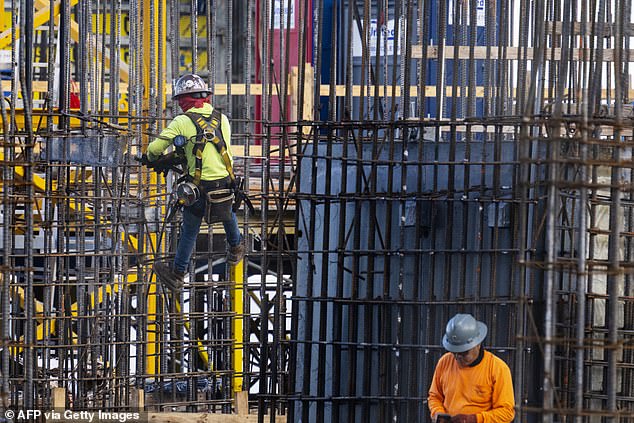

- Resilient economy created more jobs than expected despite high interest rates

<!–

<!–

<!–

<!–

<!–

<!–

Some 275,000 jobs were created in the United States in February as the hiring boom persists.

The figure was nearly 100,000 higher than economists had expected and complicates the Federal Reserve’s decision on when it will cut interest rates.

Unemployment rose between 0.2 percent and 3.9 percent, the U.S. Bureau of Labor Statistics reported Friday. While this is an increase, overall it is still the lowest since the late 1960s.

The sectors that experienced the greatest job growth were healthcare, government, food and drinking services, social assistance, and transportation and warehousing.

Approximately 100,000 jobs per month are needed to keep pace with the growth of the working-age population.

Some 275,000 jobs were created in the US in February as the hiring boom persists

The more jobs are created and the lower the unemployment rate, the more hesitant the Federal Reserve will be to finally reduce benchmark interest rates, which are at record levels.

More hiring means there is more money circulating in the economy, making it more difficult to reduce inflation.

Despite a series of layoffs earlier in the year, employers are generally holding on to their workers after struggling to find work during the pandemic.

Although labor supply and demand are returning to balance, some sectors of the economy remain desperate for qualified workers.

‘It’s true that it was close, but unemployment has remained below 4 percent for 25 consecutive months. “It’s the longest stretch since the late 1960s,” said Mark Hamrick, senior economic analyst at Bankrate.