Donald Trump’s election victory has added fuel to the tech and cryptocurrency-focused ‘Broconomy’, and the British brothers are among those hoping to cash in.

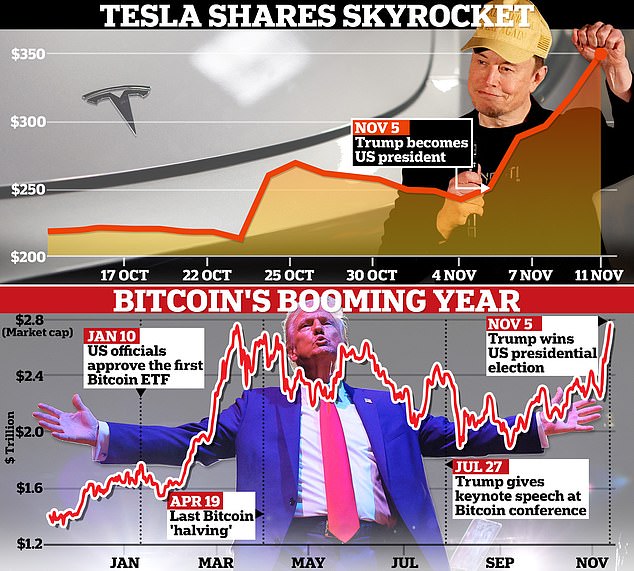

Bitcoin has been the most obvious beneficiary of the ‘Trump bomb’, with the world’s most popular digital at an all-time high after rising almost 30 per cent since election day last Tuesday to hit $88,600 (£66,100). sterling) today.

Crypto experts across the pond have taken note, with a London-based research firm saying it’s “very possible” that Bitcoin could hit $100,000 (£78,000) by the president-elect’s inauguration in January.

Elon Musk, Trump’s “brother in chief” and prominent supporter, has also benefited greatly from Trump’s victory, with Tesla shares up more than 40 percent since Election Day, boosting his net worth to an estimated $54 billion (£42 billion).

Tesla was the most popular stock buy last week on Hargreaves Lansdown, the UK’s largest platform for private investors, and is one of the largest holdings in the country’s largest investment trust, Scottish Mortgage.

The ‘Bro-conomy’, which includes cryptocurrencies and Elon Musk’s Tesla company, is one of the main beneficiaries of Donald Trump’s electoral victory.

Appealing to the ‘brother vote’ was a central platform of Trump’s reelection campaign and helped him win a larger share of voters under 30 than any Republican presidential candidate since 2008.

With his teenage son, Barron, acting as his unofficial advisor, the 78-year-old sat down with podcasters known for having a large male audience, including Joe Rogan and video game streamer Adin Ross.

He even launched his own cryptocurrency business, World Liberty Financial, while his campaign promoted an ‘America First Collection’ of NFTs that cost $99 each.

Trump has not always been a fan of cryptocurrencies and during his first presidential term he described Bitcoin and other digital currencies as “highly volatile and air-based.”

But egged on by true believers like Elon Musk, the Republican changed his tone on the campaign trail, attacking President Biden’s crackdown on cryptocurrencies and promising a “national strategic Bitcoin reserve.”

Their newfound enthusiasm has been of immense benefit to tech experts around the world, including the UK, even as financial experts warn that cryptocurrencies are immensely volatile and could crash at any time.

Nigel Green, director of British investment firm deVere, has called Trump’s pro-cryptocurrency stance “the most significant tailwind we have seen for Bitcoin since its inception.”

Trump’s “brother in chief” and prominent supporter Musk has also benefited greatly from his victory. They are seen together at a rally in Pennsylvania on October 5.

His resounding victory has given momentum to other major digital currencies, including Ethereum (up 39 percent since last week’s election) and Dogecoin, a joke cryptocurrency promoted by Musk that is now up 98 percent.

Flows into cryptocurrency exchange-traded funds (ETFs) have also increased since Trump’s election victory.

On Thursday, November 7, Bitcoin ETFs experienced their largest inflows on record, generating a net $1.38 billion (£1 billion), according to Citigroup.

“There have been significant inflows across the board,” Citi analysts said in a note. “ETF inflows have been the dominant driver of Bitcoin returns and we expect this to continue in the near term.”

The rally was so strong that the crypto sector is now estimated to be worth £2.2 trillion, more than the market capitalization of the entire FTSE 100 of just over £2 trillion.

Cryptocurrency enthusiasts are particularly excited about the president-elect’s promise to fire Gary Gensler, the head of the US financial watchdog who has led a years-long crackdown on the industry.

The morning after the election, crypto chief Cameron Winklevoss tweeted: “GM (good morning) @GaryGensler, you’re fired!”

JD Vance, Trump’s vice president, has owned Bitcoin since 2021, his financial disclosures show, and the most recent, from August, puts his reserves between $250,000 and $500,000.

Eric Trump, one of the president-elect’s sons and executive vice president of his private conglomerate, The Trump Organization, will be the keynote speaker at a Bitcoin conference in Abu Dhabi next month.

Trump’s promise to make the United States the “crypto capital of the planet” will be easier to fulfill if Republicans win control of Congress as expected, cementing his victory in both chambers.

Eric Trump will be the keynote speaker at a Bitcoin conference in Abu Dhabi next month. He is seen with his wife, Lara, at a rally at Madison Square Garden on October 27.

“The Trump Bitcoin bomb is alive and well… with Republicans about to take over the chamber to confirm a red wave in Congress, it seems the crypto crowd is betting on digital currency deregulation,” said Matt Simpson , senior market analyst. in the city index.

The cryptocurrency industry spent more than $119 million (£92.8 million) supporting pro-crypto congressional candidates, many of whom won their elections.

In Ohio, one of the cryptocurrency industry’s biggest enemies in Congress, Senate Banking Committee Chairman Sherrod Brown, was ousted, while pro-cryptocurrency candidates from the Democratic and Republican parties won in Michigan , West Virginia, Indiana, Alabama and North Carolina.

The cryptocurrency lobbyists’ biggest coup was persuading Trump to give the keynote speech at the 2024 Bitcoin Conference in Nashville, where he promised to fire Gensler on “day one,” earning applause from delegates who They consider him a hated figure for his pursuit of cryptocurrencies. companies for alleged violations of securities laws.

In a staunch defense of the industry that would have warmed the hearts of crypto bros around the world, he said: “If we don’t adopt cryptocurrency and Bitcoin technology, China will, other countries will, they will dominate, and we won’t.” can”. let China dominate.

And promising a brighter future ahead, he told the cryptocurrency world to “never sell your Bitcoin,” advice that many seem to be adopting.