Rebel Wilson looked sensational as she headed to her show at Manchester Opera House on Friday, just days after her former co-star Sacha Baron Cohen broke her silence over claims she made in her memoir about her behaviour.

The actress, 44, was seen wearing a glamorous red dress with an asymmetrical neckline as she left her hotel in the city before headlining her show An Evening with Rebel Wilson, in which she would chat about her life and her path to success in Hollywood. .

Australian star Rebel was seen beaming as she exited the building, walking with her hand on her hip, as she completed her look by opting for a pair of black heels.

The screen siren appeared in good spirits, happily posing for photos with fans before her show.

It comes after Sacha broke his silence after Rebel’s redacted memoirs were published in the UK on Thursday.

Rebel Wilson looked sensational as she headed to her show at Manchester Opera House on Friday.

The actress, 44, was seen wearing a glamorous red dress with an asymmetrical neckline as she left her hotel in the city before headlining her show An Evening with Rebel Wilson.

On her Manchester show, she was keen to chat about her life and her journey to success in Hollywood.

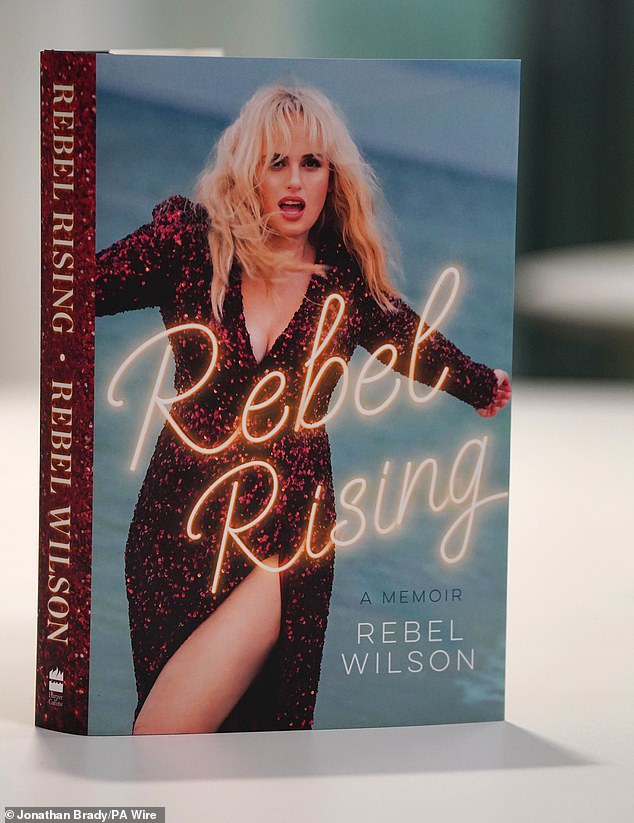

The book was published in the US earlier this month and features a chapter titled Sacha Baron Cohen and Other Morons, where Rebel makes claims about Sacha’s behavior during the filming of the 2016 film Grimsby, which he has denied. roundly.

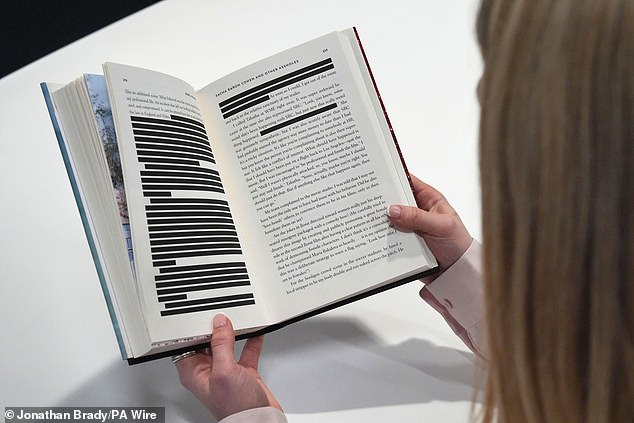

However, UK copies feature the text crudely crossed out due to what Rebel calls “peculiarities” of English law.

In response to the book’s release in the UK, Baron Cohen’s legal team has seen this decision by publishers HarperCollins as vindication, following the creator’s firm denial of Wilson’s claims.

“HarperCollins did not fact-check this chapter of the book before its publication and took the sensible but appallingly late step of removing Rebel Wilson’s defamatory claims once presented with evidence that they were false,” said the statement, filed on Deadline.

‘Printing falsehoods is illegal in the UK and Australia; This is not a “quirk”, as Mrs Wilson said, but a legal principle that has existed for many hundreds of years.

“This is a clear victory for Sacha Baron Cohen and confirms what we said all along: that this is demonstrably false.”

After the redacted edition was finally published, publisher HarperCollins confirmed to MailOnline that the details had been removed.

They told MailOnline: “The book contains some redactions in chapter 23 on pages 216, 217, 218 and 221, as well as an explanatory note at the beginning of the chapter.”

It comes after Sacha broke his silence after Rebel’s redacted memoirs were published in the UK on Thursday.

Australian star Rebel was seen smiling as she left the building, completing her look by opting for a pair of black heels.

The screen siren appeared in good spirits, happily posing for photos with fans before her show.

Rebel was seen smiling as she posed with a fan who had been waiting to meet the star outside her hotel.

After the allegations were detailed in the US version of the book, Sacha’s spokesman said: “While we appreciate the importance of speaking openly, these demonstrably false claims are directly contradicted by extensive and detailed evidence…

‘Including contemporary documents, film footage and eyewitness accounts from those present before, during and after the production of The Brothers Grimsby.’

The UK version includes a reference to “the worst experience of my professional life”. An incident that left me feeling intimidated, humiliated and compromised…

“Cannot be printed here due to peculiarities of the law in England and Wales.”

The rest of the page is redacted, with black lines also eliminating shorter details elsewhere in the chapter.

The Pitch Perfect and Bridesmaids star said her goal wasn’t to write off Sacha with her memories in the memoir, but rather to retell an experience that made her feel “completely disrespected, which led me to treat myself even more disrespectfully.” of respect when eating in an extremely unhealthy environment. shape’.

In the UK book, Rebel says she “regrets the day” she met Sacha, whom she describes as her “idol.”

She describes how they met at a dinner hosted by Little Britain star Matt Lucas, and a year later he offered her a role in Grimsby, which was released in North America as The Brothers Grimsby.

The book Rebel Rising, which has already been published in the US, features a chapter titled Sacha Baron Cohen and Other A**holes, but it will have black lines in certain parts.

In response to the book’s release in the UK, Baron Cohen’s legal team has seen this decision by publishers HarperCollins as vindication, following the creator’s firm denial of Wilson’s claims.

Rebel branded her sex scene with Sacha in the film Grimsby “the most disgusting thing ever”, nine years before calling the star a “jerk” in her new memoir (pictured filming Grimsby in 2014).

She played Dawn, the wife of Sacha’s character Nobby, a football fan who finds himself drawn into the world of his secret agent brother.

Last month, he first named Sacha as the celebrity responsible for making threats about the book, after which his representatives responded.

Taking to Instagram to confirm the identity, Rebel wrote: “I will not be silenced by expensive lawyers or PR crisis managers.” The idiot I talk about in ONE CHAPTER of my book is: Sacha Baron Cohen.

Following his statement, Sacha spoke to TMZ through representatives and said, “While we appreciate the importance of speaking out, these demonstrably false claims are directly contradicted by extensive and detailed evidence…

‘(With) contemporary documents, film footage and eyewitness accounts from those present before, during and after the production of The Brothers Grimsby.’

As well as her shocking comments about the “disgusting” Grimsby sex scene, in an interview with The Australian Women’s Weekly at the time, the Pitch Perfect star also slammed her character Dawn wearing a burqa in one scene.

She insisted at the time that all the scenes were in the name of comedy: ‘Obviously, I don’t mean to offend Muslims. I asked my Muslim friend, ‘Do you think it’s okay to tell the joke we’re telling?’ And she said she did.’

He added: “But she’s pretty liberal and lives in New York, so who knows?” But it’s a joke and I don’t want to offend.”

Rebel’s post came just two days after the Pitch Perfect star alleged that a celebrity she once worked with was threatening her over the publication of the memoir.

She detailed: ‘I wrote about a jerk in my book. Now, he said a ****** is trying to threaten me. He has hired a crisis public relations manager and lawyers. He’s trying to stop the press from talking about my book. But the book will come out and you will all know.’

Following his claims, Sacha spoke to TMZ through representatives, saying, “While we appreciate the importance of speaking out, these demonstrably false claims are directly contradicted by extensive and detailed evidence.”

In an Instagram video shared on March 15, Wilson revealed that she has dedicated a chapter of her book to the ‘huge jerk’ she worked with in Hollywood.

Rebel will discuss her book on a UK tour later this month, with appearances in Edinburgh, Manchester and London.

He will speak to comedian and Loose Women star Judi Love in Edinburgh and Manchester on April 24 and 26 respectively, and will speak to presenter Fearne Cotton at the London Palladium on April 29.

Representatives for Sacha and publisher Harper Collins have been contacted for comment.