Table of Contents

He is America’s most famous financial fraudster, having defrauded tens of thousands of investors out of an estimated $68 billion.

But how did Bernie Madoff pull off the biggest Ponzi scheme in history? It was a gigantic scam that ensnared celebrities and ordinary people alike.

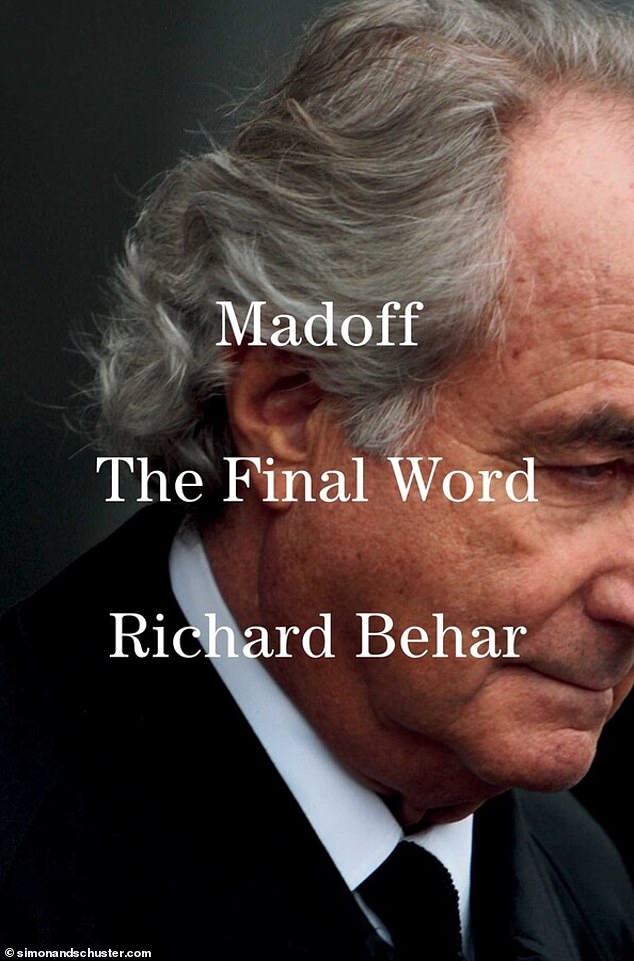

Veteran financial investigative journalist Richard Behar tackles this question in his new book Madoff: The Final Word, which offers extraordinary access to the mind and motives of the world’s most notorious financial fraudster.

Over the course of a decade and a half, Behar exchanged emails with Madoff, spoke with him on the phone and even made multiple visits to the North Carolina prison where he was serving his 150-year sentence.

To help others avoid becoming victims, the author explained to DailyMail.com the three main reasons why he believes Madoff got away with it. He also outlined the warning signs to look out for to avoid becoming a victim of fraud.

In his new book ‘Madoff: The Final Word’, Richard Behar asks how Bernie Madoff was able to carry out the largest Ponzi scheme in history.

Veteran financial investigative journalist Richard Behar offers extraordinary access to the mind and motives of the financial world’s most notorious fraudster in his first book, ‘Madoff: The Final Word.’

1. Affinity fraud

Ponzi schemes typically begin as affinity frauds, Behar said, in which the scammer targets a particular group, whether it’s an ethnic or religious group, or people of a certain age.

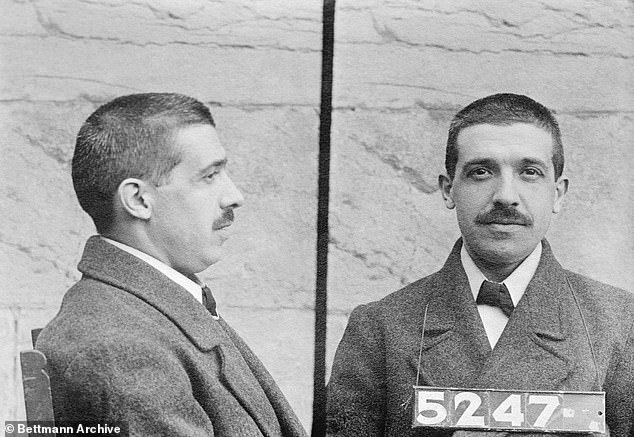

Charles Ponzi, the inventor of the scam that bears his name, targeted his fellow Italian-Americans in the 1920s, who trusted him largely because they shared the same heritage.

A Ponzi scheme, or pyramid scheme, works by paying early investors from the profits of later investors. It usually collapses when it fails to attract new investors. In Madoff’s case, this happened when the market suffered a sharp decline in 2008.

“I’m Jewish and I’ve talked to rabbis and others about this, and I’m confident in saying that Jews are especially vulnerable to being scammed by other Jews because of centuries of persecution and poverty,” Behar said.

One of Madoff’s first “feeders” in the early 1960s, he explained, was a wealthy investor who was considered a success story by his fellow Jews who had escaped Europe before or during the Holocaust.

“He told them that if they needed extra money, he would show them how to get it. These people were tailors or bakers or whatever, and that extra money from Madoff was a lifesaver for them,” he said.

Madoff also cast his net among Jewish Hollywood celebrities and media personalities, including Steven Spielberg, Larry King and Mort Zuckerman, which then attracted money from other famous figures and their money managers.

To expand — as Ponzi schemes must do to survive — his scheme evolved from a crime of affinity into a global organized crime dominated by huge feeder funds and banks, Behar said.

Madoff also cast his nets on Jewish Hollywood celebrities and media personalities, including Steven Spielberg (pictured), Larry King and Mort Zuckerman, Behar said.

Charles Ponzi, the inventor of the scam that bears his name, targeted his fellow Italian-Americans in the 1920s.

2. There’s no soup for you!

Similar to Seinfeld’s famous “Soup Nazi” character, Madoff created a universe in which investors were afraid to ask too many questions, Behar said.

The long-running sitcom character refuses to serve his famously delicious soup to any disobedient customers, quipping, “No soup for you!”

Madoff’s clients were afraid that if they continued to press him for more information, he would kick them off the wealth train and close their accounts.

“Like nightclub patrons hiding behind velvet ropes waiting to be chosen, Bernie was selective, sometimes even telling those who wanted to invest that his fund was closed for the time being and that he would not accept new money,” Behar added.

“And that only increased the appeal and desire to get into this special club. Bernie told me in prison how people begged them to be let in.”

Much like the famous Seinfeld character, the “Soup Nazi” (pictured), Madoff created a universe in which investors were afraid to ask too many questions, Behar said.

Over the course of a decade and a half, Behar exchanged emails with Madoff, spoke with him on the phone and even made multiple visits to the North Carolina prison where he was serving his 150-year sentence for “The Last Word.”

3. Due diligence? No!

Investors came aboard with little more than blind faith, according to Behar.

“Bernie was counting on that. People spend more time researching a new TV than a proposed Ponzi scheme like Madoff’s.”

He added: ‘And who among us with a brokerage account or IRA – let’s be honest – has bothered to take thirty seconds to type the name of our broker or investment manager into the search bar of the Wall Street “disciplinary actions” database at the Financial Industry Regulatory Authority?’

Behar said that when she began reporting for the book, she did some research and discovered that her 83-year-old Merrill Lynch stockbroker, who has since died, committed a felony in 1968.

As a general rule, Madoff excluded professional investors.

“After all, they could have looked at the bank statements and concluded that it was impossible to maintain consistently high returns,” Behar said.

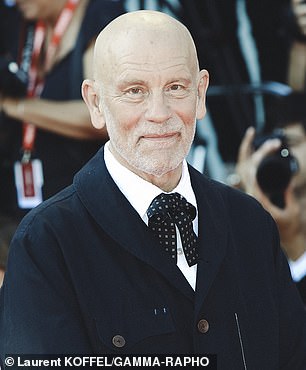

Other celebrities, including actor John Malkovich and actress Zsa Zsa Gabor, lost millions investing with Madoff.

Among those who invested with Madoff was New Yorker Sharon Lissauer, who lost everything when she gave away her mother’s inheritance. She is pictured leaving court on the day Madoff was jailed.

So what is Behar’s advice for avoiding becoming a victim of fraud?

Madoff did not allow his clients to view their account statements online nor did he allow them to email his employees.

Bottom line, if they don’t let you view your statements online, run! If they don’t let you email your broker, run!

‘If the paper statements we mail you look like they came from a computer in the 60s and 70s (and they did), run!‘

And pay attention to the disclaimer.

“Believe it or not, I also said there was always the possibility that I or others would commit fraud,” Madoff told Behar.