After years of growth, seemingly popping up in every city in the U.S., dollar stores appear to have hit a roadblock.

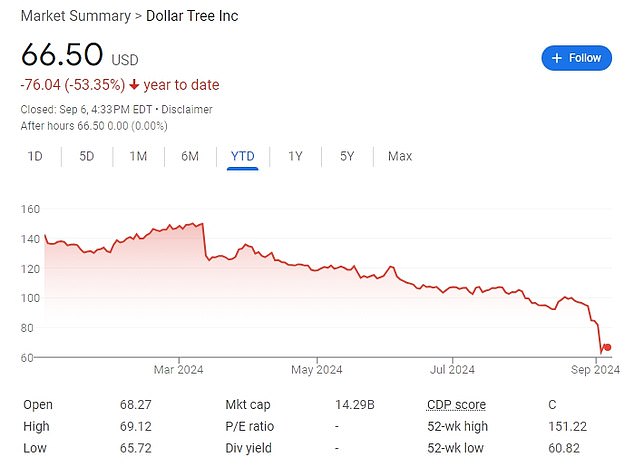

Dollar Tree shares fell to a 9-year low earlier this week after the chain reported a disappointing earnings report.

Earlier this year, the company announced it would close 600 Family Dollar stores by 2024 after struggling to integrate the chain into its business.

Dollar General, which is the largest dollar store in the United States and is located primarily in low-income rural areas, also reported poor sales last month and saw its stock fall.

Both companies blamed their customers’ economic anxiety for their struggles, saying that cash-strapped Americans are cutting back on even the most basic items after years of punishing inflation.

But supply chain problems, marketing missteps, a lack of investment in substandard stores and competition from big-box retailers are also contributing to the decline of dollar stores, retail experts say.

Dollar General, which is located mostly in low-income rural areas, reported poor sales last month and saw its stock fall.

Dollar stores have been criticized for targeting stores in struggling communities and capitalizing on poverty.

But as low-income Americans cut back on spending, cracks are beginning to appear.

“The dollar store sector appears to be facing existential uncertainties,” UBS analyst Michael Lasser said in a note last week. CNN reported.

Shares of the three national dollar store chains have faltered over the past year: Dollar General fell 39 percent through Sept. 4, Dollar Tree fell 57 percent and Five Below plummeted 57 percent, according to Forbes.

In April, 99 Cents Only announced it would close all 371 of its branches, citing high inflation and rising theft as reasons for the closures.

In its latest earnings report, Dollar General said the poorest Americans are running out of money at the end of the month, meaning they are having to cut back on even the most basic purchases.

Dollar General has more than 20,000 locations across the United States.

“Inflation has continued to negatively impact these households, with more than 60 percent saying they have had to make sacrifices in purchasing basic items due to the higher cost of those items,” Chief Executive Todd Vasos said on a call with analysts.

He said most of the chain’s core customers are households earning less than $35,000 a year.

Meanwhile, Dollar Tree, which has stores in more middle-class and suburban towns, also said its customers are cutting back on shopping in a “challenging” environment.

Dollar Tree said households with more than $125,000 in annual income had begun to shift from “need-buying” to “want-buying” and were no longer spending as much on party supplies and decorations, which they had previously done.

Chief Executive Mike Creedon said the company was “going through one of the most challenging macro environments” it has ever seen.

But the economy is not the only culprit, according to experts. Both companies have also made mistakes in their business strategies.

Dollar Tree shares have plummeted over the past year

Dollar General CEO Todd Vasos said the poorest Americans are having to cut back on even the most basic purchases.

In April, 99 Cents Only announced it would close all 371 of its locations.

David D’Arezzo, a former top executive at Dollar General and other retailers, told CNN that Dollar General made a mistake by trying to shift toward discretionary items, known as “non-consumables.”

In recent years, the chain has added items like decorations and candles to its shelves, rather than focusing on basic “consumable” products like food and cleaning supplies.

“They’re trying to get out of a failed non-consumables strategy, where they have a lot of inventory,” he said. “They didn’t realize that in tough times the consumer would be looking for consumables.”

Meanwhile, Dollar Tree has struggled to integrate Family Dollar, which it bought nearly a decade ago for more than $8 billion.

Family Dollar stores, located primarily in cities across the United States, have also been plagued by crime and theft.

Dollar Tree and Family Dollar have 16,278 stores combined across the United States.

‘Family Dollar’s sales have been stagnant, hurt by unkempt stores, poor product selection and disgruntled workers,’ says The Wall Street Journal reported in 2018.

Dollar Tree said in March it would close hundreds of underperforming stores after losing $1.71 billion in the three months ended Feb. 3.

“This dramatic takedown is the final straw in the failed acquisition of the Family Dollar chain, which has caused nothing but trouble for Dollar Tree since it was completed in 2015,” Neil Saunders, CEO of GlobalData, said at the time.

“Basically, almost ten years later, Dollar Tree is still trying to sort out the mess it inherited and hasn’t been able to fully turn it around,” he said.

Dollar Tree has also had problems with poor conditions at many Family Dollar stores, which They have been plagued by reports of unsafe working conditions.

Earlier this year, the company was ordered to pay $41.6 million for using a rat-infested warehouse to distribute products, including food, to more than 400 stores across the South.

It is the largest criminal sentence of its kind ever imposed, the Justice Department said.

Competition from other retailers, which traditionally don’t fit into the ultra-discount space, is also hurting sales, analysts say.

Dollar Tree has targeted middle-income Americans by selling party supplies and decorations.

Meanwhile, Dollar Tree has struggled to integrate Family Dollar, which it bought nearly a decade ago.

Experts say customers are put off by unkempt stores and poor product selection at dollar stores

Anjee Solanki, national director of retail services at Colliers, says consumers are still returning to dollar stores, even if they are spending less.

After years of rampant price increases, stores like Walmart, Target and Costco are now offering low-price deals on many essential items.

These retailers, as well as low-cost online marketplaces like Chinese e-commerce site Temu, are taking customers away from dollar stores.

Dollar General CEO Vasos acknowledged on last week’s earnings call that Walmart has been “doing a good job” attracting customers desperate for a deal.

“I don’t think anyone in the world shares more customers than Dollar General and Walmart because of their proximity to each other and the density of their locations in the Southeast,” David D’Arezzo told CNN.

“When Walmart is doing well, Dollar General is struggling.”

Does this change mark the end of dollar store dominance?

Anjee Solanki, national director of retail services at Colliers, says consumers continue to return to these stores, even if they spend less.

In 2021, dollar stores saw a significant 11.94 percent increase in average visits, demonstrating a strong post-pandemic recovery, he said. Even in 2022, average visits grew by 4.15 percent, further emphasizing the sector’s resilience.

Although there was a 2.37 percent decrease in average visits in 2023, cumulative data for 2024 reveals a 3.09 percent increase in visits.

“Consumers are returning to these stores despite economic pressures or changes in retail,” he told DailyMail.com.

In particular, he believes Five Below is well positioned for future success in the sector.

“This is due to their strategic focus on value, novelty and enhancing the in-store experience for their core audience of tweens and teens,” he said.

Sales rose 9 percent, demonstrating strong customer appeal, he added.