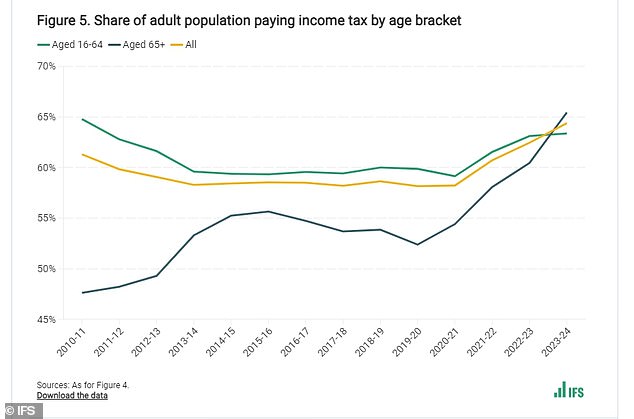

Two-thirds of pensioners now pay income tax and, for the first time, those aged 65 and over are likely to pay more than those aged 16 to 64 combined.

Historically, people aged 65 and over have benefited from a higher personal allowance than younger people.

The personal income tax allowance increased by 61 per cent during the 2010s, meaning the proportion of adults subject to the tax fell.

However, the Institute for Fiscal Studies says this has been “overshadowed by the increase over the 2020s”, from 58 per cent to a projected 66 per cent.

The proportion of pensioners paying income tax is expected to be higher than for all age groups

This is because a higher proportion of pensioners have to pay income taxes.

While the triple lock ensures that the state pension increases in line with inflation, earnings or 2.5 per cent, maintaining the personal allowance freeze means that a pensioner receiving the full state pension of £11,500 a year and Some private pension income is required to pay income tax.

During the 2010s, pensioners saw little increase in real terms in their personal allowance and are now seeing a reduction, according to the IFS.

In addition to the fact that pensioners’ incomes are increasing faster than those of the working-age population, 65 percent of people aged 65 and over pay income taxes.

In 2010-2011, 48 percent of pensioners paid taxes on their income.

In the 2023-24 tax year, they were for the first time more likely to pay income tax than those aged 16 to 64, the IFS says.

The Conservative Party has committed to introducing the triple lock plus, which increases the tax-free personal allowance for pensioners in line with the highest inflation, income or 2.5 per cent.

It claims the policy will mean the average pensioner is expected to see a state pension increase of £428 next year and £1,577 by the end of parliament.

> What the Conservative manifesto means for taxes and pensions

The frozen tax thresholds also mean that since 2010, income tax has risen from 9.4 per cent of national income to a projected 10.9 per cent in 2024-25 and 11.3 per cent by 2028-2029.

The IFS says the rise in tax revenue is driven by policy changes: frozen tax thresholds, an increase in the corporate tax rate and a tax on oil and gas companies’ windfall profits.

Economic changes, especially profit growth, have also increased tax revenues.

The IFS says the change from the Retail Price Index (CPI) to the Consumer Price Index (CPI) to measure inflation and increase tax rates and thresholds has had the greatest long-term impact on tax revenues.

‘CPI inflation tends to be lower than CPI inflation, so tax thresholds now increase less each year than if they were increased in line with the CPI.

“The difference in tax thresholds – and the resulting increase in income – increases every year, so in the long term this change dwarfs everything else.”