Donald Trump-era tax breaks are set to expire next year, meaning millions of Americans could have to start paying more in 2026.

Trump made sweeping changes to the tax landscape through the Tax Cuts and Jobs Act (TCJA) in 2017.

This included reducing individual income tax rates, nearly doubling the standard deduction, and increasing the federal estate tax exemption. He also cut the corporate income tax to 21 percent, its lowest level since 1993.

However, these cuts will expire on January 1, 2026, a date dubbed “sunset day” by financial experts.

Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center, he told CNBC The upcoming changes are “huge,” he said: “Virtually the entire individual income tax code will be on the table by the end of 2025.”

Trump made sweeping changes to the tax landscape through the Tax Cuts and Jobs Act (TCJA) in 2017. However, these cuts will expire on January 1, 2026, a date dubbed “sunset day” by financial experts. .

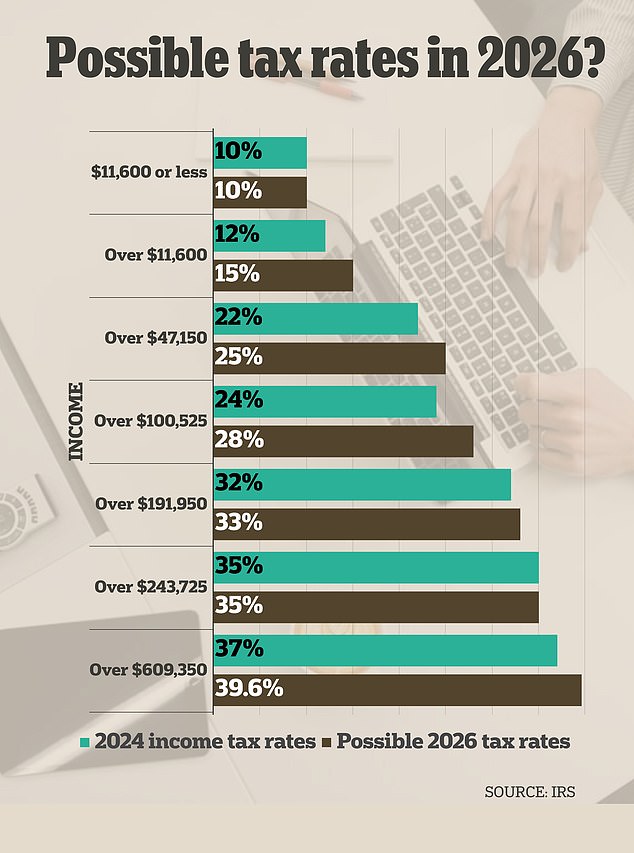

When the TCJA expires, income tax brackets could return to pre-2017 levels, which were nearly 3 percent higher.

Rates could jump from 10%, 12%, 22%, 24%, 32%, 35%, 37% this year to 10%, 15%, 25%, 28%, 33%, 35% and 39.6% in 2026.

These cuts have saved the average American household $1,600 each, according to estimates by the Tax Policy Center.

Both Biden and Trump have suggested they would extend the TCJA’s provisions for the middle class, but it is unclear exactly what this would look like, or if they would only maintain certain measures.

Fully expanding the TCJA could add approximately $4.6 trillion to the already looming national deficit over the next ten years.

If the TCJA is not extended, the biggest impact will come from lower rates and broader tax brackets.

The expiration of the TCJA would affect “virtually every aspect of the tax code and affects the vast majority of American taxpayers,” Erica York, senior economist and research manager at the Tax Foundation’s Center for Federal Tax Policy, told CNBC.

Trump has not confirmed whether or not he will extend the TCJA and experts are divided on whether he will do so. A research note from Capital Economics claims there is little “room” for Trump to be so generous.

Biden is also likely to extend many of the cuts, although he has made clear that he plans to raise the corporate income tax to 28 percent.

Trump has not confirmed whether or not he will extend the TCJA and experts are divided on whether he will do so.

The TCJA also doubled the lifetime estate tax deduction from the 2017 value of $5.49 million for individuals to $11.18 million, and this has continued to increase in subsequent years.

Under current rules, an individual can transfer $12.92 million and a married couple can transfer $25.84 million to heirs before federal estate taxes are applied.

If the TCJA is eliminated, the exemption could be effectively cut in half, leaving a person with a taxable estate valued at more than approximately $7 million subject to federal estate taxes if they do not plan ahead.

When the TCJA expires, the standard deduction could return to 2017 levels, nearly half of what it is now.

This may mean that more people will need to itemize their deductions when filing their returns in 2026 to reduce their taxable income.

Before 2018, only 70 percent of people claimed the standard deduction. In 2020, with the highest allocation, this figure jumped to 90 percent, according to the Tax Policy Center.