The property market is stagnant, according to surveyors and estate agents.

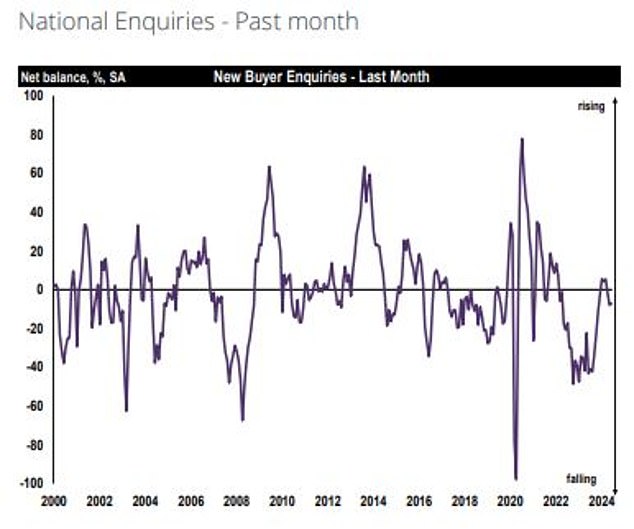

Fewer buyers in the market are resulting in fewer sales and falling house prices, according to the latest survey by the Royal Institution of Chartered Surveyors (Rics).

The widely followed monthly survey takes the temperature of Rics members and provides a snapshot of what is happening on the ground in the property market across the country.

It revealed that a greater number of its members, including estate agents and surveyors, continued to see fewer buyer enquiries and fewer sales in June.

> What’s next for mortgage rates?

Waning interest: More Rics members reported fewer buyer enquiries in June than those reporting an uptick, according to the closely watched survey

Weakening demand from home buyers marks the third consecutive month in which buyer inquiries have reportedly declined.

Meanwhile, the flow of homes entering the sales market slowed during June, according to Rics members.

More agents reported having fewer homes for sale than those who viewed more seller listings.

This ends six consecutive positive monthly readings in which agents had reported more sellers coming to the market.

In terms of house prices, more Rics members reported that house prices fell in June than those who reported that prices were rising.

Survey results differ depending on where in the country the Rics member resides.

East Anglia, along with the south-east and south-west of England, posted clearly negative results for house prices in June.

>When will interest rates fall?

House prices are falling: More Rics members continue to report that house prices are falling than those who say they are rising

Rob Swiney, a member of Rics based in Bury St Edmunds in Suffolk, said: “(The market) is still stuck with a lot of people sitting on the fence waiting for the first interest rate cut.”

“It’s very difficult to read the market at the moment because people are waiting for the general election result and are thinking about going on holiday rather than buying and selling houses,” added Christopher Clark, a member of Rics in Eastleigh, Hampshire.

David Hickman, a member of Rics in south Devon, paints a more dramatic picture, suggesting there are too many houses for sale and not enough buyers.

He said: “There has been no spring rush. Properties are coming onto the market at lower levels than last year and rapid reductions are needed to attract a buyer.

‘In addition, construction chains are long and delivery times are long. Layoffs contribute to slowdowns and foreclosures, where higher fixed rates cannot be paid. There are too many new homes.’

Rics members say there were fewer sales in June ahead of the general election

In contrast, prices in Northern Ireland and Scotland are on an upward trajectory, according to RICS members.

Belfast-based Rics member Kirby O’Connor said: “The sales market remains strong. Prices are rising and there is demand.”

Craig Henderson, a Rics member based in Ayrshire, Scotland, added: ‘The market continues much as it has so far in 2024, with demand outstripping supply.

“Homes continue to come onto the market slowly as many buyers are still waiting to see what they want to buy before they go on the market. I don’t see any reason for this to change anytime soon.”

Are better times ahead for the real estate market?

Although Rics members report that sales figures are upside down, they are more optimistic about the future than in previous months.

More members expect residential sales volumes to recover in the next three months.

In fact, the June survey represented the most optimistic picture of near-term sales expectations since January 2022.

There is also more optimism about future house price growth.

Slightly more RICS members think house prices will rise over the next three months than those who expect them to fall.

And most Rics members believe house prices will rise within 12 months.

Tarrant Parsons, senior economist at Rics, believes the market could gain momentum in the coming months.

“Although activity in the housing market remained subdued last month, the outlook improved slightly,” Parsons said.

‘Some factors are now emerging that could support a recovery in the coming months.

‘If the Bank of England decides that the current inflation environment is sufficiently benign to begin easing monetary policy next month, this could trigger further easing of interest rates.

‘Moreover, the recent elections produced a clear result: housing is high on the political agenda.’

Onwards and upwards: Rics members expect house prices to rise over the next 12 months

As for Rics members, many of them share this sentiment, even in the southernmost parts of the country where house prices are in greater difficulty.

Sean Steer, a member of Rics in Reigate, Surrey, said: “With a fall in interest rates looming, this will result in an increase in demand and prices in the coming months.”

Tony Jamieson, a member of Rics in Guildford, said: ‘There is a waiting game going on as both sellers and buyers await the outcome of the general election and also for the Bank of England to cut interest rates.

“I think when both of those things happen, the market will turn more positive as there is currently pent-up demand to move.”

Jeremy Leaf, a member of Rics based in Finchley, added: ‘Mortgage payments staying higher for longer proved to be more relevant to property decision-making than the election outcome.

‘However, buyers and sellers told us they were hitting the pause button, not the stop button, so we don’t expect significant changes in prices or activity in the coming months.’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.