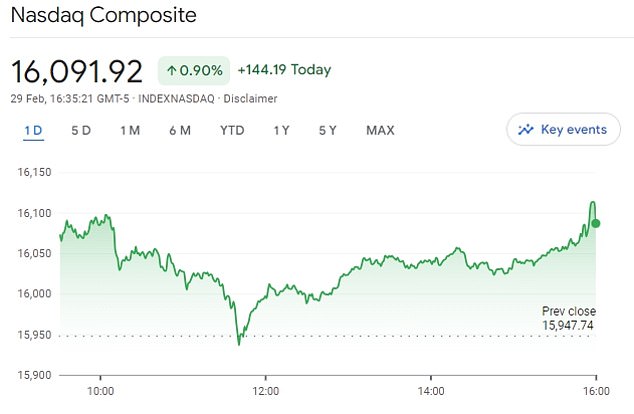

The technology-focused Nasdaq stock index closed at a record high today, another boost for investors and Americans’ 401(K) retirement accounts.

It took more than two years to beat the record set in November 2021.

The S&P 500 also closed higher on Thursday, which, like the Nasdaq, was boosted by AI-linked tech stocks.

Both indexes were also helped by inflation data and comments from Federal Reserve officials that made an interest rate cut in June more likely.

For the average American, your primary exposure to the stock market will likely be your retirement plan, since most 401(K) accounts have some money invested in these benchmarks.

The Nasdaq closed at an all-time high – the first record close since November 2021

Nvidia CEO Jensen Huang is now the 20th richest man on the planet with a net worth of $69.7 billion.

Homes in the elusive neighborhood cost tens of millions of dollars and can count tech giants Larry Ellison and David Sachs as neighbors.

Chipmaker Nvidia advanced as the biggest boost to the benchmark S&P index and Nasdaq, while smaller rival Advanced Micro Devices rose.

Those and other technology companies have been the centerpiece of Wall Street’s rally in recent months, fueled by optimism about growth prospects related to artificial intelligence.

Dell Technologies, which sells AI-optimized servers built with high-end Nvidia processors, rose ahead of its report after the bell.

Nvidia shares have been on the rise over the past year, with the company reaching a market capitalization of $2 trillion as investors continue to drive up its share price following its blockbuster gains.

On one day last week, the stock rose 13 percent, marking the largest single-day increase in value for a company, adding $150 billion to its market cap.

The company was founded and remains led by Jensen Huang, who has left fFrom minimum wage at Denny’s to living in a $44 million mansion on San Francisco’s Billionaires’ Row.

Traders added to bets that the Federal Reserve will cut rates in June, according to CME’s FedWatch tool, after a Commerce Department report showed U.S. prices rose in January in line with expectations, while annual inflation was the smallest in three years.

There were fears that inflation would be higher than expected, as had been the case in recent reports.

“Without a hawkish surprise here, which it wasn’t, it was soft or at least in line, then there’s no real reason for the market to expect the Fed to get any tougher than it already outlined,” Ross Mayfield said. investment strategy analyst at Baird in Louisville, Kentucky.

‘It doesn’t matter what you think they should do. It’s what they say they’re going to do, and once again, the market is back in line with where the Fed said it would be.

According to preliminary data, the S&P 500 gained 27.78 points, or 0.51%, to close at 5,095.78 points.

The Nasdaq Composite gained 144.19 points, or 0.90%, to 16,091.93.

The Dow Jones Industrial Average rose 24.07 points, or 0.07%, to 38,973.09.

Each of the three major indexes posted a gain in February, their fourth consecutive monthly advance.

Atlanta Fed President and voting member Raphael Bostic highlighted the adoption of a data-dependent monetary policy approach, saying the path toward the Fed’s 2 percent inflation target was to be a bumpy road, and reiterated his view that he sees the central bank cutting rates “in the future.” summer months.’

Federal Reserve Bank of Chicago President Austan Goolsbee said improvements made last year in the supply of goods and the labor market paved the way for falling inflation this year, indicating he remains supportive of the rate cuts later this year.

Reports on consumer and producer prices in early February, which pointed to persistent inflation, had led investors to delay expectations of rate cuts until June.

Earlier this year, traders viewed March as the likely starting point of the Federal Reserve’s easing cycle.

The core personal consumption expenditure (PCE) index rose 0.4 percent between December and January.

The Federal Reserve’s current benchmark interest rates are between 5.25 and 5.5 percent and have been at that elevated level since last summer. No cuts expected until June

Meanwhile, initial jobless claims for the week ending February 24 rose to 215,000, higher than expectations of 210,000, economists polled by Reuters said.

Dow gains remained in check, weighed down in part by a drop in Boeing after a report on a Justice Department investigation.

Snowflake slumped after the cloud data analytics company forecast first-quarter product revenue below Wall Street estimates and said CEO Frank Slootman was retiring.

Paramount Global rose after the media conglomerate posted a surprise profit thanks to streaming gains.