A ‘glitch’ at Chase bank ATMs that allowed customers to withdraw money from their accounts after depositing fake checks for large sums of money has sparked a wave of people flaunting their cash online.

Some Chase customers reportedly wrote checks for exorbitant amounts and deposited them to get tens of thousands of dollars that weren’t theirs, leading some to call it an “infinite money scam.”

Experts say this is no harmless trick, but rather a case of the age-old crime of check fraud, which is punishable by fines and jail time in serious cases.

Social media users who “tested” the hack reported seeing the money initially reflected in their account balance or being able to get cash from ATMs before their fake checks cleared.

But Chase, one of the nation’s oldest banks, took swift action, prompting many customers to post update videos in which they appeared devastated by the massive negative balances in their accounts.

“We are aware of this incident and it has now been addressed. Regardless of what you see online, depositing a fraudulent check and withdrawing the funds from your account is fraud, plain and simple,” a Chase spokesperson told DailyMail.com.

One of the most recognizable videos to emerge from this short-lived trend showed a man walking out of a Chase branch in Yonkers, New York, and clapping his hands as he unfolded a wad of cash.

Later in the video, they walk through the streets with hundred dollar bills in their hands and their Chase debit cards in their mouths.

Multiple images and videos have emerged of dozens of people lining up outside Chase bank branches, allegedly hoping to take advantage of the so-called cash glitch.

Chase declined to comment further on how people were able to bypass its safety protocols.

One of the most recognizable videos to emerge from this short-lived trend showed a man walking out of a Chase branch in Yonkers, New York, and clapping his hands as he unfolded a wad of cash.

Three of his friends surrounded him as they all celebrated their ill-gotten gains.

Then they cruise the streets leaning out of their cars holding hundred dollar bills in their hands and smiling with their Chase debit cards in their mouths.

Other videos showed dozens of people lining up outside Chase branches, allegedly hoping to take advantage of the alleged glitch.

The euphoria was short-lived, however, as people began sharing screenshots of their Chase accounts with alarmingly large negative balances.

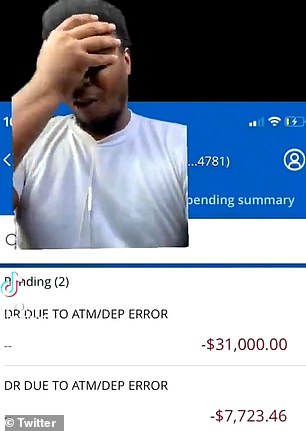

Both individuals are showing negative account balances after they allegedly participated in Chase’s financial failure.

Many people also took the opportunity to poke fun at people who fell for the get-rich-quick scheme through funny memes.

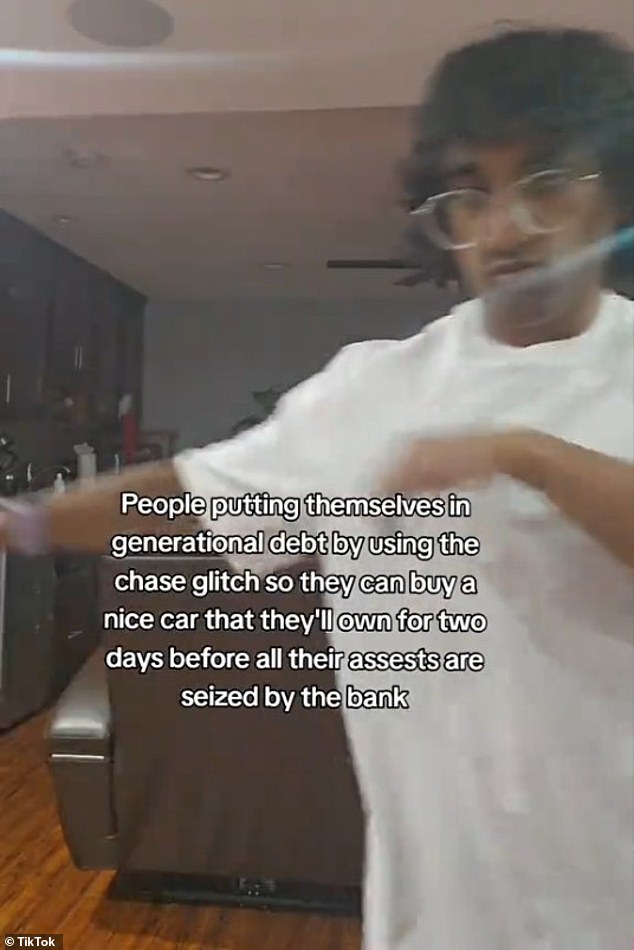

This person joked that people are going into debt “generationally to buy a nice car they can have for two days before the bank seizes all their assets.”

A visibly distressed man showed outstanding deductions from his account balance, one for $31,000 and another for more than $7,000. Both were due to an error at the ATM or a deposit.

“Fuck, man,” he said, rubbing his face. “They told me to make a deposit, that it was supposed to clear the next day, but look at my account.”

Another person showed that their account was in the red by almost $11,000 after participating in the trend.

Many people also took the opportunity to poke fun at people who fell into the get-rich-quick scheme through funny memes.

One person joked that people are going into debt “generationally to buy a nice car that they can have for two days before the bank seizes all their assets.”

Others did not see the humor and chose to warn people of what could happen to them.

This woman said Chase is going to “hurt” anyone who participated in this fraud.

Jim Wang, a popular financial educator on TikTok, posted his own take on the Chase mania and warned people that they will face serious consequences for what they have done.

A woman said that Chase is going to…put a damage on‘Anyone who participated in this fraud and criticized people for being foolish enough to post their thefts on social media.

“Go ahead and spend that money now,” he said. “Who told you this would be a sure way to get money? Don’t you think this will be traceable?”

Jim Wang, a popular financial educator on TikTok, posted his own take on the Chase mania and warned people that they will face serious consequences for what they have done.

“In the case of this ‘mistake’, it was simply a check fraud. If you do something like that, you’re going to be in big trouble,” he said.

“Just because money appears in your account doesn’t mean it’s literally yours,” he said. “If you spend it and are forced to pay it back, you’ll have to find a way to pay it back.”

Many people who made the mistake complained that they were now in debt, but that might be the least of their worries.

Check fraud can be prosecuted at the state or federal level.

The maximum punishment for large thefts of money from financial institutions is a fine of one million dollars and 30 years in prison.

(tags to translate)dailymail