforced the lack of investor protection surrounding loan bonds. They are just IOUs, but they are often marketed as shares with shaky claims that they are guaranteed or insured.

The last government did nothing to change this and I have no hope for the current group.

Too often in this country investors are alone. Investor protection is the abandoned child of successive ministers and regulators.

If you believe you are a victim of financial irregularity, please write to Tony Hetherington at Financial Mail, 9 Derry Street, London W8 5HY or email tony.hetherington@mailonsunday.co.uk. Due to the large volume of inquiries, it is not possible to provide personal responses. Please only send copies of the original documents, which we regret cannot be returned.