The Body Shop has entered administration with jobs at risk across the brand’s more than 200 stores in the UK.

The beloved chain currently employs 10,000 people in 3,000 stores it operates in more than 70 countries around the world, and another 12,000 employees work in franchises.

FRP Advisory has been brought in to manage the insolvency process just weeks after a new owner took over after promising to “re-energize the business”. The administration currently only affects staff and stores in the UK.

In a statement, it said: “The administrators will now consider all options to find a way forward for the business and will inform creditors and employees in due course.”

The business will continue to operate both in-store and online while plans are made for the future of the much-loved high street brand.

The Body Shop has started the process of submitting applications for administration with risk of job loss

The Body Shop, the nearly 50-year-old cosmetics company renowned for its ethical hair and skin products, is struggling financially in the UK.

The Body Shop was sold to L’Oreal for £675 million by founder Dame Anita Roddick in 2006.

The troubled chain, which has faced stiff competition from suppliers such as millennial and Gen Z-friendly bath bomb purveyors Lush and luxury brand Rituals, had also just closed its Avon-style home business division , The Body Shop At Home.

FRP said: ‘The Body Shop has faced a long period of financial challenges under previous owners, coinciding with a difficult trading environment for the wider retail sector.

“Having taken swift action in the last month, including closing The Body Shop At Home and selling its business in most of Europe and parts of Asia, focusing on the UK business is the next important step in the restructuring of The Body Shop”.

The administrators added: ‘The Body Shop continues to be guided by its ambition to be a modern and dynamic beauty brand, relevant to customers and able to compete over the long term.

“Creating a more agile and financially stable British business is an important step towards achieving this.”

As well as threatening thousands of jobs, the news could spell trouble for the many suppliers of Body Shop products around the world, who have been carefully sourced by the ethically minded company for decades.

While administration does not necessarily mean the end of the British brand, social media is full of reactions from those who fear the worst for the beleaguered company.

A former worker recalled on X, formerly Twitter: ‘Sad news about The Body Shop. It’s still one of my favorite jobs when I was a student, working weekends on Oxford St and Kings Rd in the late 90s.

“I met amazing people (also cool celebrities) and fell in love with skincare and makeup.”

Another simply said, “The body shop is closing, this is the worst day of my life”; one Londoner wrote: “If the body shop at Center Court (the Center Court shopping center in Wimbledon) breaks down I will really cry.”

Set up in 1976 by the late Dame Anita Roddick, the company became famous for its no-nonsense, ethical business ethos and its refusal to test products on animals.

Popular products that helped establish the brand name included bath bombs, white musk fragrance, and hemp hand cream.

There have been protests on social media in response to the news of The Body Shop entering administration.

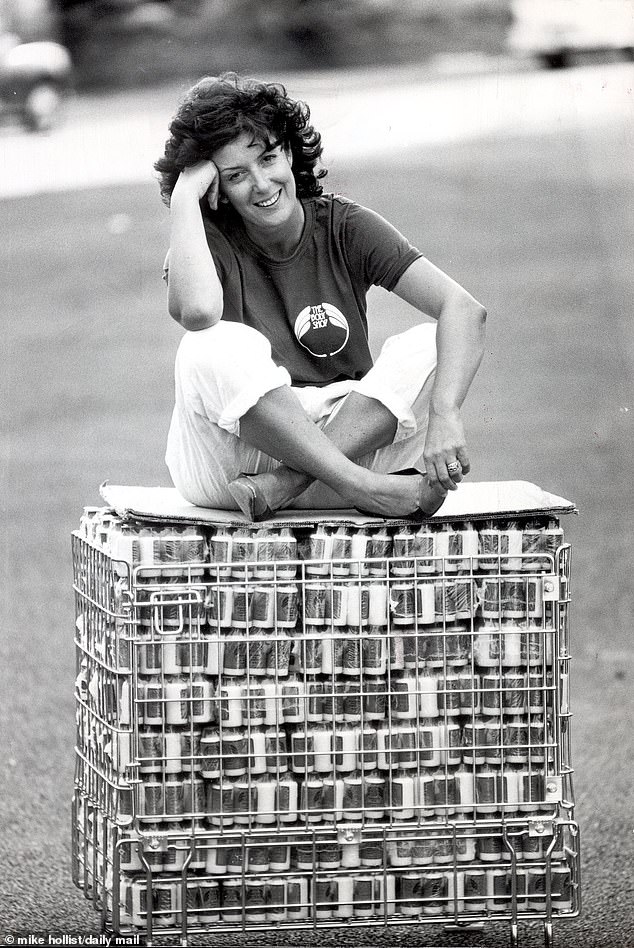

The store grew into an eco-friendly, socially responsible and politically open chain of 1,700 stores, operating in 49 markets around the world. Dame Anita is pictured above in 1984.

Protesting animal testing was a key business goal for the brand, with Anita leading the resistance.

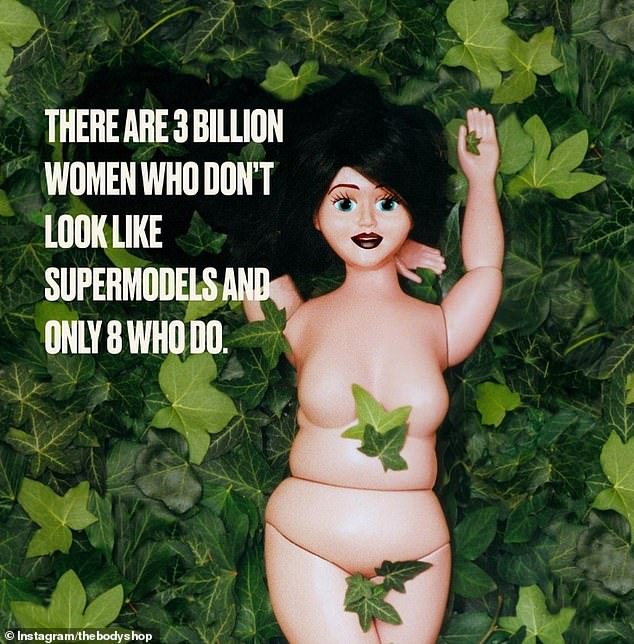

Redefining beauty standards was another of The Body Shop’s key goals, with the goal of making women feel comfortable in their own skin.

In 2012, British actress and model Lily Cole (pictured) became the brand’s first global ambassador.

However, in recent years it has seen its popularity decline in the UK among shoppers due to the rise of rivals Lush, Holland and Barrett, and a growing online market for cheaper alternatives.

The company also fell out of favor with some buyers after Dame Anita sold it to L’Oreal for £675 million in 2006, a move that surprised many who saw the sale to a large corporation as contrary to the company’s values. .

Since then, The Body Shop has changed hands several times, before being bought by private equity firm Aurelius just a few weeks ago for £207 million.

After purchasing the brand, Aurelius said that “despite the challenging retail market, there is an opportunity to revitalize the business to enable it to take advantage of positive trends in the high-growth beauty market.”

It has since emerged that the company does not have enough working capital and suffered a poor Christmas trading period.

In January, Body Shop said most of its business came from continental Europe and Asia, and it has since sold those businesses to an anonymous investor.

He told Retail Week in January that the move “places greater priority on Body Shop’s strategically important markets and relationships with key global franchise partners, which it will look for opportunities to build.”

“The Body Shop will also focus on more effectively reaching customers by strengthening digital platforms, developing new sales channels and through differentiated retail experiences.”

MailOnline has contacted The Body Shop and Aurelius for comment.