Table of Contents

At one point, almost every bored schoolchild who received a calculator used it, not to calculate, but to try to spell the dirtiest word possible.

You might think that when people are old enough to drive, maturity will kick in and the need to combine numbers and letters into laugh-inducing terms and phrases will have ceased.

Clearly not, as every year the Driver and Vehicle Licensing Agency (DVLA) has to spring into action when new number plates are launched every two years, banning potentially rude combinations.

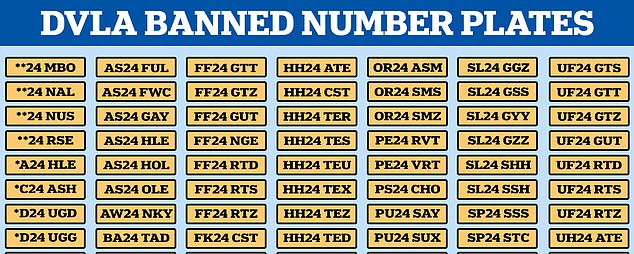

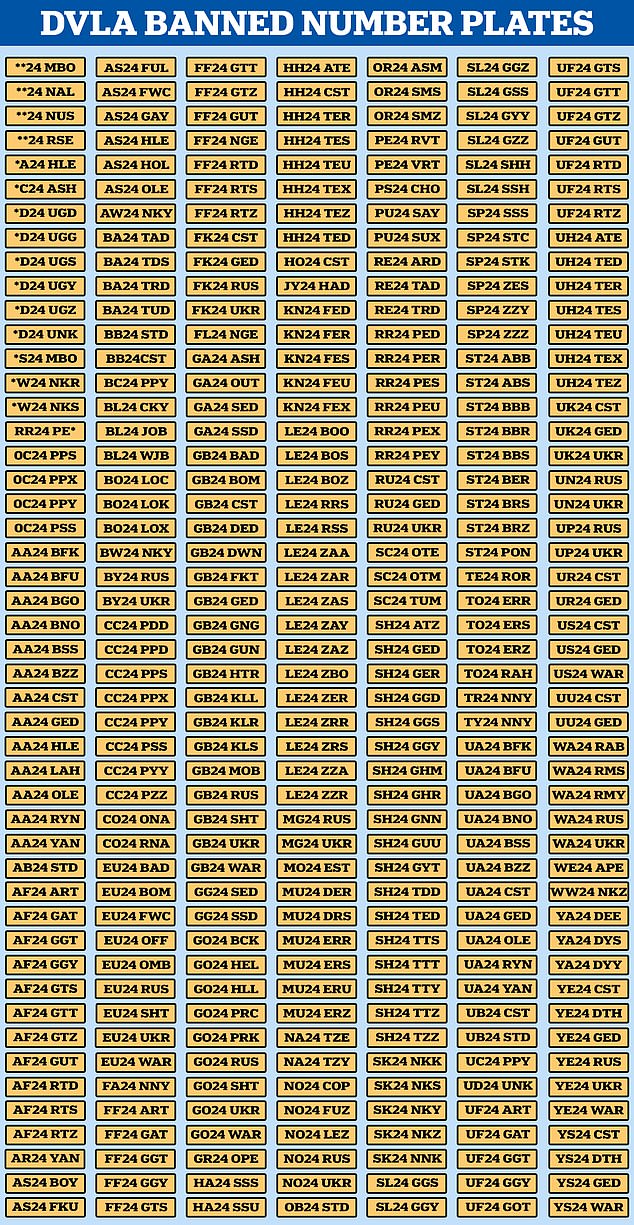

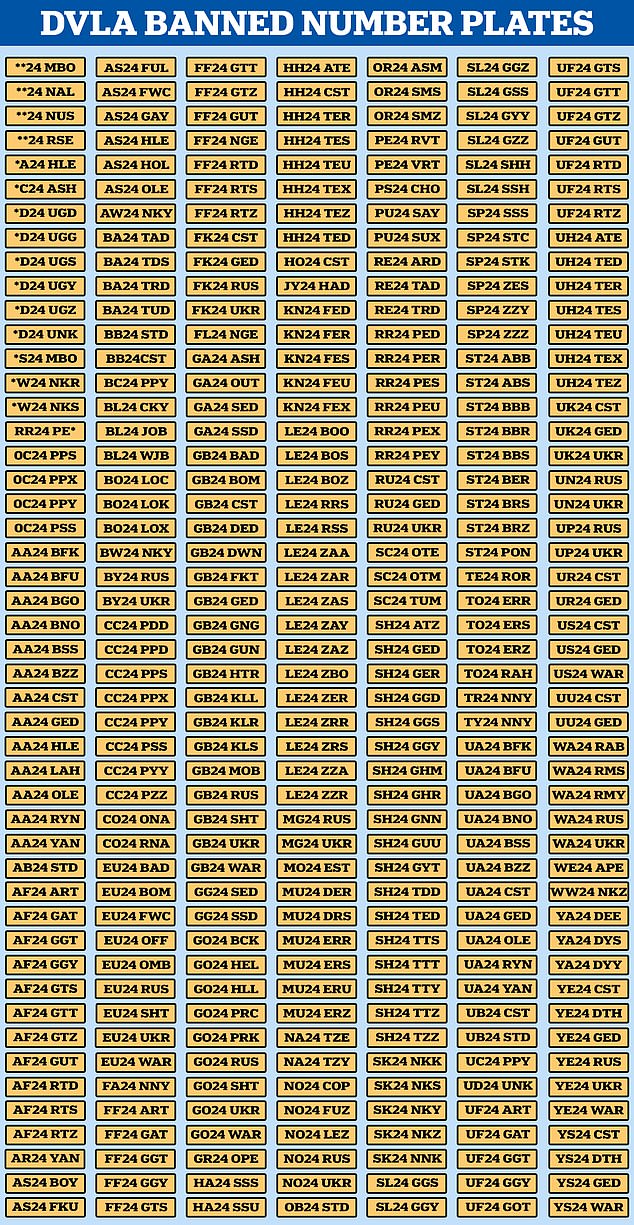

Here are the banned license plates for 2024 – a list of 334, including license plates such as ‘FA24 NNY’, ‘EU24 UKR’ and ‘GB24 WAR’.

SCROLL TO THE END OF STORY TO SEE THE FULL LIST

Banned: Just some of the 334 number plates banned by the DVLA this year; scroll to the bottom of this story to see the FULL list

March 1 marks the arrival of the new ’24’ age identifier for vehicle registration plates and, with it, a new list of combinations that DVLA considers it too offensive has been made public.

Twice a year, in March and September, the DVLA issues new plates, and in September the ’74’ age identifier debuts.

With these changes comes a whole host of offensive combinations that the agency wants to eradicate before drivers with a warped sense of humor or those desperate to portray a social or economic message can get their hands on them.

The most obvious reason to ban a dish is if it contains, or almost spells out, a swear word that may be considered offensive.

References to Brexit and the EU, war or any topic of a racist, religious or political nature are removed by the DVLA’s team of specialists, who have to scrutinize all combinations to eliminate the worst examples.

And the change from March to ’24’ has meant extra work for the organization.

The simple ‘4’ of class ’24’ is causing most of the DVLA’s problems.

This is because it looks like the letter ‘A’ and can therefore replace it in rude combinations.

And that single vowel is responsible for the banning of ’24 NUS’, ‘AS24 HOL’, ‘W24 NKR’ and ‘SH24 GED’.

Some will be sad, but the prudes will calm down.

Much of the public won’t think twice about this list, but private straightener buyers are disappointed every year because they are prevented from getting their hands on these unique and eye-catching combinations.

While we take this lightly, the DVLA sets aside many working hours each year to examine and remove any plates that may offend the public.

Senior members of the agency meet twice a year in Swansea to discuss the matter.

After a team of experts has reviewed and vetted any combinations that may have potentially rude or offensive meanings, they do everything they can to make sure they don’t end up by the wayside.

The criterion is that everything that “may cause offense, embarrassment or is in bad taste” be eliminated. And if some slip through the net, they can be terminated at a later date.

But “the vast majority of registration numbers are available”, the DVLA said.

In fact, the list is relatively short most years, but it certainly makes for joyful reading.

What does the rest of the tuition mean?

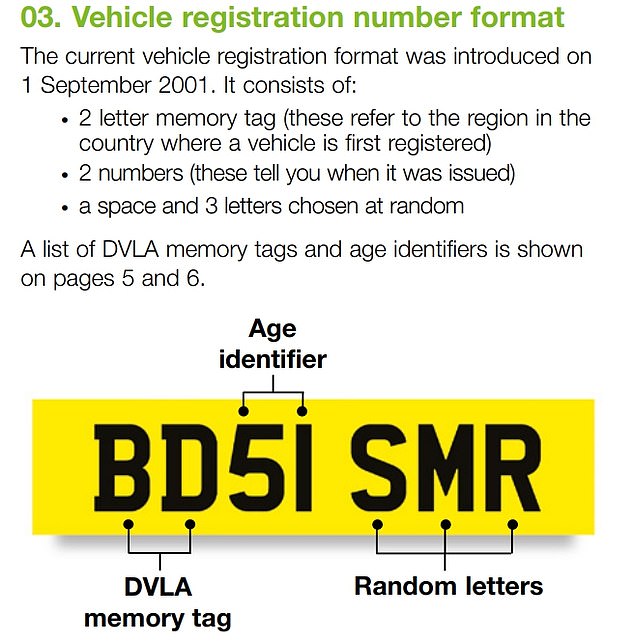

How the number plates are arranged and what the different elements mean (Source: DVLA)

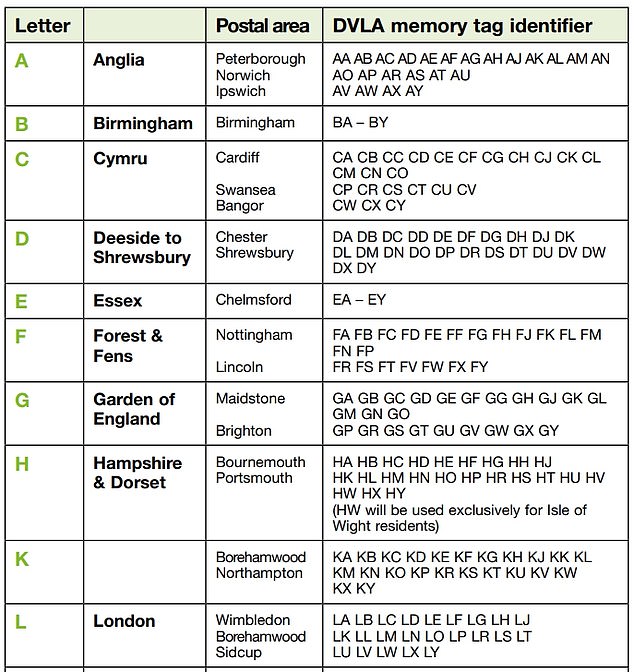

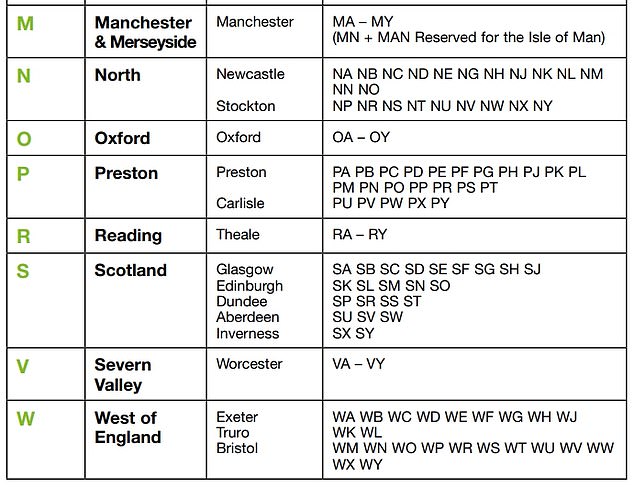

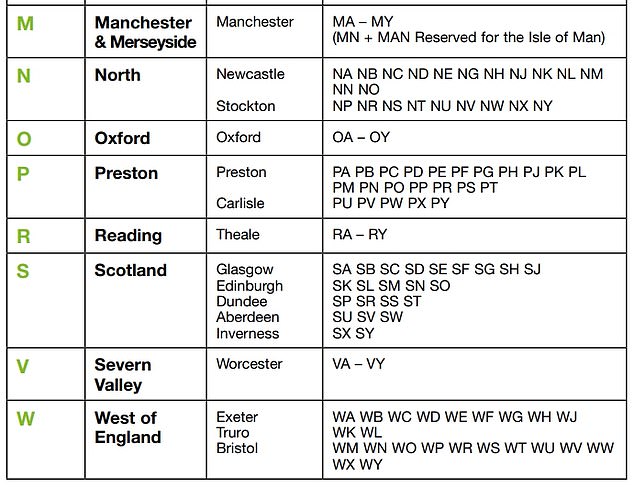

The rest of the characters on the plate are given as usual, with the first letters indicating the region where the car is registered.

The end of the license plate, however, is randomly generated and used as a way to uniquely identify the car.

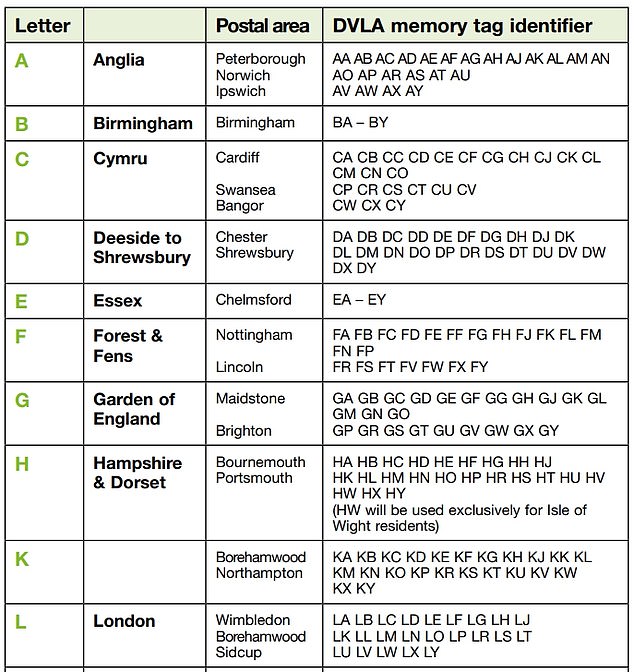

The regional license plate identifier tells you where your car was registered

Below is the list of regional identifiers from the DVLA guide. It will not use I, Q or Z in local tag identifiers and will only use Z as a random letter.

Source: DVLA Vehicle registration numbers and registration document INF104

What rules are there about how dishes are displayed?

Manufacturers who make plates must follow rules about fonts, font sizes, colors, and placements.

Drivers who do not display their number plate correctly will fail their MOT and could be fined up to £1,000 if caught.

In practice, you will regularly see license plates whose screen has been modified to say a word or name, but this is not legal and the police can and do stop people for it.

He DVLA license plate guide explains: ‘The numbers and letters on a license plate cannot be rearranged or distorted to form names or words so that they are difficult to read.

‘For example, fix bolts to change some of the letters or numbers. You could be fined up to £1,000 and your car will not pass the MOT test if you drive with incorrectly displayed number plates.

«In some cases, the registration number may be permanently withdrawn. If you misrepresent a vehicle’s registration number, you will not get back any money you paid for the registration number or any other costs you may have to pay.

“You cannot use a license plate number to make your vehicle appear younger than it really is.”

Does a license plate change reduce the value of your car?

Cars with new plates are always in demand, although less than before. A car with new plates will obviously be newer and will have a knock-on effect on those with older plates, but this will not make a substantial difference to the value of the vehicle.

Condition, history, mileage and other factors will tend to matter more to buyers than a semi-annual license plate change.

Darryl Bowman, of car insurance app Cuvva, said: “If you want to sell your car soon and want the best price possible, it’s best to sell it before the new plates come out.”

And if you want to get a bargain on an almost new car, buying a car with an old registration could be a good idea.

“There are ways to reduce the depreciation of a car, including regular maintenance, MOT checks, choosing a popular model and reducing driving time to keep mileage down.”

HERE IS THE FULL LIST OF 334 PROHIBITED ’24’ LICENSES:

Each year the DVLA bans a list of potentially offensive or rude number plates and this year the ’24’ rules have been published which will not be allowed on the roads.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.