<!–

<!–

<!– <!–

<!–

<!–

<!–

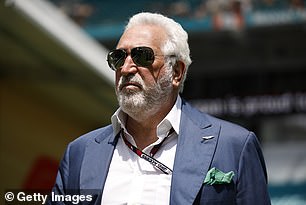

Petrolhead: Aston Martin chairman Lawrence Stroll said there will ‘always’ be demand for sports cars with petrol engines

The Aston Martin boss said he will continue making gasoline cars until regulators force him to stop amid subdued demand for electric vehicles.

President Lawrence Stroll said there will “always” be demand for sports cars with gasoline engines, such as V8 and V12 models.

Like its rivals, the 111-year-old manufacturer will have to deal with a ban on new petrol or diesel cars in Britain from 2035.

But Stroll has stated that his company will not abandon gas-guzzling products until it is necessary.

‘We will continue to do them as long as we are allowed to do so. There will always be demand, although it will reduce,” he stated.

His comments contrast with competitors such as Jaguar and Rolls-Royce, which have pledged to go fully electric within six years.

And it comes against a backdrop of fears that the transition to electric cars in Britain is being slowed due to a lack of available charging points.

In February, the maker of James Bond cars delayed the launch of its first battery-powered electric vehicle (EV) by a year.

It was planned for next year, but will now go on sale in 2026 at the earliest.

At the time, Stroll, a Canadian billionaire who rescued the automaker from collapse in 2020, said “everything is in place” aside from consumer appetite for electric vehicles.

He said drivers wanted “some electrification” but didn’t want to lose “the smell, feel and noise of the sports car.”

He told The Times newspaper yesterday that it had been a “prudent decision” to delay the electric vehicle programme.