Table of Contents

Savers tend to accumulate many pension funds during their working life

Almost three quarters of people who recently changed a pension did not first check the fees charged by their old or new plans, research reveals.

This despite the staggering difference even a small percentage increase in charges can make.

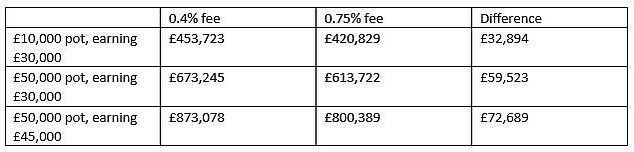

An increase from 0.4 per cent to 0.75 per cent could take more than £70,000 off a potential £870,000 pot (see below).

Savers typically accumulate many retirement funds during their working lives.

Sometimes, but not always, it is beneficial to merge them with their current job provider or move them to a private pension provider.

Rates are one of the main items to check before deciding, but many savers aren’t aware of how much they are paying or how small differences in costs can have a huge impact on their bottom line, according to the People’s Partnership.

The pension provider, which surveyed 1,000 people who had moved an invested retirement fund without the help of a financial adviser over the past two years, found that 11 per cent were unaware that their pension had any charges.

Around 72 per cent of those who did this did not know what their previous or current pension fees were.

> What to check before transferring a pension? Read our guide and find tips below

People’s Partnership analysis shows you could end up with a pot tens of thousands of pounds smaller if you don’t pay attention to the charges.

For example, a 30-year-old earning £30,000 who transferred a £10,000 pension fund from a provider charging 0.4 per cent to another charging 0.75 per cent could lose £32,900 from a fund potential of £453,700 when he retired at age 67.

They would lose £59,500 if they moved a £50,000 pot in the same circumstances. If they earned £45,000 and transferred a pension of £50,000, the impact of the charges would be £72,700.

This assumes that total contributions are 8 percent of salary, salary inflation is 3.5 percent, investment returns are 5 percent and inflation is 2.5 percent.

The PP also found that 50 per cent of respondents did not believe it was easy to track the fees they were charged for their pensions.

He recommends searching your provider’s website first and, if the information is not available, calling to ask how much they are charging you.

But PP adds that the pensions industry needs to be more transparent and should help savers understand key information when transferring funds to prevent them from making harmful financial decisions.

Chief executive Patrick Heath-Lay says: ‘While there are many factors that can make a pension attractive, the two key aspects are investment returns and charges.

‘Unfortunately, very few people know exactly what they are charged for their pensions and feel let down by an industry that does not make this information easy to find or understand.

‘If people cannot make an informed decision about the value offered to them by different providers, they risk losing thousands of pounds from their retirement funds.

“Our research shows that the real-world impact of small percentage differences is incredibly difficult to understand.”

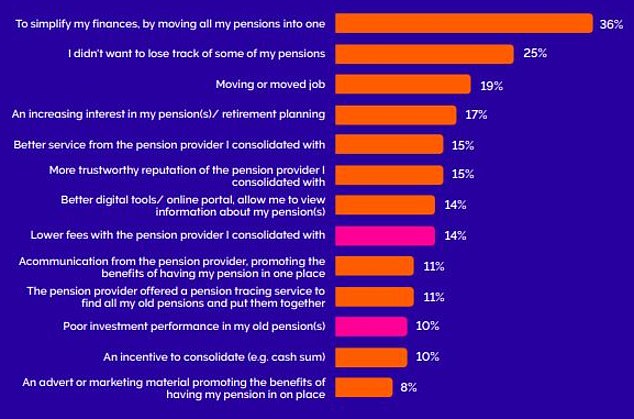

Why do savers decide to transfer pensions?

Source: People’s Partnership survey of 1,000 people who transferred a pension in the last two years.

Are you considering transferring a pension?

The People’s Association offers the following advice.

– If you are thinking about consolidating your pension because you are changing jobs or want to have your pensions in one place, ask yourself what is most important to you when you retire and look for a provider that will help you meet your long-term goals.

– Many providers will allow you to consolidate your pensions, but there are big differences in the rates they charge and, in some cases, the investment returns they generate, which will affect the amount you have saved at retirement age.

– There are three core areas of value when considering a pension provider: What is their most recent investment history? What type of organization are they in terms of the help they offer and how accessible are they? What are they going to charge you?

– Charges are usually expressed as a percentage. Don’t think the difference between seemingly small numbers is insignificant because the fact is that you may have to work longer to get the value you’re looking for to sustain you in retirement.

– There may be significant variations in rates between providers. You may also want to ask if there are any penalties you may have to pay if you decide to move forward in the future. There are other areas you can consider, special conditions you could waive, such as the age at which you can access your savings with your new provider.

– Don’t be fooled by the first ad you see. Most people talk to their current provider about consolidating or respond to the first ad they see, but it’s worth doing your homework.

– Ask your current pension providers, and anyone you are considering switching to, to send you simple, easy-to-understand information about the fees they charge, with examples to bring it to life.

– There is independent help at money helper (a free, government-supported monetary service).

What should you consider before transferring your pensions? A 10-point checklist

Merging pensions is not always advisable because you risk losing valuable benefits. Here’s what you should check before making a decision.

1. Commissions on old and new pension plans

As explained above, you should check the charges as they can seriously affect your future returns.

2. Where are your pensions invested?

Past performance is no guide to the future, but you should investigate where your money will be kept. Read our guide to carrying out an investment checkup.

3. A private provider versus your work scheme

Pension consolidation companies have emerged to help people manage all or most of their pensions in one place, and this can be cheaper and more convenient.

However, your current job scheme may have negotiated lower rates and accumulating your previous pensions there could be even more useful if you want to reduce administration.

STEVE WEBB ANSWERS YOUR QUESTIONS ABOUT PENSIONS

4. Guaranteed annuity rates

If these are high, it may be worth keeping an old pension and using it to buy an annuity.

You must receive paid financial advice to transfer a pension worth more than £30,000 with a GAR attached.

5. Guaranteed profitability of funds

These are rare, but it’s worth checking the fine print to see if you benefit.

6. Larger Lump Sums

Some older company pensions allow you to receive a tax-free lump sum higher than the typical 25 per cent.

7. Large exit penalties

Most default workplace pension funds are trackers with cheap fees these days. If you have an old, expensive pension with restrictive investment options, you might want to weigh the benefits of moving despite the penalties.

Exit fees are capped at 1 percent after you turn 55.

8. Ongoing employer contributions

You’ll receive free employer contributions in your current work plan and you won’t want to lose that cash coming into your fund.

9. Protected retirement ages

It depends on the rules of the plan, so check them, but you may not want to miss the opportunity to access a pension at age 50, especially if you have several others that will come into effect later.

10. Pensions for final salary

Outside the public sector, generous final salary pensions that pay a guaranteed income until death, plus valuable death benefits for surviving spouses, have virtually disappeared.

They are the most generous and secure pensions that exist. You should receive paid financial advice if the value of your transfer is over £30,000, which is a lasting protection against making mistakes that you won’t be able to correct later.

> Should you combine your pension funds? Read our full guide

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.