Table of Contents

Three of Britain’s biggest mortgage lenders are raising rates, despite the Bank of England cutting interest rates last week.

Santander, TSB and HSBC have announced that the prices of their fixed rate mortgage agreements will increase this week.

Last week, TSB and Santander were among several lenders to announce they would cut mortgage rates on variable and tracker rate deals, in response to the Bank of England cutting the base rate from 5 per cent to 4.75 per cent on Thursday.

However, this week they are doing the opposite when it comes to fixed rate mortgage offers.

Rising: Three big banks announced they are raising prices on fixed-rate mortgages even though the base rate fell to 4.75 percent last week.

This will be a concern for mortgage borrowers, given that the vast majority of households have fixed rate agreements.

Around 82 per cent of mortgaged households have fixed rate mortgages, according to UK Finance. That’s equivalent to almost 7 million homes.

Most households are protected from any immediate changes in rates until their current deal ends, but the Bank of England said in its November Monetary Policy Report that around 800,000 fixed-rate mortgages, currently with rates of 3 percent cent or less, will be renewed annually. year until the end of 2027.

Santander has announced increases of up to 0.29 percent in its residential fixed rates for purchases and remortgage.

In addition to Santander, HSBC and TSB also raise their rates. HSBC will not reveal the changes until tomorrow. For its part, TSB yesterday increased fixed rates to 0.3 percent.

Why are banks increasing fixed rate mortgages?

The rate increases may seem counterintuitive given the Bank of England’s recent decision to cut the base rate to 4.75 percent, the second reduction this year.

Mortgage brokers believe this is likely due to the rising cost of funding as a result of higher inflation expectations following the Labor budget and Trump’s election victory.

Rohit Kohli, director of The Mortgage Stop, told news agency Newspage: “Many borrowers will be wondering why, less than a week after the Bank of England cut the base rate by 0.25 per cent, lenders such as TSB are increasing fixed rates.

‘Markets are still feeling the consequences of the labor budget. Although it was not as disastrous as the mini-budget, the cost of long-term borrowing continues to rise.

‘Bond yields and swap rates are reacting not only to budget policy but also to geopolitical uncertainties, including Trump’s re-election to the White House. “Anyone expecting big cuts in interest rates is taking a risk for now.”

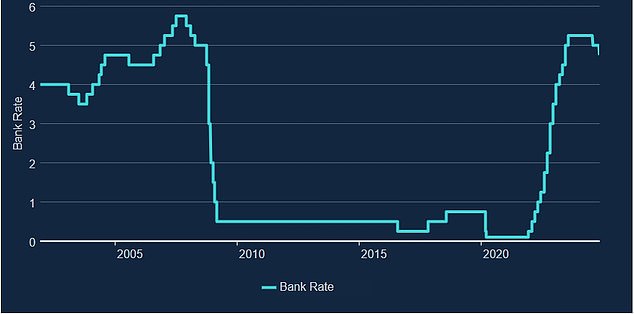

Second cut: Bank of England cut base rate from 0.25% to 4.75% in November 2024, but fixed mortgage rates are now rising

John Fraser-Tucker, mortgage director at brokerage Mojo Mortgages, said: “While the Bank of England’s decision to cut bank rates last week might lead some to expect across-the-board reductions in mortgage rates, it is important to understand that the mortgage interest rate The market does not always move in perfect synchronization with the Bank of England’s base rate decision.

‘Fixed rate mortgages, in particular, are influenced by a complex series of factors beyond bank rate.

“These can include the lender’s own financing costs, its view on future economic conditions, its competitive positioning in the market and even its internal objectives for new business.”

The price of fixed rate mortgages is also largely based on Sonia swap rates, the interbank lending rate, based on expectations of future interest rates.

When Sonia swaps rise high enough, it often results in fixed mortgage rates rising, and vice versa when they fall.

As of Nov. 8, five-year swaps were at 3.97 percent and two-year swaps were at 4.19 percent.

Five-year swaps have risen from 3.87 per cent on October 29, the day before the Budget. They are an increase from 3.7 percent on October 24.

“To add to the pressure, swap rates (key indicators used by lenders to price fixed-rate mortgages) have risen, requiring even more of these adjustments,” says Nicholas Mendes, mortgage technical manager at John Charcol.

“The combination of market dynamics and rising swap rates highlights the difficult landscape borrowers are experiencing.”

What should mortgage borrowers do?

The advice to borrowers is simple: strike a new fixed-rate deal as soon as possible to prevent rates from rising further.

A new mortgage deal typically lasts up to six months, meaning homeowners can lock in a new rate long before their current fixed-rate deal ends.

“For customers nearing the end of their fixed rate terms, it is essential not to delay in the hope that rates will return to levels seen weeks ago,” Mendes said.

‘Getting a deal now provides security in an uncertain market. There is always the option to review and adjust if circumstances change, but acting promptly minimizes exposure to further rate increases.

“This development underscores the importance of staying informed and proactive when managing mortgage commitments in today’s rapidly changing financial environment.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.