Retailers have been criticised for using “unethical” discounts and rewards to encourage Britons to spend money using “buy now, pay later” and other credit schemes.

Most brick-and-mortar stores now use BNPL forms on their websites to encourage people to make purchases.

Buy now, pay later products allow users to take out a loan for a specific purchase, which is then repaid in installments. These products often offer an interest-free loan for an initial period.

However, these products are often unregulated and providers do not have to run credit checks on users. This means that those who are already financially vulnerable could find themselves racking up even more debt if they fail to repay the money on time.

JD Williams is offering £20 off a first order for those who spend more than £80 using its ‘JDW Pay’ scheme, designed to encourage shoppers to spend and sign up to a credit account that has a 44.9 per cent APR interest rate.

And there is growing concern that buyers, particularly young adults, may be tempted to shell out more than they can afford.

Flannels offers claimed price discounts of up to 50 percent for using its BNPL payments app

Buy now, pay later products allow users to take out a loan for a specific purchase, which is then repaid in installments. These products often offer an interest-free loan for an initial period.

Alarm bells have been rung by the fact that several retailers are now using claims of deep discounts – up to 50 per cent – and other benefits that are only available to BNPL or new credit buyers.

Frasers Group, set up by controversial street trader Mike Ashley, is one of the retailers leading the way in this new development.

Its brands, including House of Fraser, Sports Direct and Flannels, are offering discounts of up to 50 per cent for using its BNPL payments app.

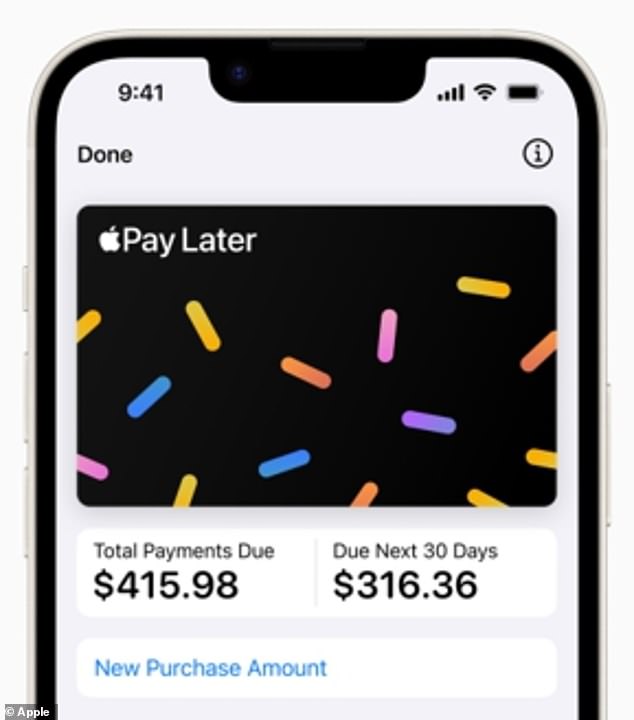

Last year, Apple launched its highly anticipated ‘Apple Pay Later’ product for people aged 18 and over.

But the move was plagued by controversy, with experts warning it could leave households in crippling debt as they already struggle with high living costs.

Apple Pay Later lets shoppers split a purchase made through Apple Pay on an iPhone or iPad into four equal payments over six weeks.

For an approved purchase, the consumer would pay 25 percent of the initial amount, and then 25 percent every two weeks thereafter until the full amount is theoretically paid in the sixth week. Apple says it does not charge “any interest or fees.”

The Very and Littlewoods group, which offers a wide range of home, fashion and toy products, has been offering a 20 per cent discount for anyone making a first purchase on credit.

JD Williams, part of N Brown Ltd, is offering £20 off your first order for those who spend over £80 using its ‘JDW Pay’ scheme.

This is not strictly BNPL, however it is designed to encourage shoppers to spend and sign up for a credit account that has a 44.9 percent APR interest rate.

The JD Sports Group, which includes all of them, has been running promotions over the past year offering free standard or express delivery deals if you pay using the ‘pay later’ option at checkout.

Most brick-and-mortar stores now use forms of BNPL, such as Klarna, on their websites to encourage people to make purchases.

Apple Pay Later lets shoppers split a purchase made through Apple Pay on an iPhone or iPad into four equal payments over six weeks

Last year, Apple launched its highly anticipated product ‘Apple Pay Later’

Critics warn that these plans could push struggling families into debt.

Adam Butler, director of public policy at debt advice charity StepChange, said: ‘While retail credit can be useful in spreading the cost of an expensive item, credit should be bought, not sold, to customers.

‘Retailers choosing to incentivize people with discounts if they apply for retail credit can lead to hasty borrowing decisions and poor outcomes, especially since this type of credit can carry high APRs.’

He said retailers agreed to end a tactic of offering introductory discounts to people who took out store cards since 2011.

“We would like to see that commitment applied consistently to online retail credit. Simply put, the decision to apply for credit should be unlinked to a discount on a purchase,” he said.

Frasers Group offers the FrasersPlus Buy Now Pay Later payment scheme, which allows buyers to pay in three interest-free instalments.

Many retailer websites encourage people to use this system by promoting products with a discounted FrasersPlus price.

For example, the Sports Direct website was selling Nike Air Max Invigor trainers for £80, but then £40 less if bought through FrasersPlus – a supposed 50 per cent saving using BNPL.

Critics warned that BNPL could lure struggling families into debt

For example, the Sports Direct website was selling Nike Air Max Invigor trainers for £80, but then £40 less if bought through FrasersPlus, which was a 50 per cent saving if using BNPL.

Frasers Group offers the FrasersPlus Buy Now Pay Later payment scheme, which allows buyers to pay in three interest-free instalments.

And an Under Armour Down jacket was listed at the regular price of £70, but is cheaper (£42) if purchased using the BNPL option.

At House of Fraser, a Flavia printed dress from Rixo is listed at a regular price of £195, but shoppers are then told they can get it for a cheaper £139 if they use BNPL.

Similarly, a Mongoose – Boundary 1 Women’s Bike is listed at a stated regular price of £240, but with a budget BNPL figure of £180.

A pair of DSQUARED2 ‘Cool Guy Jeans’ is listed at Flannels with a regular price of £319 and a BNPL value of £199.

The regular price of Chloe’s Woody Large Bag is £1,050 and the cheapest BNPL price is £839.

N Brown, owner of JD Williams, said: ‘N Brown is not a BNPL service provider – we offer a flexible, revolving credit option for our customers that can only be used with our retail brands.

‘Our customers are our priority and our credit option gives them greater choice and flexibility when it comes to paying for products. We take our role as a responsible lender very seriously and regularly review our offering to ensure it meets our customers’ needs and complies with credit rules and regulations.

‘Everyone who signs up for our credit option is provided with clear information about the credit service and undergoes a thorough credit check before being approved.’

Research has claimed that nearly half of people aged 18 to 34 are unaware that lenders offering the buy now, pay later option can add late payment fees.

Some 46 per cent of young people said they were unaware they could get into debt using BNPL products, compared with 35 per cent on average.

The study by lender Creditspring also revealed that BNPL products are now the second most common form of lending among the younger generation.

Klarna, the buy now, pay later giant, said other research refutes Creditspring’s findings, citing the FCA’s Financial Lives survey of 19,000 consumers, which it said found 81 percent of consumers were fully aware of the fees charged.

Creditspring said its research showed that while credit cards remain the most popular form of borrowing for young adults, with 19 per cent taking out these products, 15 per cent of 18-34 year-olds said they had taken out BNPL products for the first time since August last year.

In the 35-54 age group, this proportion is 13 percent, while among those over 55 only 4 percent have started using these products in the last six months.

Young people are by far the biggest users of BNPL services: 36 percent of 18-34 year-olds already use these products at least once a month, compared to just 20 percent of 35-54 year-olds.

Creditspring offers products that compete with BNPL, offering borrowers “two interest-free loans per year” but charging them a monthly fee of £7. On the other hand, BNPL providers receive payments from businesses that sell the goods and services for which the loans are requested.

Neil Kadagathur, CEO and co-founder of Creditspring, said: “The UK is sitting on a BNPL time bomb – millions of young people are unwittingly putting their financial future at risk by racking up BNPL debt.”

(tags to translate)dailymail