- Emil Forsberg joined the New York Red Bulls after eight years at RB Leipzig

- Emil and Shanga have two young children named Florence and Siena.

- DailyMail.com provides the latest international sports news.

<!–

<!–

<!–

<!–

<!–

<!–

New York Red Bulls star Emil Forsberg and his wife, Shanga, are divorcing, the footballer’s childhood sweetheart announced on Instagram on Monday.

Emil, 32, and Shanga, 31, hail from Sundsvall, Sweden, and have been together for 19 years. The couple married in the summer of 2016 and have two children named Florence and Siena.

Shanga has filed for divorce, according to documents seen by express.

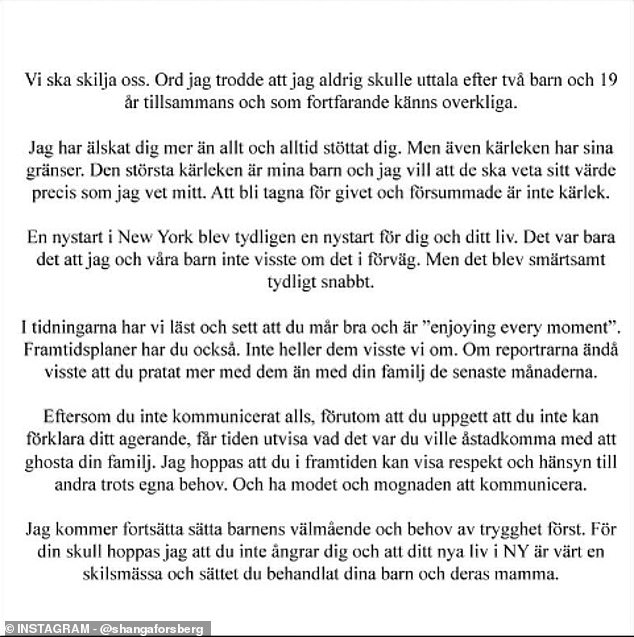

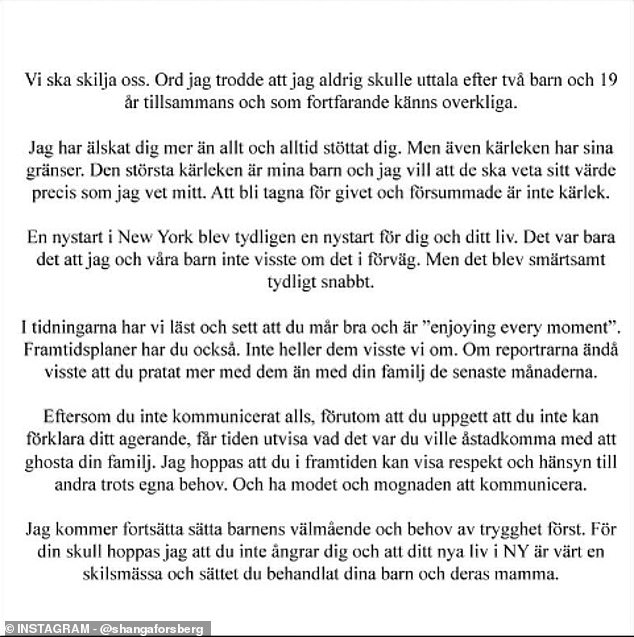

‘We will separate. Words that I thought I would never utter after two children and 19 years together and that still feel unreal,” she wrote in an Instagram post that was deleted hours later.

Their split comes months after the midfielder completed his move to Major League Soccer from RB Leipzig.

The wife of Swedish footballer Emil Forsberg, Shanga, filed for divorce after 19 years of relationship

In a now-deleted Instagram post, Shanga accused Emil of ‘ghosting’ his young family.

The divorce comes months after the midfielder agreed to sign for the New York Red Bulls of the MLS.

‘I have loved you more than anything and I have always supported you. But even love has its limits. The greatest love is my children and I want them to know their value just as I know mine. Being taken for granted and neglected is not love,” continues her post, written in Swedish.

‘A new beginning in New York was apparently a new beginning for you and your life. Only, as a child, I didn’t know it beforehand. But it soon became painfully clear. In the newspapers we have read and seen that you feel well and that you “enjoy every moment.” You also have future plans. We didn’t know about them either.

If only journalists knew that you’ve been talking to them more than your family these past few months. Since he hasn’t communicated at all, other than insisting that he can’t explain his actions, let time tell what he wanted to achieve by hiding his family. I hope that in the future you can show respect and consideration for others despite your own needs. And have the courage and maturity to communicate.

‘I will continue to prioritize the well-being and safety of children. For your sake, I hope you don’t regret it and that your new life in New York is worth the divorce and the way you treated your children and their mother.’

While Shanga has spoken openly about their relationship, Emil has yet to address the breakup.

The couple has been together for 19 years and married in the summer of 2019.

Shanga cited Emil’s move to New York as the catalyst for him ‘neglecting’ his family.

Forsberg played 243 games and scored 48 goals for RB Leipzig between 2015 and 2023.

Upon joining the MLS team, Forsberg was immediately named captain of the Red Bulls. So far this season, he has appeared and started in four of their five games.

Forsberg has a goal and two assists as the team sits in third place in the Eastern Conference with a 3-1-1 record.

New York’s No. 10 missed this weekend’s 4-0 rout of Inter Miami at Red Bull Arena while on international duty with Sweden. He played in the 5-2 loss against Portugal on March 21 and will be in the lineup against Romania on the 25th.

Forsberg began his professional career at GIF Sundsvall, scoring 24 goals between 2009 and 2012. He was briefly on loan to Medskogsbrons BK in 2009 and scored two goals in three appearances.

From 2013 to 2015, he played for Malmö and scored 19 goals before his longest spell with RB Leipzig in the Bundesliga. Forsberg made 243 appearances, scoring 48 goals for the German team between 2015 and 2023, and joined Leipzig’s sister club in the United States.

As an international, Forsberg made 87 appearances for the Swedish senior team and scored 21 goals.